-

The bank's noninterest expenses fell by 8% in the second quarter — a sign that CEO Charlie Scharf is making progress in reining in spending that had been soaring in recent years amid heightened regulatory scrutiny. He ultimately hopes to reduce gross expenditures by $8 billion annually.

July 14 -

The return of more normalized numbers for two key players in the home loan market could be the lead-up to a wave that’s been anticipated since the coronavirus arrived.

July 14 -

Purchase loans also increase, as their average size shrinks

July 14 -

Consumer price spikes, which in June surged the most since 2008, will likely be a temporary feature of an economy that’s quickly recovering from the pandemic, said Federal Reserve Bank of San Francisco President Mary Daly.

July 14 -

The president has a chance to make his mark on the central bank as the terms of Federal Reserve Chair Jerome Powell and Vice Chair of Supervision Randal Quarles near their end. He will face pressure from progressives to pick reform-minded leaders, while moderate Democrats and Republicans in the narrowly divided Senate might favor reappointing Powell.

July 14 -

The Mortgage Bankers Association is advocating for more funding for the agency due to its elevated securitization activity, and counterparty risk linked to a lingering concentration of loans in forbearance.

July 12 -

The sharp decline suggests borrowers are recovering enough from pandemic-related hardships to leave forbearance plans even before a key expiration date arrives this fall.

July 9 -

The defendant faces seven criminal counts — ranging from stolen property to falsifying business records — for two Harlem brownstones he paid just $20 for in 2012, according to tax filings.

July 9 -

The Federal Housing Finance Agency recently became the third agency along with the Office of the Comptroller of the Currency and Consumer Financial Protection Bureau without a Senate-confirmed leader. But analysts say the appointment of interim chiefs gives the administration even more control over regulatory initiatives.

July 9 -

Identifying where payment stress is concentrated could help mortgage servicers and federal policymakers prepare for the broader range of loan workouts that will resume this summer.

July 8 -

With talk of an overheating economy abating, economists see few signals that would indicate near-term rate spikes.

July 8 -

But some local markets in the Midwest and oil regions are seeing a lag compared to nationwide annual gains, Veros Real Estate Solutions found.

July 8 -

Officials responded to a more elevated outlook for prices by penciling in two interest-rate hikes for 2023, according to the median of their projections, while seven of 18 wanted to raise interest rates next year.

July 8 -

The White House's firing of Federal Housing Finance Agency Director Mark Calabria sparked immediate speculation about who will run the agency and help chart the future of the two mortgage giants. Potential nominees include ex-Obama administration officials, congressional staffers and members of the Biden transition team.

July 8 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

Government-sponsored loans gain volume share, but overall numbers tumble to a point not seen since before the pandemic.

July 7 -

The number of grievances about evictions and federal student loans declined between January 2020 and May 2021. Nonetheless, the Consumer Financial Protection Bureau warned financial firms that poor customer service can undermine government efforts to provide aid.

July 2 -

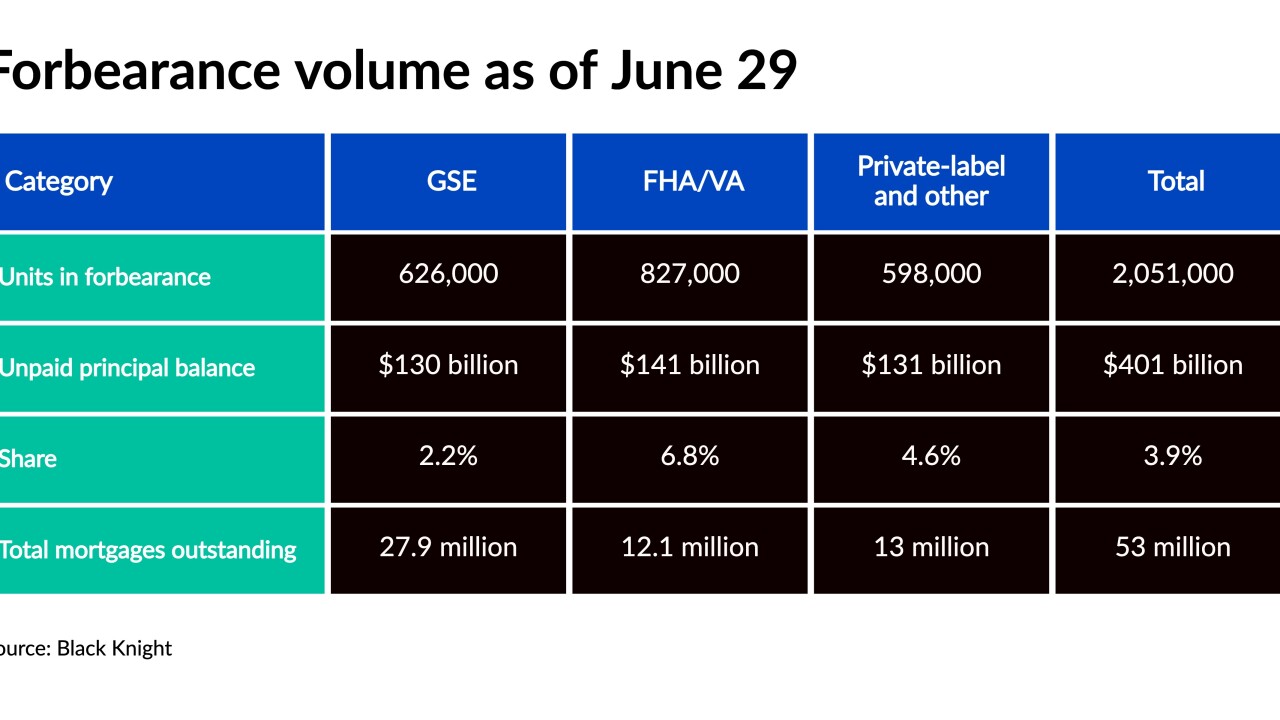

The number of GSE-backed and government sponsored loans in forbearance declined, while portfolio and private-label loans increased.

July 2 -

It is only a modest positive for new publicly-traded mortgage companies if acting Federal Housing Finance Agency head Sandra Thompson rolled back the caps put in place by the agreement with the Treasury.

July 2 -

The department's antitrust division said Thursday that it was withdrawing from the November 2020 agreement because its terms prevent the division from continuing to investigate association rules that may harm homebuyers and sellers.

July 2