-

Excellent credit quality and strong performance of post-housing-crisis originations resulted in a steep decline in foreclosure starts in September, according to Black Knight.

November 5 -

Black Knight's third-quarter net earnings were slightly below the same period last year, although total revenue increased by 7% compared with one year prior.

October 30 -

After falling to its lowest level in over 12 years, servicers expected September's surge in delinquencies following the damage of Hurricane Florence, according to Black Knight.

October 24 -

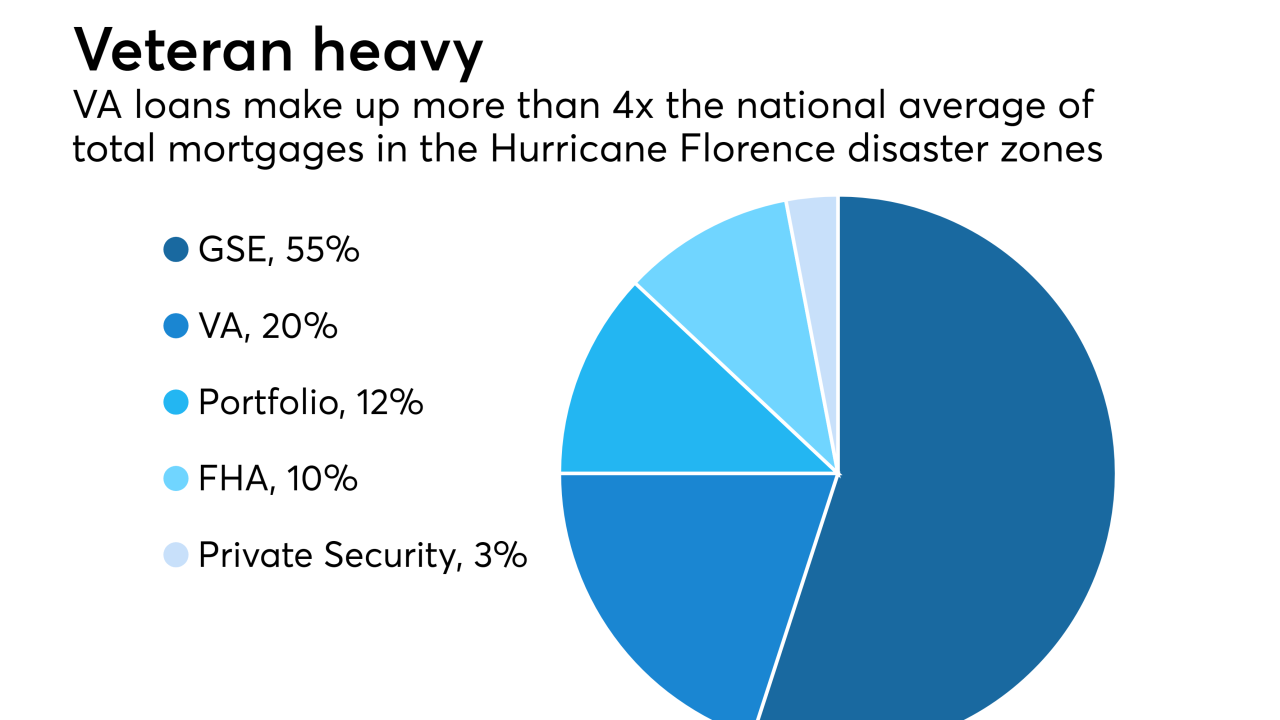

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

An artificial intelligence platform that integrates with key industry utilities and keeps critical data at lending professionals' fingertips was selected as the top fintech demo by attendees of the 2018 Digital Mortgage Conference.

September 26 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Home price appreciation slowed throughout 64% of the U.S., a boon to affordability, according to Black Knight's most recent three-month figures.

August 6 -

Black Knight reported net earnings of $40 million for the second quarter as adjusted revenue from its servicing and origination software businesses grew by 7% over the previous year.

July 31 -

The Pennsylvania Housing Finance Agency is switching to Black Knight's LoanSphere MSP to service the agency's $4.9 billion mortgage loan portfolio.

July 30 -

Mortgage foreclosure starts and active foreclosures were at their lowest level in over a decade although there was an increase in new delinquencies in June, according to Black Knight.

July 24 -

Despite available home equity shooting up in the first quarter, the share of total equity withdrawn by borrowers hit a four-year low, likely due to an increase in interest rates, according to Black Knight.

July 9 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6 -

Black Knight has acquired HeavyWater, a developer of artificial intelligence and machine learning technology for the mortgage industry, and plans to incorporate the startup's borrower data verification and other automation capabilities into its existing product suite.

June 4 -

Historically, mortgage delinquencies in the month of April have risen 85% of the time, but April 2018 bucked that trend as they fell, according to Black Knight.

June 4 -

The number of mortgage borrowers for whom it made sense to refinance declined by nearly half since the end of last year and is at its lowest since November 2008.

May 7 -

March's increase in foreclosure starts was a direct result of the end of the moratorium for borrowers affected by Hurricanes Harvey and Irma, Black Knight said.

April 19 -

Publicly traded mortgage technology firms seeking growth could eventually end up squaring off against or buying privately owned point of sale system startups.

April 17