-

Also: Fannie Mae announces imminent implementation of hedge accounting.

October 30 -

The upcoming shift may help to prepare the government-sponsored enterprise for a conservatorship exit by reducing interest-rate volatility in Fannie’s earnings.

October 29 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26 -

Existing-home sales reach 14-year high as bidding wars increase across the country.

October 23 -

To continue providing liquidity for lenders, Fannie Mae lengthened the period in which it would continue the purchase of forborne mortgages and pools of mortgage-backed securities into 2021.

October 22 -

Leadership from those entities confirmed this week that they will move forward with a plan to add a controversial 50-basis-point charge for refinancing.

October 21 -

The agency confirmed that loans backed by Fannie Mae and Freddie Mac can continue avoiding debt-to-income limits as the bureau completes a revamp of the Qualified Mortgage standard.

October 20 -

Johnson led Fannie in the 1990s and played an advisory role in President Barack Obama's 2008 campaign.

October 20 -

The overall forbearance rate was under 6% for the first time since April as another large swath of loans fell out of CARES Act coverage, according to the Mortgage Bankers Association.

October 19 -

While using the 30-day SOFR as its index, Freddie Mac structured the deal so it could shift to a one-month term if and when that rate is approved.

October 19 -

This year will top the total volume generated in the housing boom year of 2003. Meanwhile, next year's 30-year FRM is predicted to stay at 2.8%.

October 16 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

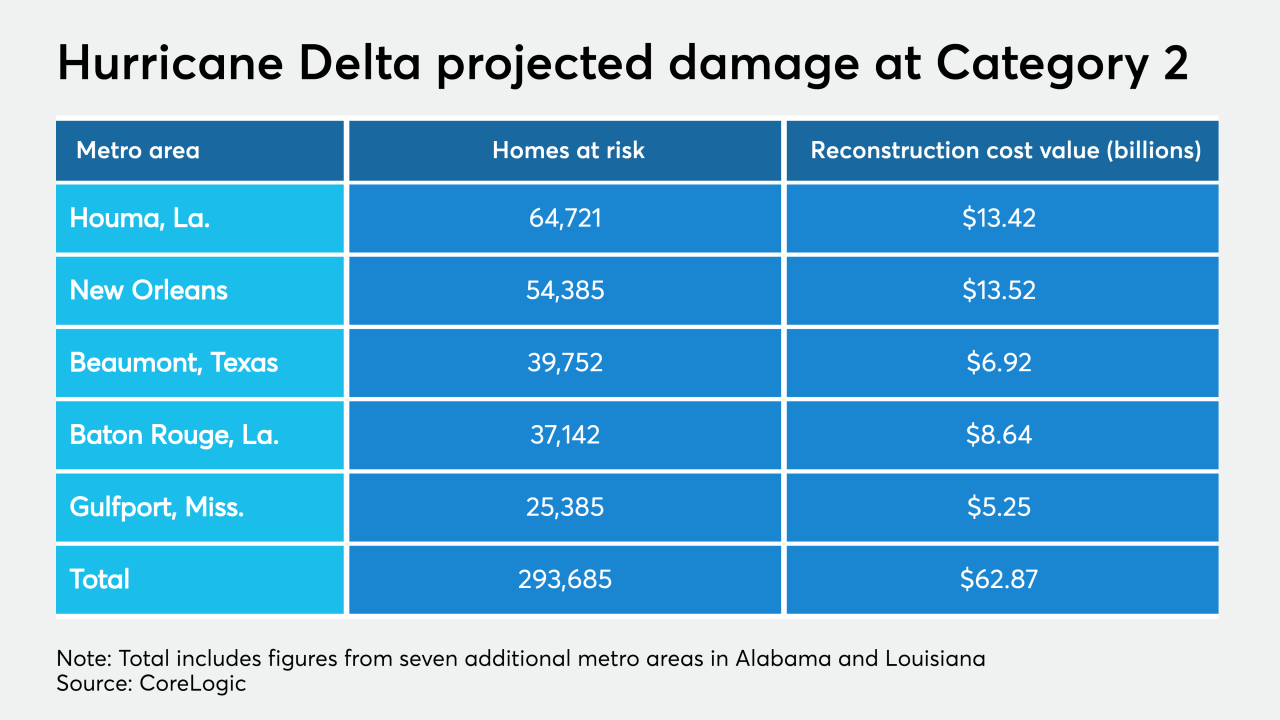

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

But overall sentiment as measured by Fannie Mae continued to recover from the depths of this spring.

October 7 -

HSBC, Bank of the West and Fannie Mae are among those offering green mortgage bonds, financing commercial clients’ efforts to rein in carbon emissions and developing other novel products that help customers tackle environmental challenges.

October 6 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

The Financial Stability Oversight Council said the mortgage giants may need a bigger capital cushion than their regulator has proposed, but stopped short of designating them as “systemically important financial institutions.”

September 25 -

The agency’s report on mortgage data submitted by lenders identified persistent disparities between white borrowers and minorities in denial rates and pricing. Some observers say the bureau should have been more explicit as the nation wrestles with systemic racism.

September 24 -

But the group is more conservative than Fannie Mae when it comes to interest rate movements over the next six quarters.

September 22