-

Evaluations for payment reduction still represent a relatively small share of home retention actions but their uptick could add incrementally to servicers’ workloads.

June 22 -

The high court sent the case back to the New York-based 2nd U.S. Circuit Court of Appeals to revisit whether the dispute can continue as a class action lawsuit.

June 21 -

The Consumer Financial Protection Bureau at press time had promised to take the sudden nature of the new holiday’s implementation into consideration as it consulted with other agencies on the issue.

June 18 -

The new calculation of borrowers’ monthly obligations will allow for a higher debt load from tuition, potentially opening eligibility to more Black applicants, according to public officials.

June 18 -

The deal will add $7.8 billion in reverse mortgage subservicing to Ocwen $6.7 billion portfolio.

June 18 -

The data also showed that more purchase loans were made to low- and moderate-income borrowers last year, but fewer refinances.

June 18 -

Signs from the Fed regarding tapering and interest rate hikes could spell the end to the year’s low rates.

June 17 -

A congressional hearing on reforming the National Flood Insurance Program focused on whether mortgage companies need to disclose incremental risks even if a homeowner lives outside a federally designated floodplain.

June 17 -

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17 -

Federal Reserve officials held interest rates near zero while signaling they expect two increases by the end of 2023, pulling forward the date of liftoff and projecting a faster-than-anticipated pace of tightening as the economy recovers.

June 16 -

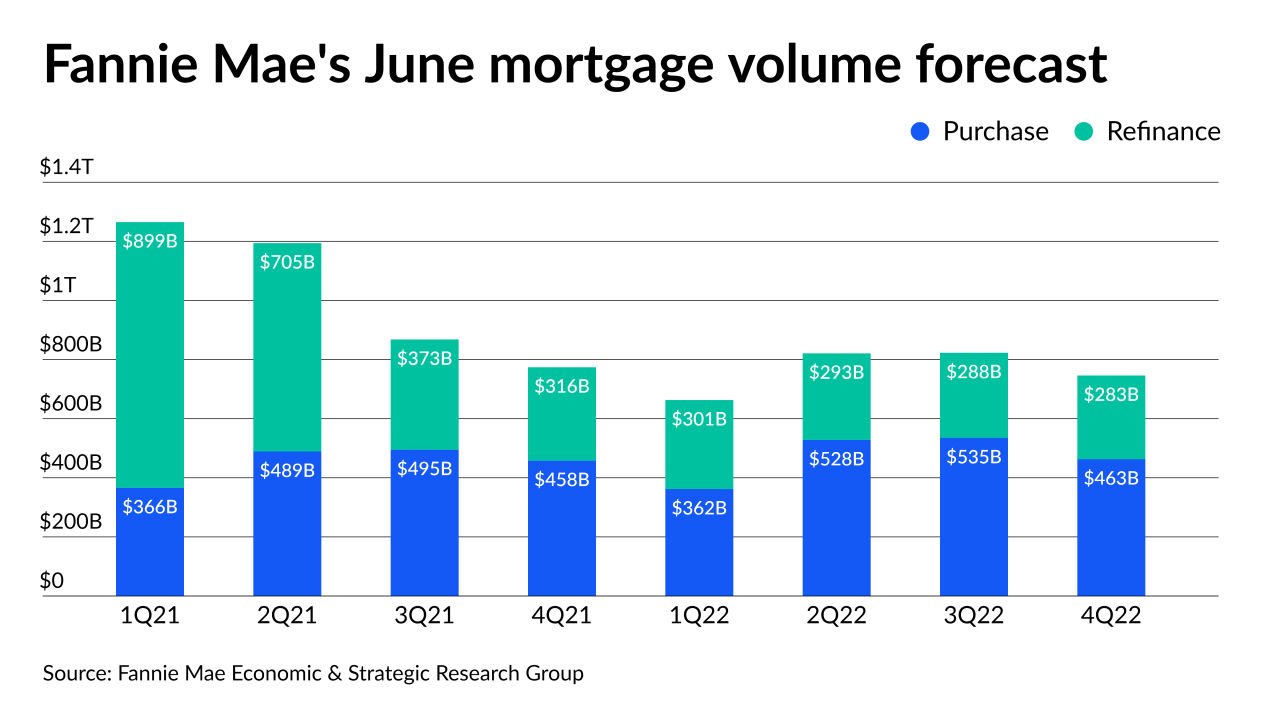

But the government-sponsored enterprise raised its total origination volume forecast for 2021 based on slightly stronger than expected refinance activity.

June 16 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16 -

While the company did notify the public and regulators in May 2019, executives were not aware at the time that there was previous knowledge of the security vulnerability within the company.

June 15 -

A $28.8 billion rise in multifamily debt made up 65% of the $44.6 billion quarter-to-quarter gain, the Mortgage Bankers Association reported.

June 15 -

The long-time title and mortgage technology industry executive wants to reduce the number of public company boards he serves on.

June 14 -

There’s now a unique, additional source of demand that’s opening up in an already fiercely-competitive housing market that VA lenders have to solve for.

June 14 -

Fears of widespread credit losses have largely subsided, but demand for new commercial real estate loans remains lackluster because many companies are sitting on so much cash they don’t need to borrow. Meanwhile, competition from private equity groups and other nonbank lenders is escalating.

June 14 -

Mortgage lenders should develop a comprehensive program to identify potential risks of noncompliance with consumer protection rules and take corrective actions before the Biden-era Consumer Financial Protection Bureau comes calling.

June 11Klaros Group -

With the Colonial Pipeline attack still in the news, bank CEOs testifying at a recent hearing cited cyber risk as the biggest threat facing the industry. But members of Congress did not share those concerns, and instead were more focused on criticizing banks about overdraft fees and their level of investment in minority communities.

June 11 -

The Department of Housing and Urban Development reinstituted the “affirmatively furthering fair housing" measure, which the Trump administration had argued was overly prescriptive, and promised a later rulemaking to bolster the policy.

June 10