-

The American Dream Down Payment Act would let states establish and manage accounts, which would be similar in structure to 529 college savings plans.

August 6 -

Deferrals on residential mortgages and home-equity loans have been a common theme at JPMorgan Chase, Bank of America, Wells Fargo and Citigroup since the start of the coronavirus pandemic.

August 5 -

With year-to-date issuance at $51.7 billion, investor demand appears to remain strong despite economic headwinds of the pandemic.

August 5 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

The common stock for the new parent of Quicken Loans is expected to start trading on the New York Stock Exchange on Thursday.

August 5 -

The Federal Reserve Racial and Economic Equity Act would direct the Fed to consider racial inequality in employment, income and access to affordable credit when making monetary policy and in its regulation and supervision of banks.

August 5 -

For years, there has been an expectation that markets and governments would figure out how to provide enough incentives for homeowners to make energy efficiency upgrades and environmental improvements. It hasn't happened yet.

August 5 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

The company, which launched last fall, announced a partnership with an organization that aids military families.

August 5 -

Housing prices continued to grow in June, maintaining a streak in monthly increases that began in February 2012. But the trend could be reversed in 2021 with the resurgent effects of the coronavirus, according to CoreLogic.

August 4 -

PREIT, which owns a number of large malls, is trimming the salaries of its CEO and chief financial officer while suspending dividend payments as part of a deal with its lenders to stave off default as the coronavirus pandemic continues to take its toll on the troubled company.

August 4 -

The overnight shift to working from home created a number of practical quandaries for mortgage firms large and small, according to a recent survey conducted by Arizent.

August 4 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

Louisiana ranks second in the nation in the percentage of homeowners who are late on their mortgage payments, according to Black Knight.

August 3 -

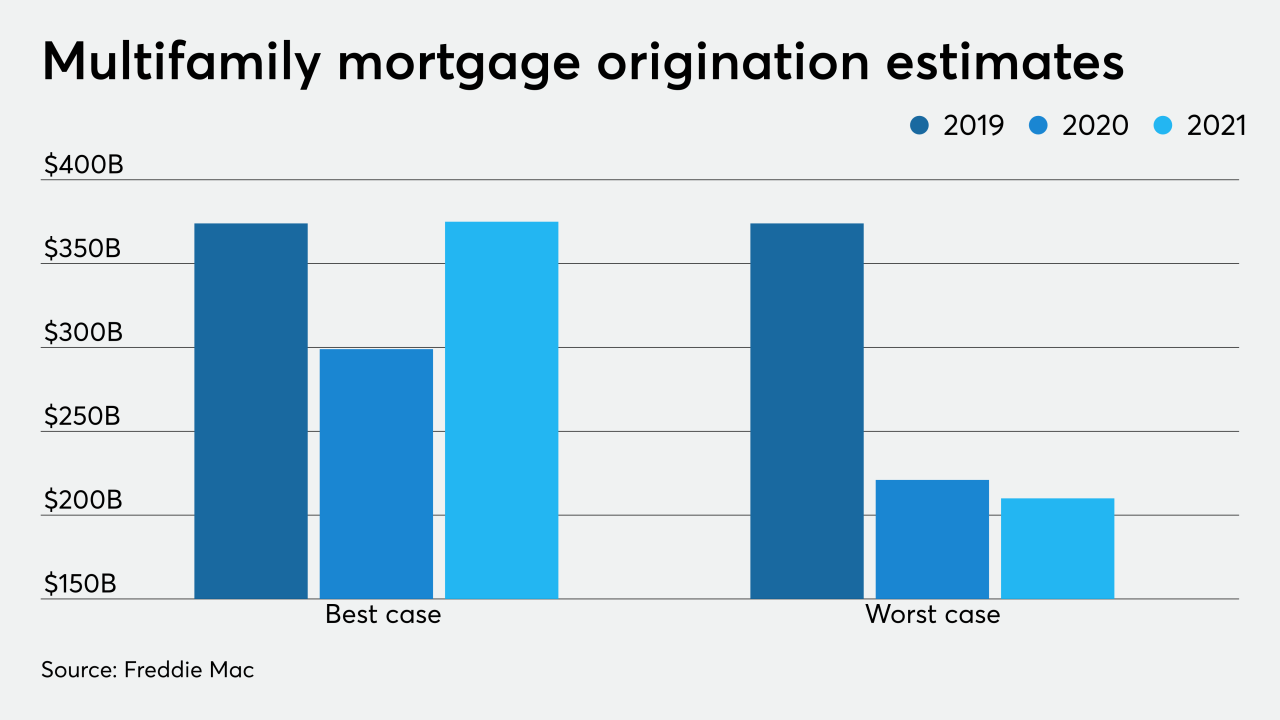

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

Record-low interest rates allowed homebuyers to purchase $32,000 more house for the same monthly payment compared to last July, boosting affordability to the highest level since 2016.

August 3 -

The year-over-year increase came as homebuying picked up and the company's mortgage lending business boomed.

August 3 -

With low inventory and coronavirus limiting accessibility, nearly half of shoppers made offers sight-unseen in June, according to Redfin.

August 3