Federal Reserve

Federal Reserve

-

Federal Reserve Chair Janet Yellen announced Monday that she intends to step down from the Board of Governors after her successor is sworn in when her term expires early next year, ending any speculation that she may stay on.

November 20 -

Mortgage rates fell slightly across the board after the release of the Republican Party tax plan and the nomination of a new Federal Reserve chairman.

November 9 -

So long as the current monetary regime survives, homeowners — present and potential — can expect higher average prices interspersed with wild rides up and down.

November 8 -

During his time as Fed governor, chair-designate Jerome Powell has outlined his views on a host of bank regulatory matters, including the need for regulatory relief, the push for housing finance reform, blockchain and much more.

November 5 -

Many industry observers believe Federal Reserve Board Janet Yellen will retire from the central bank once her term as chair expires in February. But there are reasons she might stay.

November 3 -

Fed Gov. Jerome Powell, who was first nominated to the central bank by former President Obama, is widely seen as a continuity choice.

November 2 -

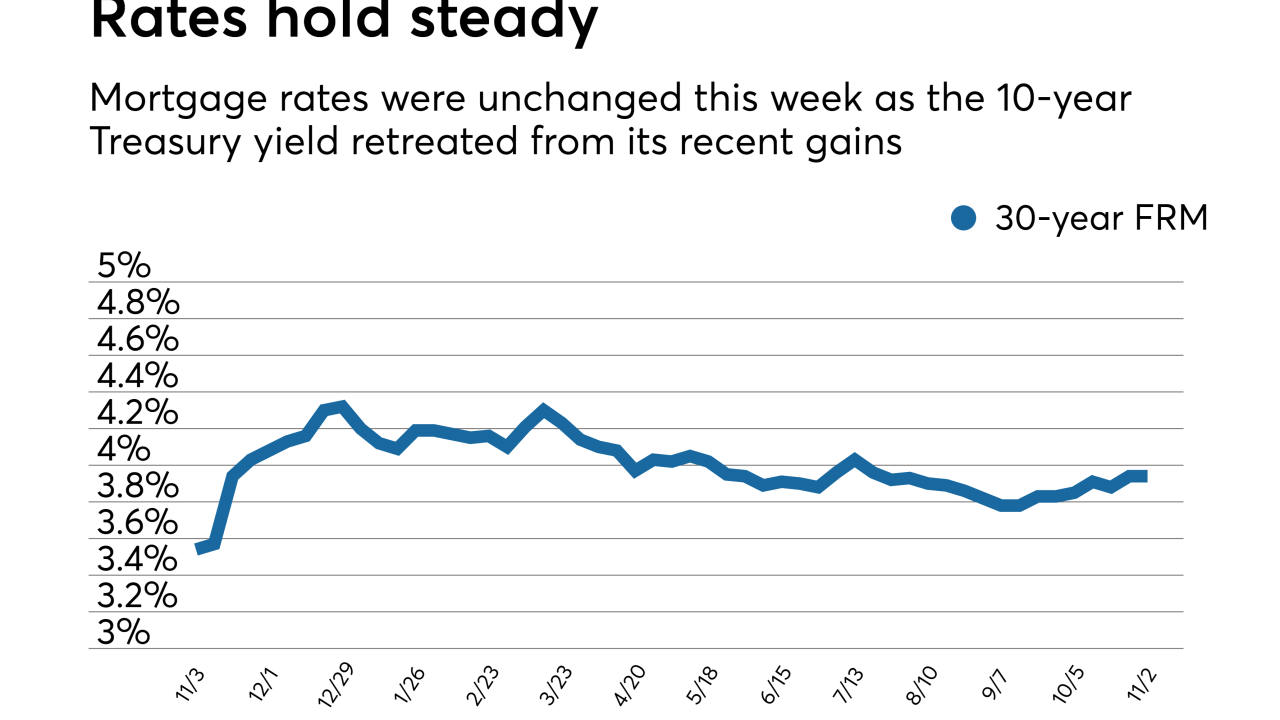

Mortgage rates were unchanged or up slightly this week even as the 10-year Treasury yield retreated from its recent gains, according to Freddie Mac.

November 2 -

Following the release of the nonbinding statement of policy, regulators still have an important role to play in making sure the industry achieves an effective data-sharing model.

November 1 -

If President Trump picks Federal Reserve Board Gov. Jerome Powell as its next chair, it may represent the best of all worlds for bankers — a policymaker who will continue the central bank's monetary policy but be open to regulatory changes.

October 30 -

Mortgage rates reached their highest level since July and are closing in on 4%, according to Freddie Mac.

October 26 -

Mortgage rates ticked down for the first time in two weeks as the 10-year Treasury yield fell to its lowest point in October, according to Freddie Mac.

October 19 -

Under a joint order, lenders still have to document the value of properties in storm-affected regions, but they will not have to depend on appraisers.

October 17 -

The Treasury Department is expanding its calls for overhauling regulation of the financial services sector, this time focusing on changes to the most significant rules surrounding securitization and derivatives.

October 6 -

Mortgage rates ticked up to their highest mark in six weeks, reflecting the 20-basis-point rise in the 10-year Treasury yield during September, according to Freddie Mac.

October 5 -

After the FSOC voted to rescind its systemic designation for AIG, it's unclear whether the interagency council will continue to appeal a court ruling overturning MetLife's SIFI designation.

October 2 -

The share of purchase and refinance loans originated by nonbanks are at their highest point since at least 1995, according to an analysis of new Home Mortgage Disclosure Act data.

September 28 -

Mortgage rates remained unchanged from last week even through the 10-year Treasury yield first moved lower then spiked up during the period, according to Freddie Mac.

September 28 -

The proposal is aimed at a simpler capital regime particularly for community banks, but some industry representatives and regulators themselves questioned whether the plan went far enough.

September 27 -

The Trump administration has implemented an apparent role reversal for the Financial Stability Oversight Council, leaving the true intended role of the post-crisis systemic risk body unclear.

September 25 -

Federal Reserve Chair Janet Yellen said Wells Fargo’s treatment of customers was “egregious and unacceptable," hinting that more regulatory action was likely.

September 20