Federal Reserve

Federal Reserve

-

Regulators said they were taking steps to recognize contributions to the recovery made by banks anywhere in the nation.

January 25 -

Senators overwhelmingly approved Jerome Powell to lead the Federal Reserve Board despite vocal opposition from some Democrats.

January 23 -

Mick Mulvaney, acting director of the Consumer Financial Protection Bureau, said his zero-funding request for the agency is not meant to drain it of resources.

January 23 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, has requested no funding from the Federal Reserve in the second quarter and instead will use reserves to fund the agency.

January 18 -

The Senate Banking Committee had approved Powell already in December, but a revote was necessary after the Senate adjourned for the year without finalizing his confirmation.

January 17 -

The payments resolve a number of cases that date back to 2011 and were among the largest coordinated U.S. enforcement efforts in the years following the crisis.

January 12 -

More than 100 pending Trump administration nominees, including Fed Chair-designate Jerome Powell, must update their financial disclosures and have the White House resubmit their names for consideration by the Senate.

January 3 -

The Trump administration's Financial Stability Oversight Council is likely to remove the systemically important financial institution label for the remaining nonbanks on the list, but it might consider adding other firms such as Fannie Mae and Freddie Mac.

December 28 -

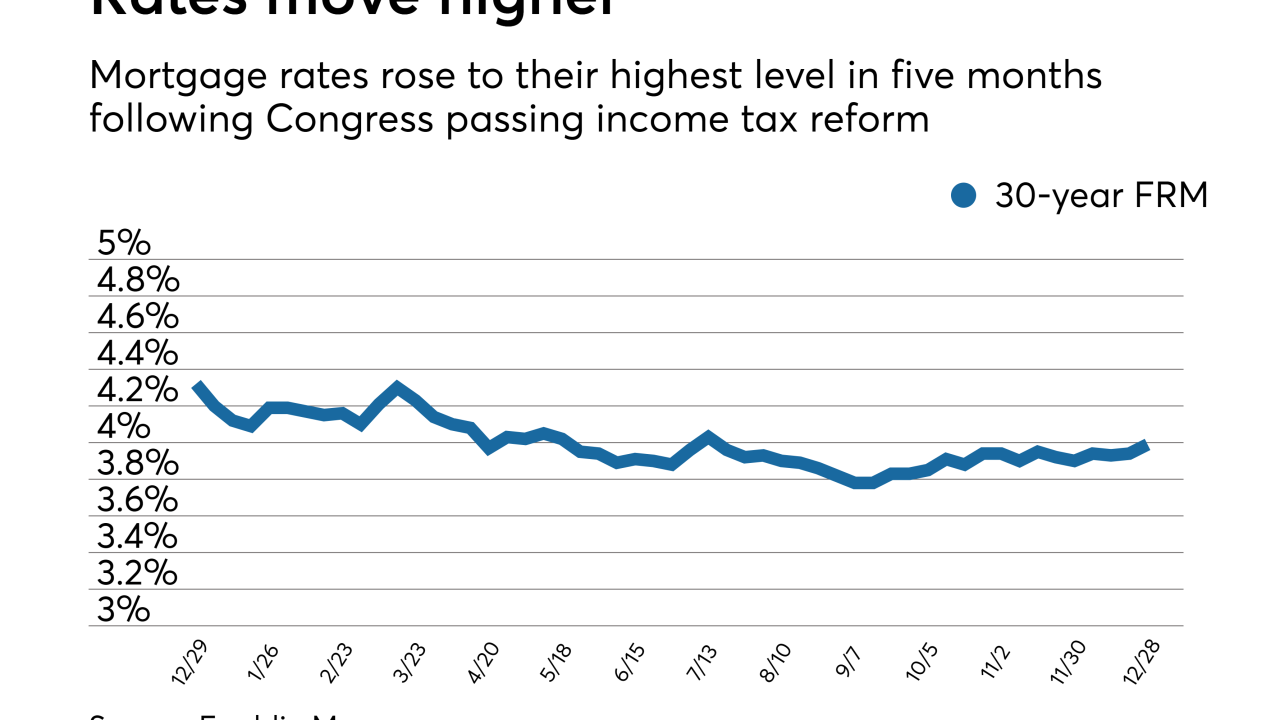

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

Comptroller of the Currency Joseph Otting said in a press conference Wednesday morning that there is a place in the banking world for some kind of fintech charter, though the exact parameters of such a charter are still unclear and have to be worked out.

December 20 -

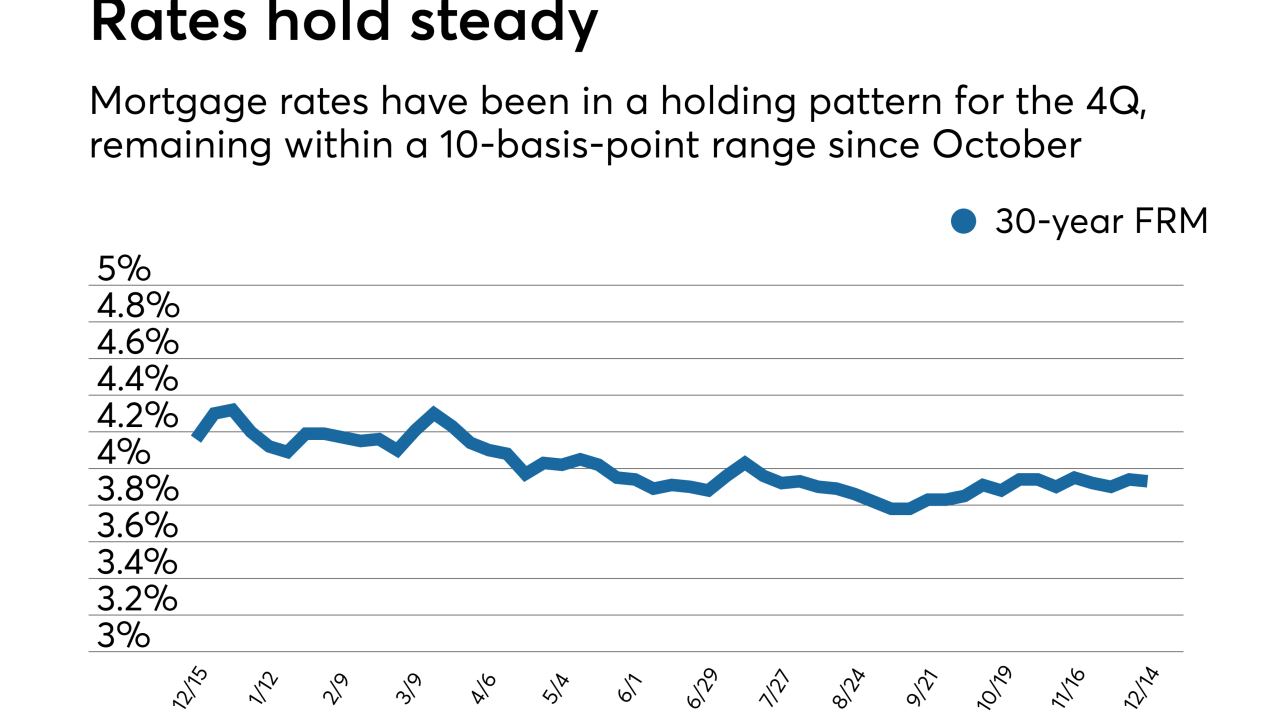

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

Critics argue that the consumer bureau's independence is being undermined, and they worry that a precedent is being established that could hamper the autonomy of other U.S. financial regulators.

December 5 -

Sen. Elizabeth Warren, D-Mass., was the only member of the Senate Banking Committee to oppose the nomination of Federal Reserve Board Gov. Jerome Powell to lead the central bank.

December 5 -

Private mortgage insurers are better positioned to weather a flatter or even inverted yield curve than other financials from an investment perspective, a report from FBR Capital Markets said.

December 4 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

Consumer house-buying power, measuring how much one can purchase based on changes in income and interest rates, fell 2.1% year-over-year, but increased by 1.3% from the month prior, according to First American Financial Corp.

November 28 -

President Trump’s pick to head the Federal Reserve will face the Senate Banking Committee this week. Here’s what to watch for.

November 27 -

Federal Reserve officials meeting earlier this month saw an interest-rate increase in the near term even as divisions persisted over the policy path forward amid tepid inflation.

November 22