-

After 10 years of conservatorship, the new year could finally usher in big steps toward housing finance reform.

December 27 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

Home retention actions from Fannie Mae and Freddie Mac through the first three quarters of 2018 already eclipsed 2016 and 2017 while forfeitures kept declining, according to the Federal Housing Finance Agency.

December 21 -

The process to confirm Mark Calabria as FHFA director could be lengthy, forcing the White House to consider how it will proceed with housing finance reform under Joseph Otting as acting head of the agency.

December 21 -

For hedge funds that have been hoping the Trump administration would deliver a windfall on their investments in Fannie Mae and Freddie Mac, 2019 could be a make-or-break year.

December 21 -

The White House said that Comptroller of the Currency Joseph Otting will serve as acting director of the Federal Housing Finance Agency beginning Jan. 6, after Director Mel Watt’s term ends.

December 21 -

The Trump administration wants to work with Congress on freeing Fannie Mae and Freddie Mac from government control, though it's considering pursuing some changes on its own, Treasury Secretary Steven Mnuchin said Tuesday.

December 18 -

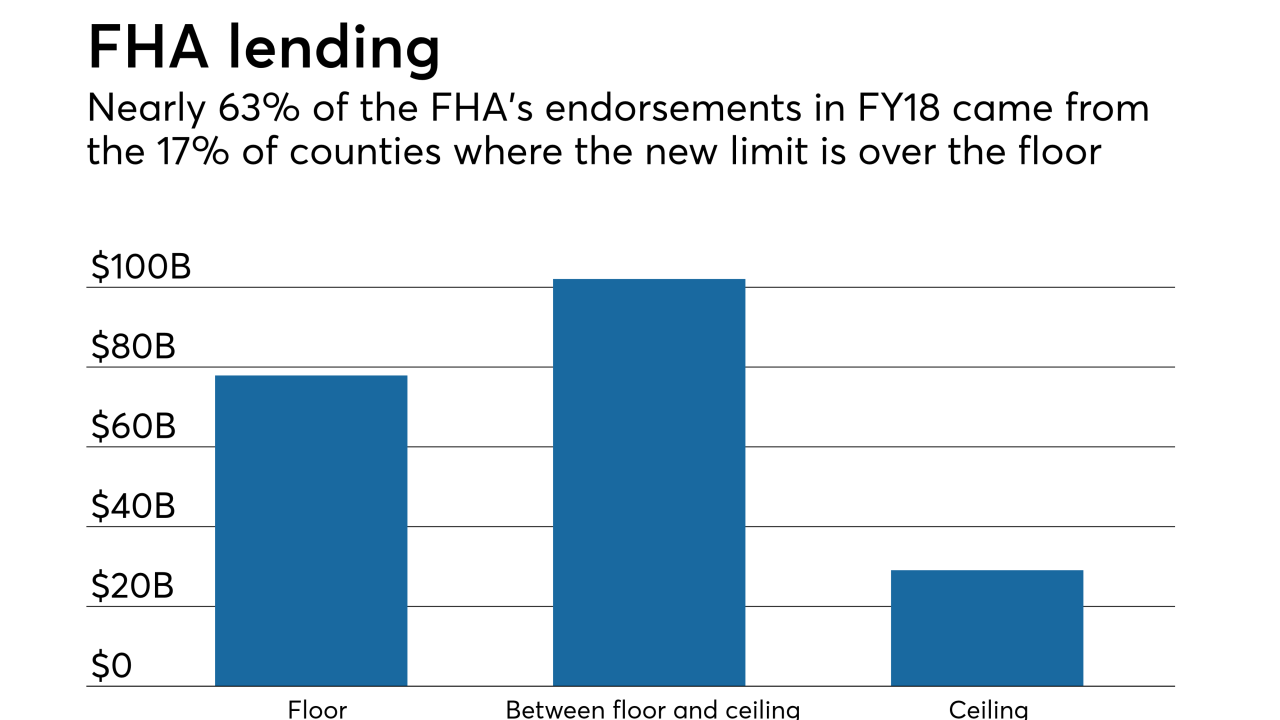

The Federal Housing Administration mortgage loan limit will increase by approximately 7% for next year, mirroring the rise for conforming loans.

December 14