-

Title underwriters won’t be hit as hard by the coronavirus as other insurers, but related economic changes will challenge them, Fitch Ratings said, in assigning a negative outlook to the sector.

March 26 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26 -

The reprieve from mortgage data collection was among several changes to the agency’s supervisory and enforcement procedures to help firms responding to the COVID-19 pandemic.

March 26 -

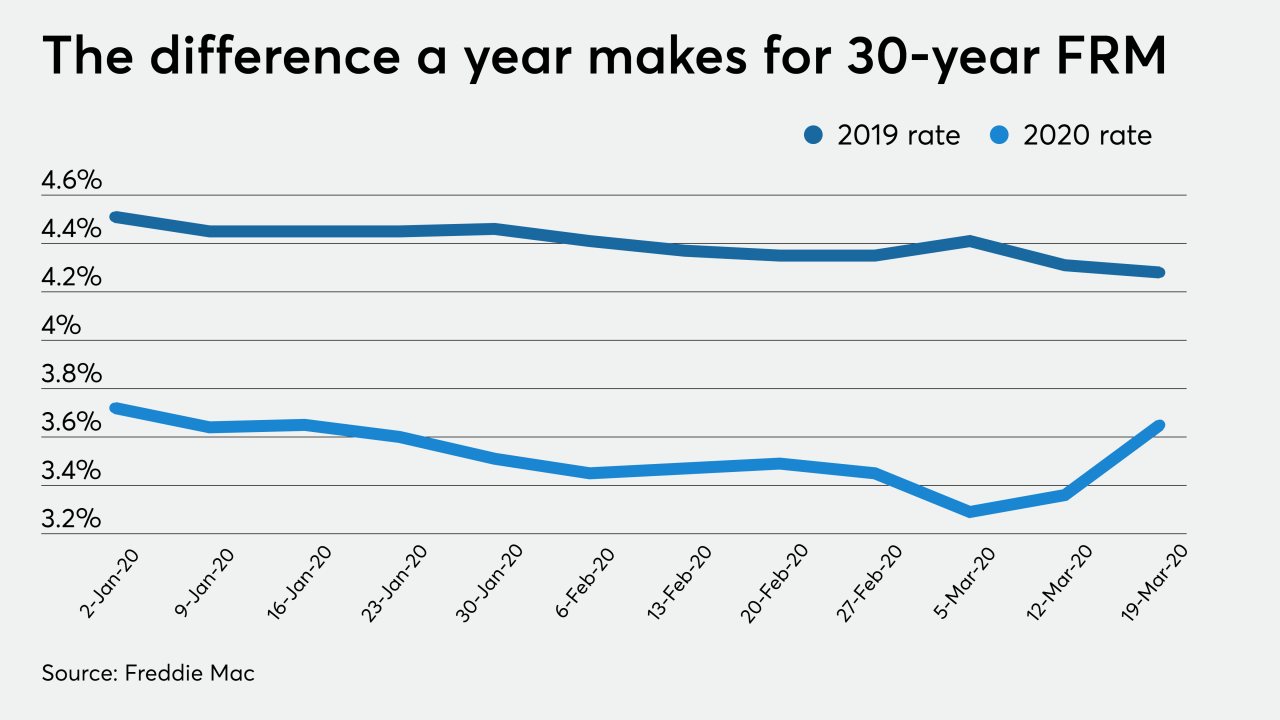

The actions taken by the Federal Reserve to calm the financial markets was key to the drop in mortgage rates this week, according to Freddie Mac.

March 26 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

March 25 -

JPMorgan Chase, Wells Fargo, Citigroup and U.S. Bancorp, along with 200 state-chartered banks and credit unions, have agreed to let borrowers skip payments for 90 days if their finances have been upended by the pandemic.

March 25 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

As real estate prices soared in recent years, working-class adults everywhere have increasingly relied on mortgages backed by the Federal Housing Administration — and U.S. taxpayers.

March 25 -

The Department of Housing and Urban Development's 60-day foreclosure halt for Federal Housing Administration borrowers is too short to help reverse mortgage borrowers, a letter from consumer groups stated.

March 25 -

The $2 trillion deal passed by the Senate late Wednesday would aim to put banks and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25 -

Detroit-based mortgage giant Quicken Loans could be facing a cash crunch in coming weeks and possibly need temporary emergency federal assistance if lots of borrowers stop making payments on their home mortgages during the coronavirus pandemic, according to a news report.

March 25 -

High demand and low interest rates continued to drive strong sales of existing single-family homes in Maine in February, according to Maine Listings.

March 25 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25 -

Independent mortgage bankers had their most profitable fourth quarter in seven years for originations, but the fallout from the coronavirus could upset the economics of the industry in the short term.

March 24 -

The Federal Reserve Board should create a dedicated facility for mortgage servicers to access in order to make required advances, industry participants and observers, including its largest trade group, said.

March 24 -

With economists fearing high unemployment stemming from the pandemic, the housing finance system is grappling with how it will recoup lost revenue from delinquencies, forbearance plans and other tremors.

March 24 -

The $16 trillion U.S. mortgage market — epicenter of the last global financial crisis — is suddenly experiencing its worst turmoil in more than a decade, setting off alarms across the financial industry and prompting the Federal Reserve to intervene.

March 24 -

The central bank's sweeping actions suggest a cash shortage gripping sectors directly hit by the pandemic. Banks were supposed to be protected by Dodd-Frank but are still vulnerable to a funding domino effect.

March 23 -

Congressional Democrats want forceful action to prevent damage to millions of Americans' credit scores during the COVID-19 pandemic. But the credit bureaus argue that the tools needed to protect consumers are already in place.

March 23 -

The coronavirus pandemic is threatening to put a damper on the Marin County, Calif., real estate market as it enters its normally busy spring season, with the nation facing economic uncertainty and a "shelter in place" order forcing the cancellation of many house events.

March 23