-

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Meanwhile, July saw a record surge in existing-home sales, while mortgages in serious delinquency were on the rise

August 21 -

Recent changes to housing policy and uncertainty regarding the coronavirus could slow that growth.

August 19 -

There are five separate note offerings with maturities ranging from 2023 to 2060.

August 18 -

Earnings reports out this week beat pessimistic expectations, but strained coronavirus relief negotiations in Congress cloud the outlook for what's ahead.

August 7 -

Thoma Bravo bought Ellie Mae last February and is selling it for a $7 billion gain.

August 6 -

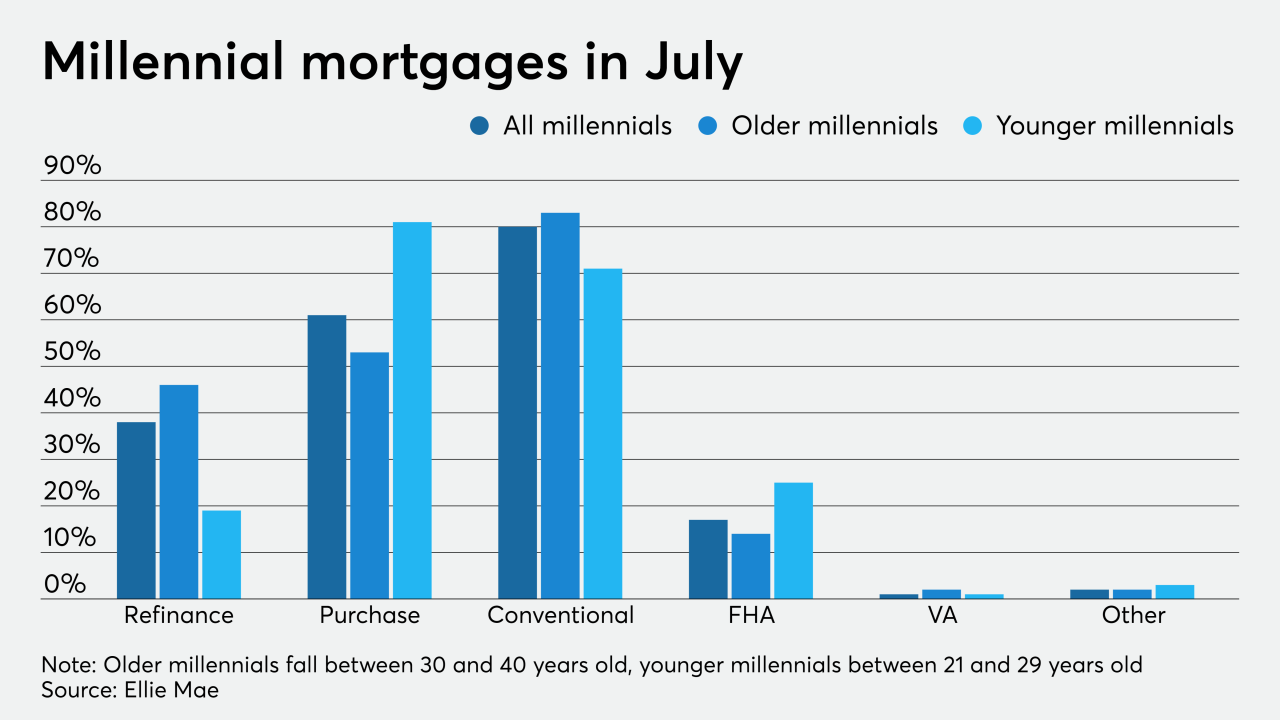

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

As the country wrestles economic volatility, millennial homeownership demand rises, fueled by historically low mortgage rates.

July 1 -

Millennial refinance activity hit a new high-water mark behind historically low mortgage rates, up 40 percentage points from the year before, according to Ellie Mae.

June 3 -

The company will still offer the product it is most known for, Point.

May 27 -

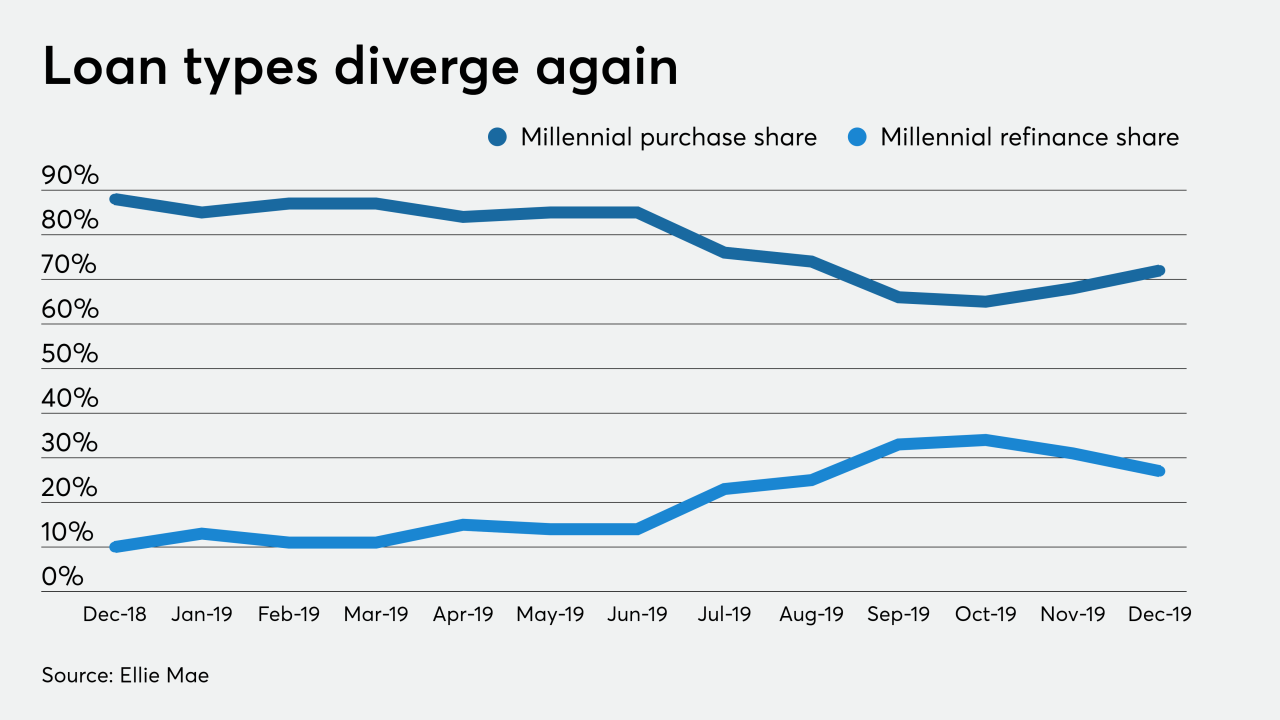

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

As lenders scale up on their remote capabilities in response to the pandemic, the software companies that service them see exponential growth.

April 27 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

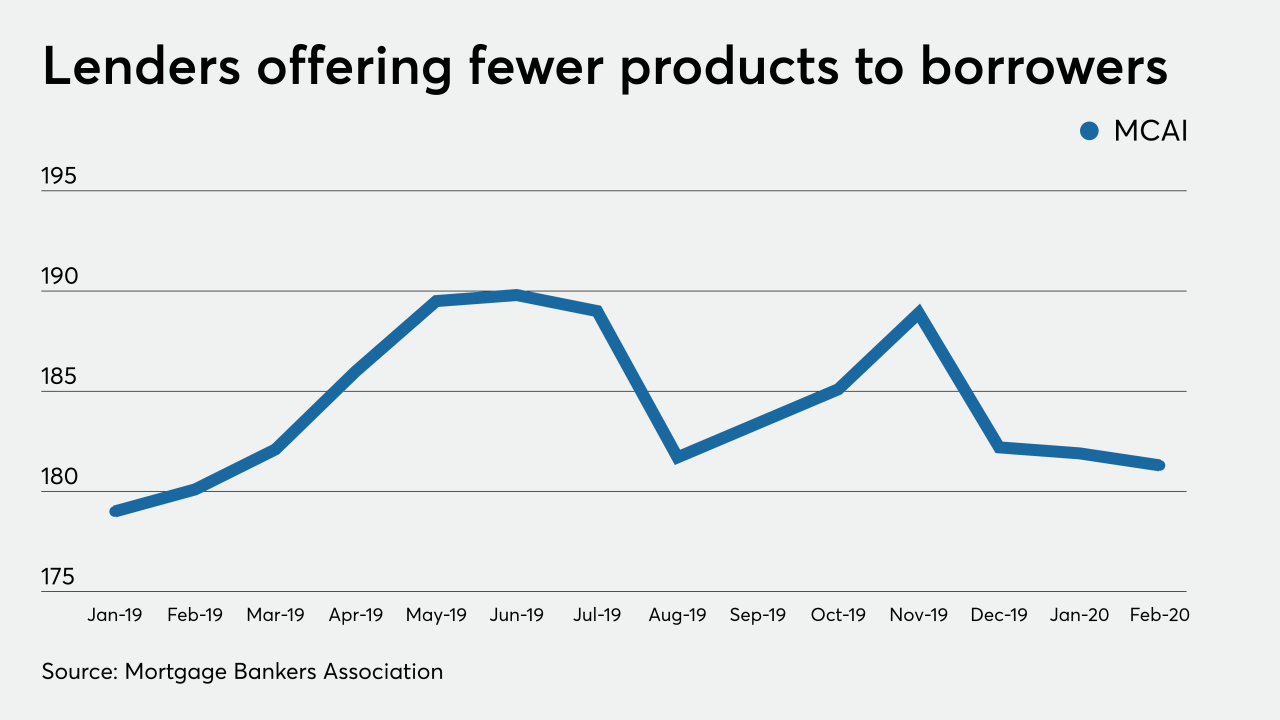

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

Women are becoming more and more empowered in home purchasing, thanks in part to the digitization of the mortgage and real estate industries, according to a report from Compass and Better.com.

March 4 -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9