-

Mortgage rates fell 7 basis points this week to yet another record low in the 49-year history of the Freddie Mac Primary Mortgage Market Survey, as stock market indicators sank during the period.

September 10 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

The final version of the amended rule, like the original proposal, makes fair lending claims tougher to prove; but it does soften language that otherwise might have allowed mortgage companies to use algorithms to prove nondiscrimination.

September 9 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

As bidding wars raged on and mortgage rates remained near historic lows, housing market confidence grew in August, according to Fannie Mae.

September 8 -

Without further government help, that rate could double again by 2022, CoreLogic said.

September 8 -

The Federal Housing Finance Agency's proposal could undermine the companies’ mission to support the housing market and penalize consumers in underserved communities, industry and consumer groups say.

September 8 -

The regulatory road ahead is as uncertain and risky to banks as the pandemic.

-

More than half of listings underwent bidding wars in August with some housing markets peaking above 65%, according to Redfin.

September 4 -

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

Today there are 1 million fewer Americans in forbearance than there were at the peak in May, according to Black Knight.

September 4 -

When it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

September 4 -

The mortgage industry comes together to address current issues and prepare for a post-COVID marketplace Sept. 14 to 17.

September 4 -

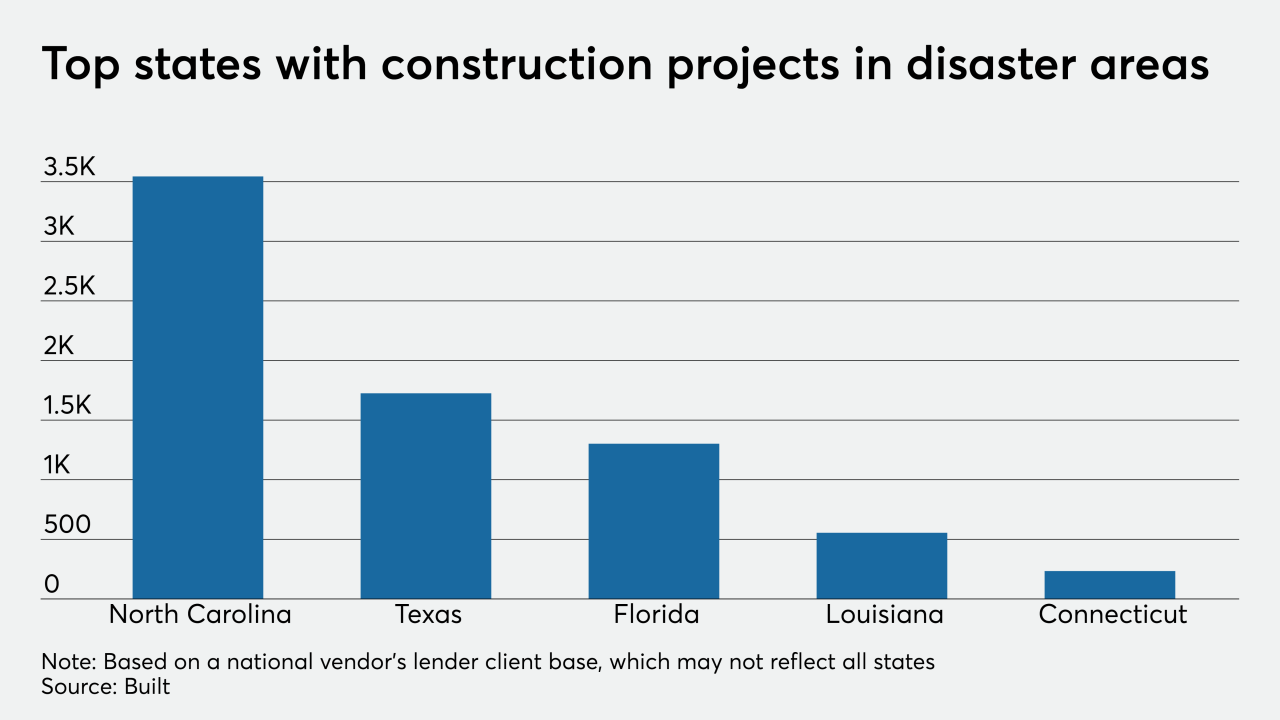

The technology company arrived at this percentage by mapping federally declared disaster areas to the projects it helps lenders manage.

September 3 -

Home purchase power increased by almost 7% annually in July as mortgage rates were at or near record lows.

September 3 -

Mortgage rates remained relatively flat this week, as yields for the benchmark 10-year Treasury spiked at the start of the period before dropping, according to Freddie Mac.

September 3 -

Nearly half of the second-quarter volume came from its existing customers.

September 3 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2