Federal Reserve

Federal Reserve

-

Federal Reserve officials held interest rates near zero while signaling they expect two increases by the end of 2023, pulling forward the date of liftoff and projecting a faster-than-anticipated pace of tightening as the economy recovers.

June 16 -

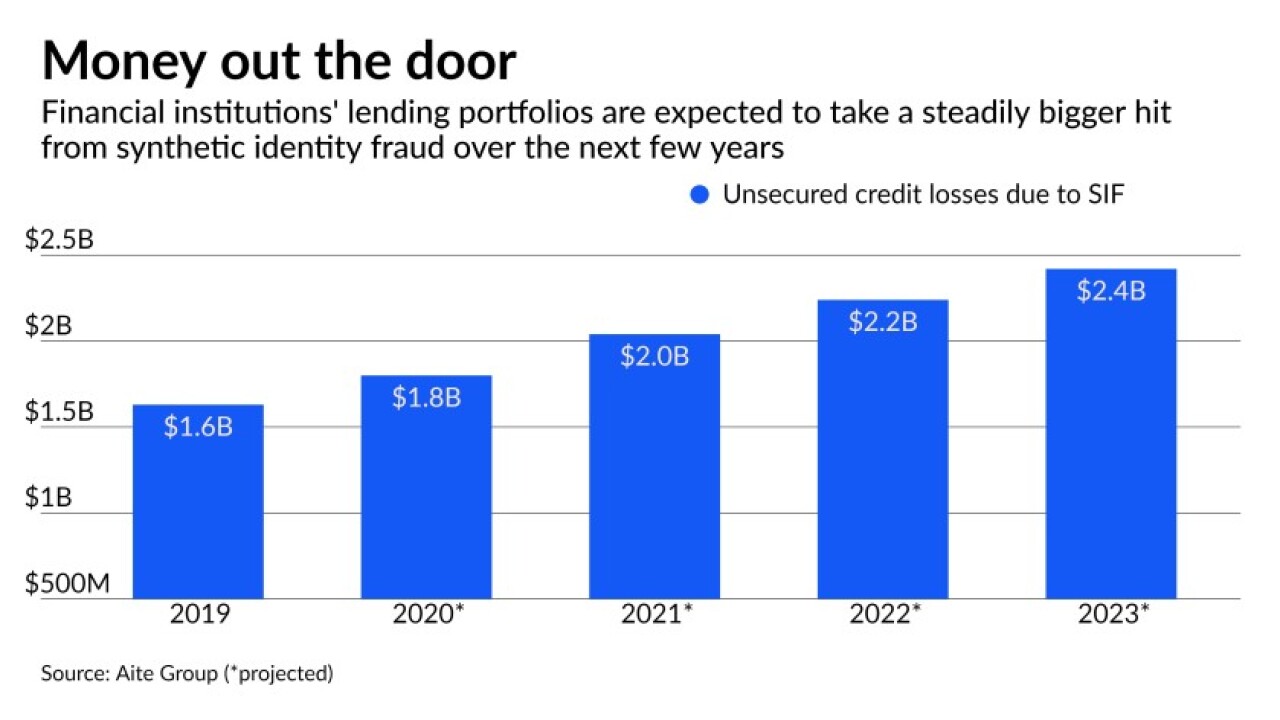

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 - LIBOR

Federal Reserve Vice Chair Randal Quarles has made it clear that banks failing to make the transition away from the benchmark rate could face supervisory consequences.

June 1 -

A week of light data could possibly lead to further mortgage-rate volatility ahead depending on what monetary officials say in the coming days.

May 20 -

Financial institutions said they needed more time to weigh in on issues such as how they use artificial intelligence for fraud prevention and underwriting.

May 17 -

The head of the Federal Reserve appeared to support Congress’s expanding the scope of the Community Reinvestment Act to unregulated institutions, just as regulators weigh how to modernize the framework for banks.

May 3 -

U.S. personal incomes soared in March by the most in monthly records back to 1946, powered by a third round of pandemic-relief checks that also sparked a sharp gain in spending.

April 30 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

April 28 -

More than two-thirds of the economists surveyed expect the Federal Open Market Committee will give an early-warning signal of tapering this year, with the largest number — 45% — looking for a nod during the July-September quarter.

April 26 -

The markets and the Fed are not on the same page about the future of inflation. Luke Tilley Senior Vice President and Chief Economist at Wilmington Trust will discuss the economy and inflation.

-

Economists see two quarter-point hikes in 2023. But they also expect the U.S. central bank’s own forecast will show the median Fed official projecting rates staying on hold near zero throughout that year.

March 15 -

Some nominees poised to take their agencies in a new direction appear headed for Senate confirmation while an intraparty squabble has delayed the administration’s choice to lead the Office of the Comptroller of the Currency. Here’s the roster update.

March 9 -

Bond bears appear to be having more than just a moment here at the start of 2021, with Treasury yields finally busting out of long-held ranges to levels last seen in the early days of the pandemic.

February 22 -

Also: CoStar boosts CoreLogic offer, Biden extends forebearance and the Fed sounds alarms on commercial real estate

February 19 -

Just because the Fed is staying put doesn’t mean that mortgage rates, and prices of MBS, are staying put as well, writes Vice Capital Markets Principal Chris Bennett.

February 19 -

The Federal Reserve warned of significant risks of business bankruptcies and steep drops in commercial real estate prices in a report published on Friday.

February 19 -

In their detailed presentation to the FOMC last month, Fed staff “assessed asset valuation pressures as elevated” — their highest characterization of risk.

February 18 -

The best mortgage bonds to buy now may be the ones the Federal Reserve is purchasing, because the securities might benefit the most if macro optimism fades.

February 12 -

January’s excess return came in at a level well above the trailing average for the month, thanks in large part to a helpful hand from the Federal Reserve.

February 2 -

Federal Reserve officials left their benchmark interest rate unchanged near zero as they flagged a moderating U.S. recovery and reiterated a pledge to use all available tools to support the economy during the coronavirus pandemic.

January 28