-

Reviving a long-dormant loan guarantee program could go a long way toward restocking the supply of starter homes and helping households of modest means create wealth, writes the President and CEO of University Bank.

May 24 University Bank

University Bank -

The CFPB missives are an early and unmistakable warning that the era of COVID-19 flexibility is over, write two partners and a law clerk from Buckley LLP.

May 21 Buckley LLP

Buckley LLP -

A week of light data could possibly lead to further mortgage-rate volatility ahead depending on what monetary officials say in the coming days.

May 20 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Groups active in low-income and rural housing expressed frustration that the post-pandemic resumption of long-term goal-setting didn’t do more to raise the bar.

May 19 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

The month saw the highest median home sales price ever along with the quickest time ever to sell a new listing.

May 19 -

Mortgage lenders have much riding on a yearslong effort to overhaul a program that requires homeowners to hold policies in flood-prone areas. A congressional panel meeting to discuss the issue was once again split between lawmakers from storm-threatened states and those concerned about government costs.

May 18 -

The agency said it will reconsider the controversial regulation to reform the Community Reinvestment Act, and allow banks to halt efforts to comply with key provisions of the framework.

May 18 -

The rate of new forbearance requests as a share of portfolio volume also dropped to its lowest point since March, the Mortgage Bankers Association reported.

May 18 -

Financial institutions said they needed more time to weigh in on issues such as how they use artificial intelligence for fraud prevention and underwriting.

May 17 -

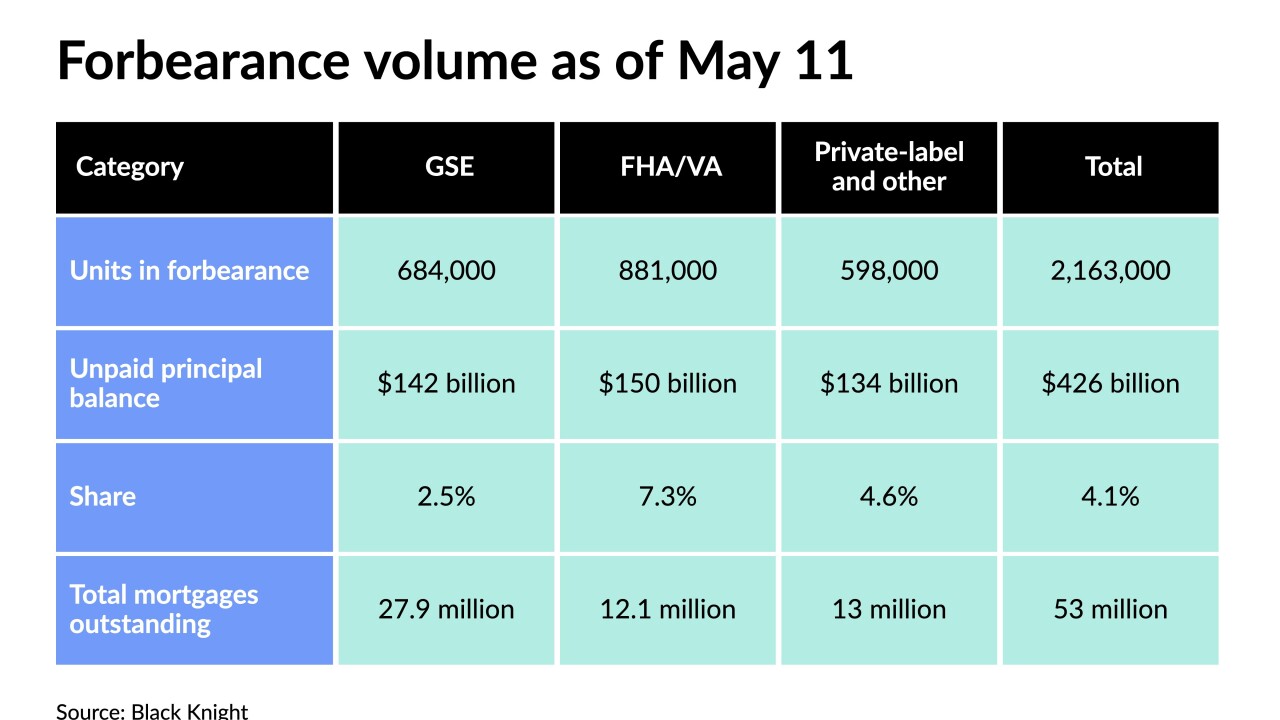

Numbers fell across the board, with private-label and portfolio loans declining most.

May 14 -

Patience and vigilance are virtues when using certain social media for marketing, writes the CEO of Paragon Digital Marketing Group.

May 14 Paragon Digital Marketing Group

Paragon Digital Marketing Group -

Inflation concerns may reverse the trend that has seen the 30-year rate decline six out of the last seven weeks.

May 13 -

Stock prices for the four stand-alone MI companies have declined significantly since the start of May.

May 13 -

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12 -

Expansion of an existing translation clearinghouse is among steps that could be taken, the Mortgage Bankers Association suggested in a letter sent to the leaders of the House Financial Services Committee on Wednesday.

May 12 -

The move formalizes the use of the Rocket Mortgage moniker, which has been a major part of the company’s branding since 2016.

May 12 -

Collectors are mulling a procedural overhaul after a three-judge panel said the practice of using vendors to inform consumers about outstanding debts is illegal. The case may also complicate the CFPB's upcoming rule on electronic messaging.

May 11 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10