-

The Mortgage Industry Standards Maintenance Organization drew up the recommended wording in consultation with a group of lenders and investors after the passage of the Taxpayers First Act last year.

September 30 -

Mortgage applications decreased 4.8% from one week earlier, as refinance activity was down even as average rates fell to a new record low, according to the Mortgage Bankers Association.

September 30 -

Home prices around Seattle rose faster than in any city in the country, save Phoenix, for the sixth consecutive month in midsummer.

September 30 -

Through Operation Corrupt Collector, the bureau is coordinating with over 50 other state and federal agencies to target firms for wrongdoing and inform consumers of their rights

September 29 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

Home prices in 20 U.S. cities gained in July, pushed higher by demand for housing that has been fueled by low mortgage rates.

September 29 -

Dallas had the greatest price gains in more than a year the latest nationwide comparison.

September 29 -

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29 -

Consumer home purchasing power gained steam in July thanks to plummeting interest rates and gains in the median income despite steady price growth, according to First American.

September 28 -

Despite a roller-coaster stock market, lingering pandemic and uncertainty caused by natural and made disasters, the real estate market continues to connect buyers to sellers.

September 28 -

Wall Street won big buying up homes during the foreclosure crisis and renting them out. Now, it's headed back to the suburbs in hopes of scoring again.

September 25 -

The Financial Stability Oversight Council said the mortgage giants may need a bigger capital cushion than their regulator has proposed, but stopped short of designating them as “systemically important financial institutions.”

September 25 -

After an annual gain in July, newly constructed home listings tumbled in August as coronavirus complications caused the largest inventory drops on record, according to Redfin.

September 25 -

Retiring Ellie Mae CEO Jonathan Corr and new ICE Mortgage Technologies President Joe Tyrrell discuss how the two companies will be merged.

September 25 -

Arizent's latest survey finds that respondents are sharply divided on key issues regarding the upcoming election.

September 25 -

The agency’s report on mortgage data submitted by lenders identified persistent disparities between white borrowers and minorities in denial rates and pricing. Some observers say the bureau should have been more explicit as the nation wrestles with systemic racism.

September 24 -

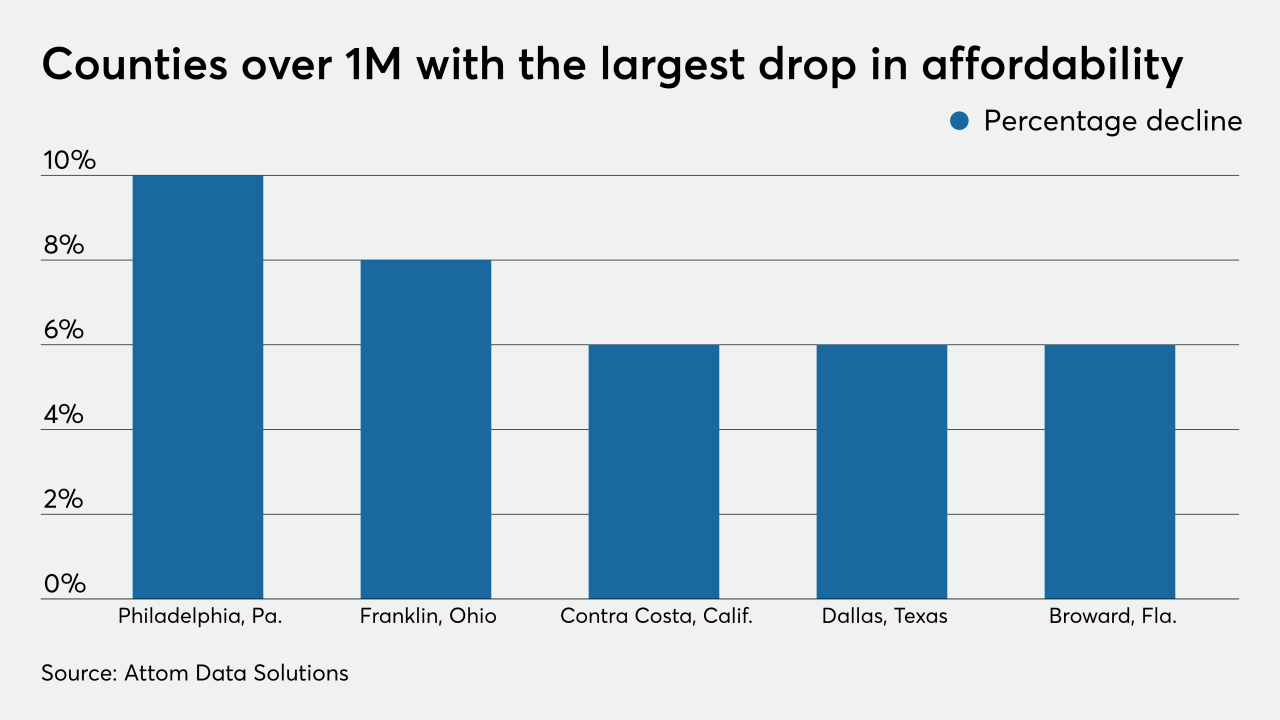

More counties have median home prices above their historic averages for typical wage earners, the company found.

September 24 -

Twelve people were charged in a scheme regarding the creation of 100 fraudulent mortgages in Georgia, according to the HUD inspector general.

September 24 -

Mortgage rates experienced a marginal uptick this week, rising three basis points. But they remained near record lows and possibly soon could track down again, according to Freddie Mac.

September 24 -

A summer resurgence of home buying stretched into August, defying the pandemic to set record home prices and drive sales to a near two-year high, new housing figures show.

September 24