-

The process to confirm Mark Calabria as FHFA director could be lengthy, forcing the White House to consider how it will proceed with housing finance reform under Joseph Otting as acting head of the agency.

December 21 -

For hedge funds that have been hoping the Trump administration would deliver a windfall on their investments in Fannie Mae and Freddie Mac, 2019 could be a make-or-break year.

December 21 -

The White House said that Comptroller of the Currency Joseph Otting will serve as acting director of the Federal Housing Finance Agency beginning Jan. 6, after Director Mel Watt’s term ends.

December 21 -

Consumers traditionally pick the lender with the best rate and the lowest payment, but in a competitive marketplace, the customer's digital mortgage experience is often the first tiebreaker.

December 19 Notarize

Notarize -

The Trump administration wants to work with Congress on freeing Fannie Mae and Freddie Mac from government control, though it's considering pursuing some changes on its own, Treasury Secretary Steven Mnuchin said Tuesday.

December 18 -

Dividing the transaction into two tranches allowed the GSE to tailor the transaction to the risk appetite of participants, lowering the cost of reinsurance.

December 17 -

Fannie Mae made a slight increase to its origination forecast, expecting housing affordability to improve in 2019 as mortgage rates remain flat and home price appreciation moderates.

December 14 -

Texas Capital Bank, which already provides warehouse financing for e-mortgages, will now purchase these loans off those lines as it looks to increase liquidity for this product.

December 12 -

Mortgage lenders are more pessimistic than ever about the industry's profit margin outlook, with many blaming tight competition for the negative attitudes, according to Fannie Mae.

December 12 -

The White House confirmed that it plans to nominate Mark Calabria as the next director of the Federal Housing Finance Agency.

December 12 -

Fannie Mae and Freddie Mac charged lenders slightly lower guarantee fees in 2017 for mortgages with riskier characteristics, according to a Federal Housing Finance Agency report.

December 10 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

Despite increasing mortgage rates and a tepid housing market, positive consumer perception of the economy carried over to home buying during November, according to Fannie Mae.

December 7 -

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5 -

Reps. Lacy Clay and Emanuel Cleaver, both from Missouri, have shown interest in running the panel that could be a focal point in efforts to reform Fannie Mae and Freddie Mac.

December 5 -

It's in lenders' best interests to show first-time homebuyers how to avoid overextending themselves, which is easy to do in a housing market short on inventory and long on big down payments, the CEO of Freedom Mortgage says.

December 4 -

The performance of loans included in commercial mortgage-backed securities improved for the fifth consecutive quarter, with delinquencies down 179 basis points over the time frame, according to the Mortgage Bankers Association.

December 4 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

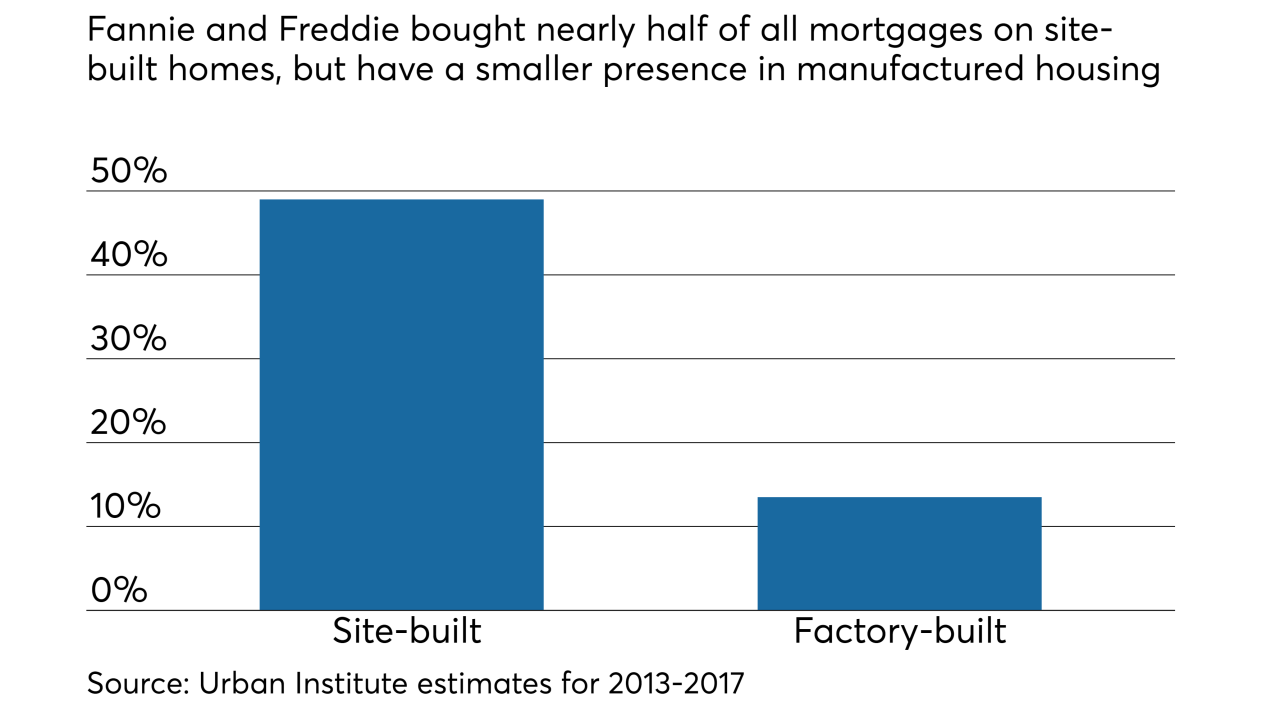

A new Freddie Mac pilot program will offer mortgages on manufactured housing with terms that more closely resemble conventional financing for site-built homes.

November 30