Millennials make up the largest constituent group of both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

The millennial generation currently accounts for 42% of homebuyers and 31% of sellers, according to Zillow's third annual Group Report on Consumer Housing Trends.

While

The contemporary issues experienced by millennials could initially signal slowly changing market dynamics.

"These seller challenges don't indicate we're suddenly in a buyers' market — we don't expect market conditions to shift decidedly in favor of buyers until 2020 or later. But buyers certainly are starting to balk at the rapid rise in prices and home values are starting to grow at a less frenetic pace," said Zillow Chief Economist Svenja Gudell in a press release.

Millennials are currently the demographic most going through life-altering events like new jobs, relocation, marriage and having kids. Nearly 70% of millennial sellers said they felt pressure to buy a new house or sell their old one because of those familial or professional obligations.

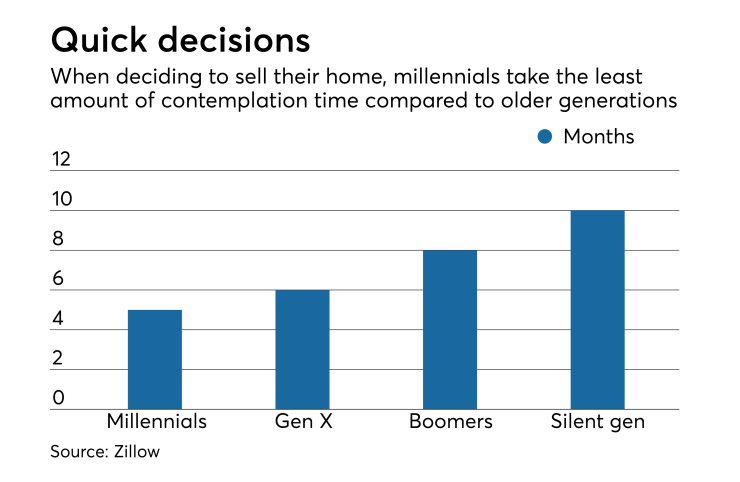

On average, millennials sell their homes three months faster than the generations before them. With those changes and added haste come a greater likelihood of compromise. If they could redo their home selling process, 86% said they'd change something they did, while 58% had offers fall through and 89% made concessions to close a deal, compared to 67%, 41% and 83%, respectively, of all generations.

"The Zillow Group Report reveals that as hectic and stressful as the process can be, most sellers still go on to buy another house, and, if past is prelude, they'll find themselves back in the market as sellers in another decade," said Gudell.