-

Fannie Mae and Freddie Mac charged lenders slightly lower guarantee fees in 2017 for mortgages with riskier characteristics, according to a Federal Housing Finance Agency report.

December 10 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

Despite increasing mortgage rates and a tepid housing market, positive consumer perception of the economy carried over to home buying during November, according to Fannie Mae.

December 7 -

The government-sponsored enterprises sold fewer nonperforming loans in the first half, but the drop-off in the number of sales year-to-year is less severe than it was in 2017 as a whole.

December 5 -

Reps. Lacy Clay and Emanuel Cleaver, both from Missouri, have shown interest in running the panel that could be a focal point in efforts to reform Fannie Mae and Freddie Mac.

December 5 -

It's in lenders' best interests to show first-time homebuyers how to avoid overextending themselves, which is easy to do in a housing market short on inventory and long on big down payments, the CEO of Freedom Mortgage says.

December 4 -

The performance of loans included in commercial mortgage-backed securities improved for the fifth consecutive quarter, with delinquencies down 179 basis points over the time frame, according to the Mortgage Bankers Association.

December 4 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

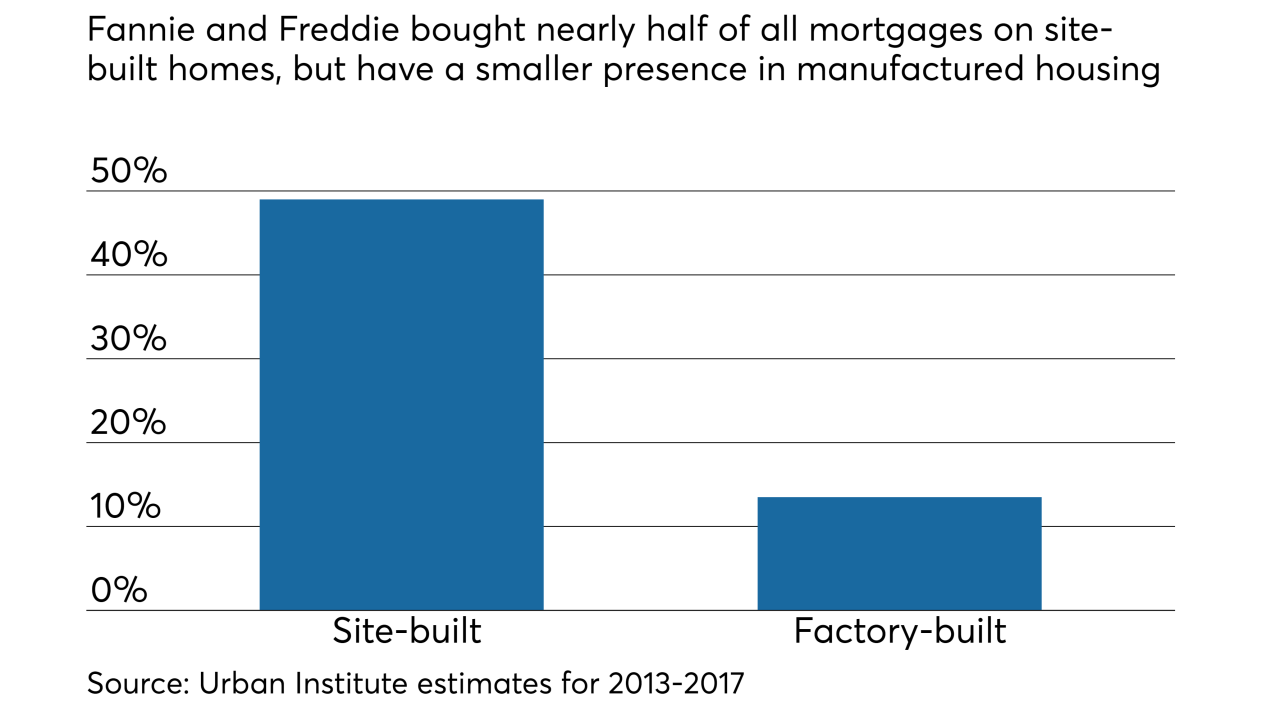

A new Freddie Mac pilot program will offer mortgages on manufactured housing with terms that more closely resemble conventional financing for site-built homes.

November 30 -

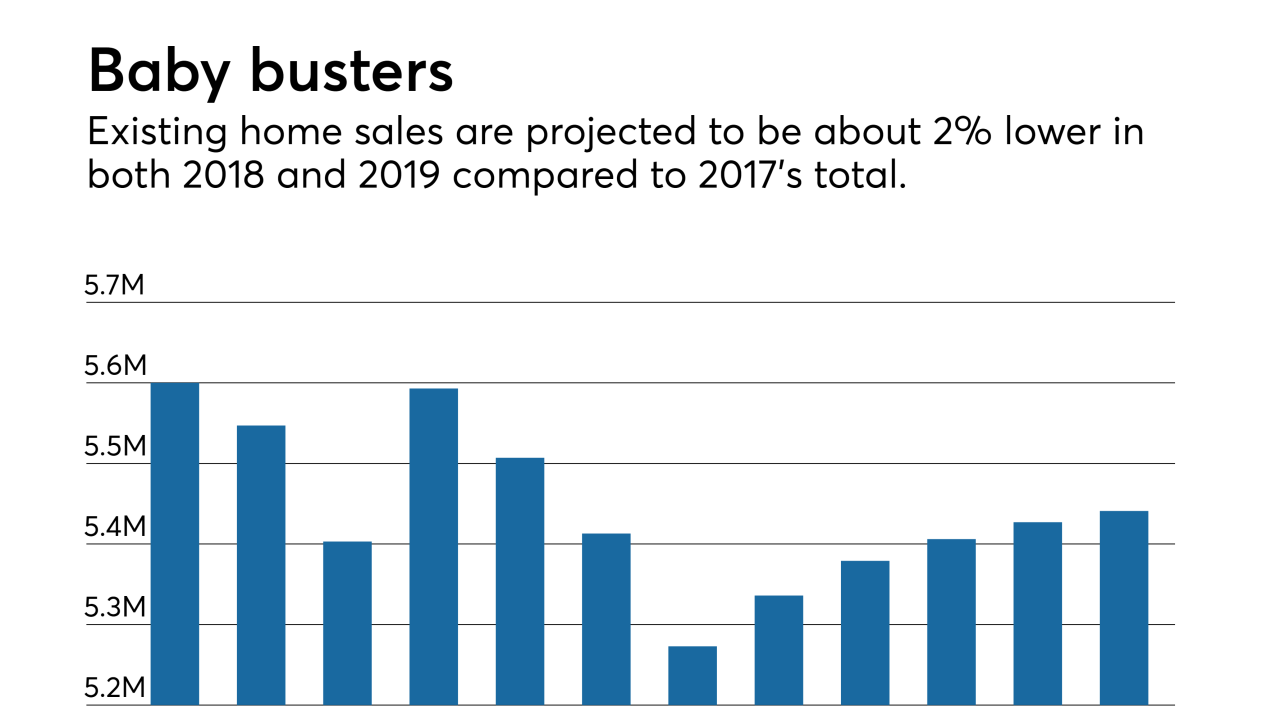

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

New financing options and better inventory have bolstered the manufactured housing sector. Is this the answer to lenders' purchase-market woes?

November 27 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

Average credit scores for mortgage borrowers remain at a 2018 high, a sign that lenders aren't easing standards despite refinance candidates already falling off on higher rates, according to Ellie Mae.

November 21 -

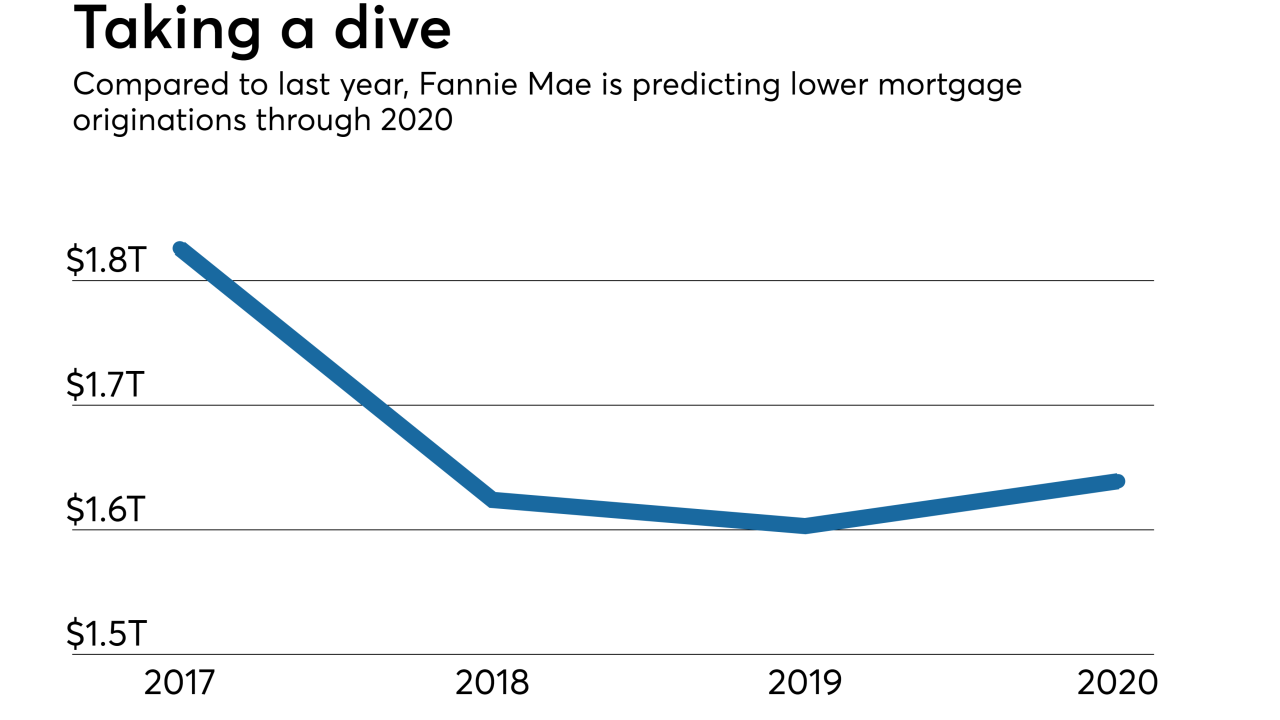

Fannie Mae's economic growth forecast for 2018 inched up slightly, but a strong labor market won't mean the same positive results for housing.

November 20 -

The Trump administration should consider putting much of the subsidized mortgage lending done by the federal government under the government-sponsored enterprises to improve efficiency and transparency.

November 19Walker & Dunlop -

The end of one-party rule in Washington could move the needle on efforts to devise a new housing finance framework.

November 18 -

A U.S. regulator's plan to boost capital in the mortgage-finance giants won't work unless investors get "compensated" for the billions of dollars the government has collected from the companies in recent years, one shareholder said.

November 16 -

Fannie Mae completed 10 traditional and front-end credit risk insurance transactions during 2018, sharing $2.6 billion of risk, including $192 million in its final deal of the year.

November 15