-

Incenter Mortgage Advisors is brokering an $898 million alt-A bulk servicing rights portfolio for an undisclosed bank.

April 21 -

The Mortgage Bankers Association released a detailed transition plan Thursday designed to help policymakers turn the government-sponsored enterprises into private guarantors of mortgage-backed securities.

April 20 -

Incenter Mortgage Advisors is accepting bids on behalf of an independent mortgage banker for a $326 million portfolio of Fannie Mae, Freddie Mac and Ginnie Mae mortgage servicing rights.

April 20 -

Vladimir Putin is taking a page from the U.S. housing market to boost homeownership. Call it Russia's Fannie Mae.

April 19 -

DLJ Mortgage Capital Inc. was the winning bidder on all four pools in Fannie Mae's second reperforming loan sale.

April 13 -

Employment in the nondepository mortgage banker and broker sector fell for the second consecutive month in February, a possible sign of growing concern about shrinking demand for mortgages.

April 7 -

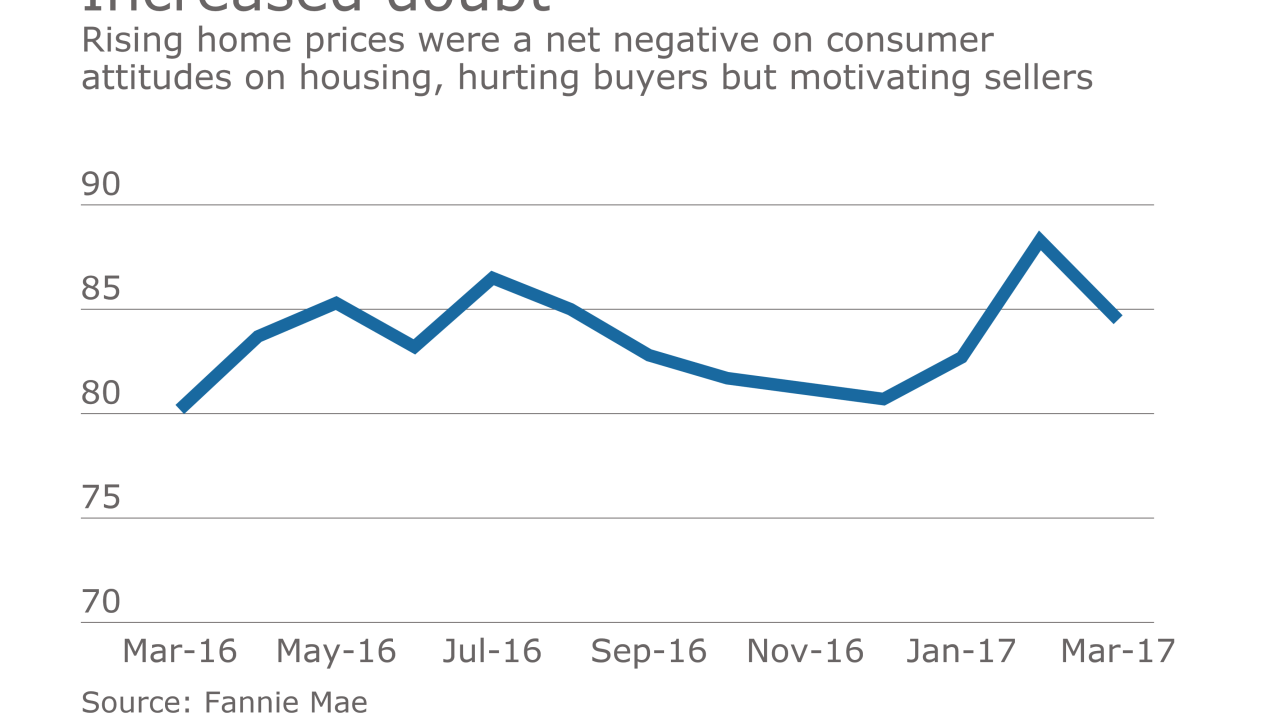

Home price increases combined with rising rates drove consumer confidence in the housing market off of its all-time high.

April 7 -

Private market mortgage insurance companies should better align their buyback and rescission policies with those of Fannie Mae and Freddie Mac, the Federal Housing Finance Agency said.

March 30 -

Post-recession, educational achievement became a factor in determining whether a young adult decided to buy a home.

March 30 -

A bipartisan group of senators told Mel Watt, the regulator who oversees Fannie Mae and Freddie Mac, that he shouldn't allow the companies to recapitalize without congressional approval.

March 30 -

New Jersey Community Capital was the winning bidder of Fannie Mae's sixth Community Impact Pool auction of nonperforming loans.

March 28 -

In a bitterly partisan Congress, two senators are making a rare push across party lines to solve a persistent riddle with huge implications for the U.S. housing market: What to do with Fannie Mae and Freddie Mac?

March 28 -

Suspending Fannie Mae and Freddie Mac's regular dividend payments to the Treasury, thus enabling the companies to replenish their reserve capital, would put their future on better footing.

March 28 -

Most tax lien and civil judgment data will be taken out of credit bureau files on July 1, possibly inflating scores and raising concerns about liability for mortgages that sour.

March 27 -

Rising interest rates made mortgage lenders bearish on their short-term outlook for purchase originations and that is affecting their expectations on profits.

March 27 -

Fannie Mae has obtained reinsurance for $510 million of credit losses on $20.4 billion of single-family residential mortgages through a pair of credit insurance risk transfer transactions.

March 24 -

With refinance volume shrinking, some lenders are making up the difference by turning to alternative loan products for borrowers with lower credit scores.

March 23 -

Modification activity increased slightly in January over December as servicers worked their way through the remaining Home Affordable Mortgage Program applications.

March 20 -

Homes for sale listings are scarcer than they've ever been entering the spring selling season.

March 17