Federal Reserve

Federal Reserve

-

Fed economists are suggesting a new mortgage product that would allow home buyers to build equity faster and give banks incentive to profitably hold the loans in portfolio.

September 13 -

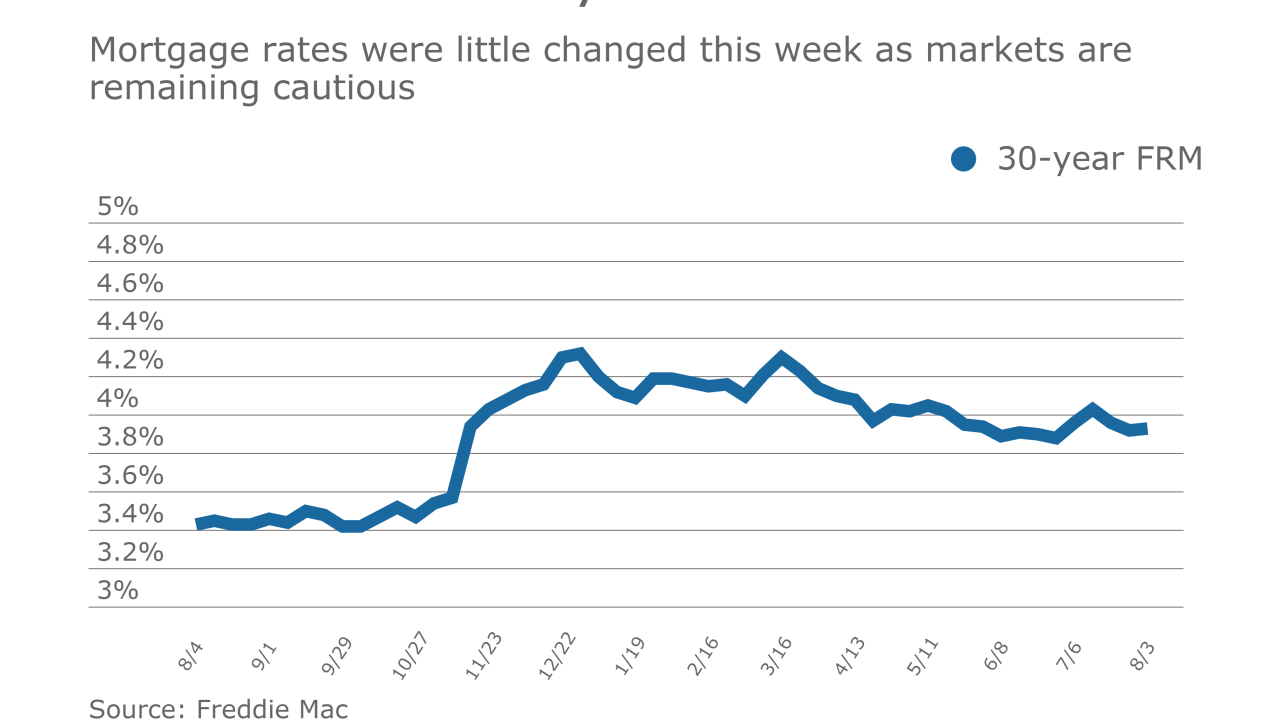

Mortgage rates dropped to a year-to-date low for the third consecutive week as the 10-year Treasury yield also declined, according to Freddie Mac.

September 7 -

Loan application defects were unchanged for July compared with June, the first time in eight months there has not been an increase, according to First American Financial Corp.

August 31 -

The Fed's order noted that Sterling had clarified errors in its Community Reinvestment Act data before receiving a "satisfactory" rating from the OCC.

-

Mortgage rates fell to a new low for the year this week, but are 38 basis points higher than they were one year ago, according to Freddie Mac.

August 31 -

If mortgage rates rise slowly as the economy continues to grow, the impact from the Fed’s unwind on housing likely will result in a decline in refinancing activity.

August 28 -

Federal Reserve Chair Janet Yellen defended post-crisis reforms but allowed that further adjustments may be necessary to reduce adverse effects on small businesses and subprime borrowers.

August 25 -

A Fed committee studying Libor’s replacement has dwelled heavily on the potential impact to the derivatives market. Loans may become a bigger part of the conversation later this year, but the panel plans to leave a lot of the specifics up to lenders.

August 17 -

Mortgage rates continued to move lower as a result of economic uncertainty, according to Freddie Mac.

August 17 -

For all the talk that Janet Yellen’s plan to shrink the Federal Reserve’s balance sheet will hurt Treasuries, U.S. mortgage bonds face a bigger test.

August 11 -

Mortgage rates dropped to their lowest point in six weeks as bond investors were concerned about inflation and the U.S. economy, according to Freddie Mac.

August 10 -

Mortgage rates were little changed this week after declining the previous two weeks, according to Freddie Mac.

August 3 -

Financial regulation is too complex and needs to be retooled to improve access to credit, President Trump’s nominees to two top banking regulators told Capitol Hill on Thursday.

July 27 -

Mortgage rates dropped for the second consecutive week, although the yield on the benchmark 10-year Treasury actually increased during the period, according to Freddie Mac.

July 27 -

Federal Reserve officials said they would begin running off their $4.5 trillion balance sheet “relatively soon” and left their benchmark policy rate unchanged as they assess progress toward their inflation goal.

July 26 -

Fed Vice Chair-nominee Randal Quarles will likely face questions about his support for small banks, while Comptroller-nominee Joseph Otting must face fallout from his predecessor.

July 25 -

A regulatory plan to create new restrictions on banks’ executive compensation practices appears dead — but changes since the financial crisis may have made the proposal largely obsolete anyway.

July 21 -

Borrowers with variable-rate debt affected by Federal Reserve rate hikes showed they could handle December's 25-basis-point increase, but that could be changing as short-term rates continue to rise.

July 20 -

The industry and GOP lawmakers face short time frames and other challenges in trying to repeal the Consumer Financial Protection Bureau's arbitration rule.

July 13 -

Mortgage rates rose across the board for the second consecutive week, with the 30-year fixed-rate loan moving over 4%, according to Freddie Mac.

July 13