-

Homebuilder sentiment plunged in April to the lowest level in more than seven years as the coronavirus pandemic kept potential buyers quarantined and paralyzed construction in much of the country.

April 15 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

The Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

April 15 -

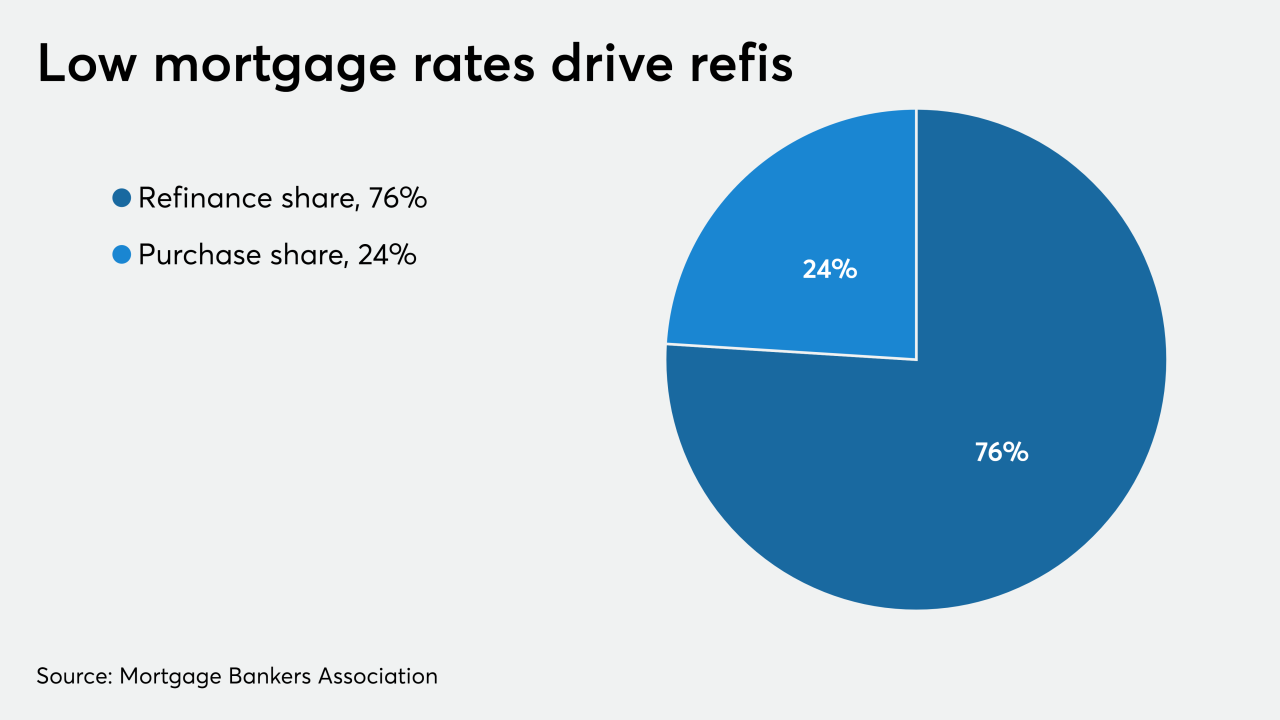

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

The nascent market for private U.S. mortgages is teetering on the brink of collapse as the coronavirus crisis imperils years of work to lessen the government's role in home lending.

April 14 -

The volume of COVID-19 forbearance requests has risen rapidly as operational processing has improved and hold times have contracted, according to the Mortgage Bankers Association.

April 14 -

Purchase originations will recover somewhat in the third and fourth quarters as home sales pick up.

April 14 -

January saw the lowest mortgage delinquency rate in over 20 years, according to CoreLogic.

April 14 -

At issue is whether the U.S. should step in now to save nonbank mortgage servicers to head off damage to the housing market.

April 13 -

Researchers predict that the rate will rise in step with unemployment rate projections.

April 13 -

FHFA head Mark Calabria and his FSOC counterparts need to sit down with the Treasury and fashion an emergency capital plan for the GSEs.

April 13 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Tenants have threatened to suspend payments during the pandemic to pressure officials into providing rental assistance, but the effects on multifamily loans would compound concerns about servicers' liquidity and, ultimately, lenders' performance.

April 13 -

Ginnie Mae will begin taking requests for assistance from issuers who, having exhausted all other options, are having trouble advancing borrowers' principal-and-interest payments to investors amid the pandemic.

April 11 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

Mortgage rates remained flat from last week, but are expected to fall further as they continue to lag changes in 10-year Treasury yields, according to Freddie Mac.

April 9 -

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

April 9 -

If rising flood waters were the right analogy last time around, this time a tsunami is probably a more accurate description of the wave of delinquencies about to come.

April 8 Mayer Brown LLP

Mayer Brown LLP -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Lenders and community groups say it's a mistake for the banking agencies to move forward during a national crisis. But Comptroller of the Currency Joseph Otting says updated Community Reinvestment Act rules would speed relief to neighborhoods and small businesses.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8