Rising household incomes paired with December's drop in mortgage rates gave consumers their largest monthly jump in home buying power since 2013, according to First American Financial Corp.'s Real House Price Index.

Homebuyers saw

"The affordability trend shifted toward buyers in December, as mortgage rates fell and household income continued to grow. The December decline in mortgage rates from 4.87% to 4.64% boosted house buying power by an impressive $10,000," Mark Fleming, First American's chief economist, said in a press release.

"That means a homebuyer with a 5% down payment and a mortgage rate of 4.6% saw their house buying power increase from $354,500 to $364,500. The monthly increase in household income further increased house buying power to $365,600. Overall, house buying power increased by $11,100 in December compared with the previous month, the second largest monthly increase in house buying power since the beginning of the millennium," Fleming continued.

"In 2018, the increase in household income helped mitigate the impact of rising mortgage rates and the fast pace of unadjusted house price growth on affordability," said Fleming.

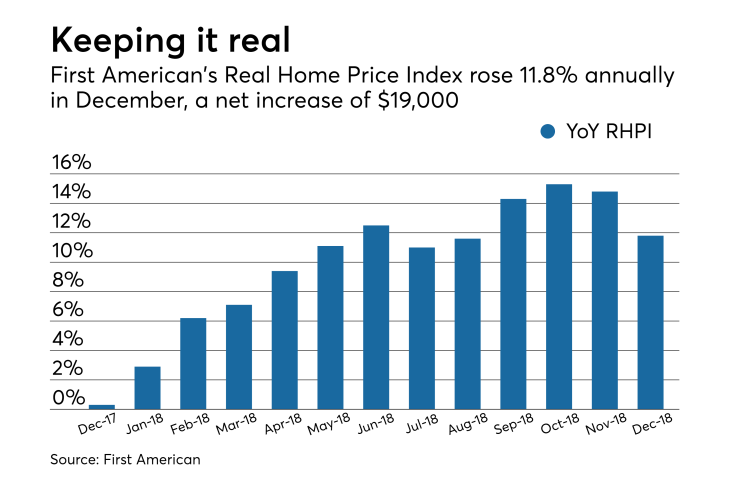

While affordability went up, the real house price index still increased 11.8% year-over-year in December. At the state level, Ohio had the highest year-over-year RHPI increase with 17%, followed by Montana at 16.7% and Nevada at 16.6%. Broken down by city, Cleveland led all housing markets with a 20.1% increase, Las Vegas was second at 19.9% and Orlando, Fla., was third at 19.8%.