-

For hedge funds that have been hoping the Trump administration would deliver a windfall on their investments in Fannie Mae and Freddie Mac, 2019 could be a make-or-break year.

December 21 -

The White House said that Comptroller of the Currency Joseph Otting will serve as acting director of the Federal Housing Finance Agency beginning Jan. 6, after Director Mel Watt’s term ends.

December 21 -

The Trump administration wants to work with Congress on freeing Fannie Mae and Freddie Mac from government control, though it's considering pursuing some changes on its own, Treasury Secretary Steven Mnuchin said Tuesday.

December 18 -

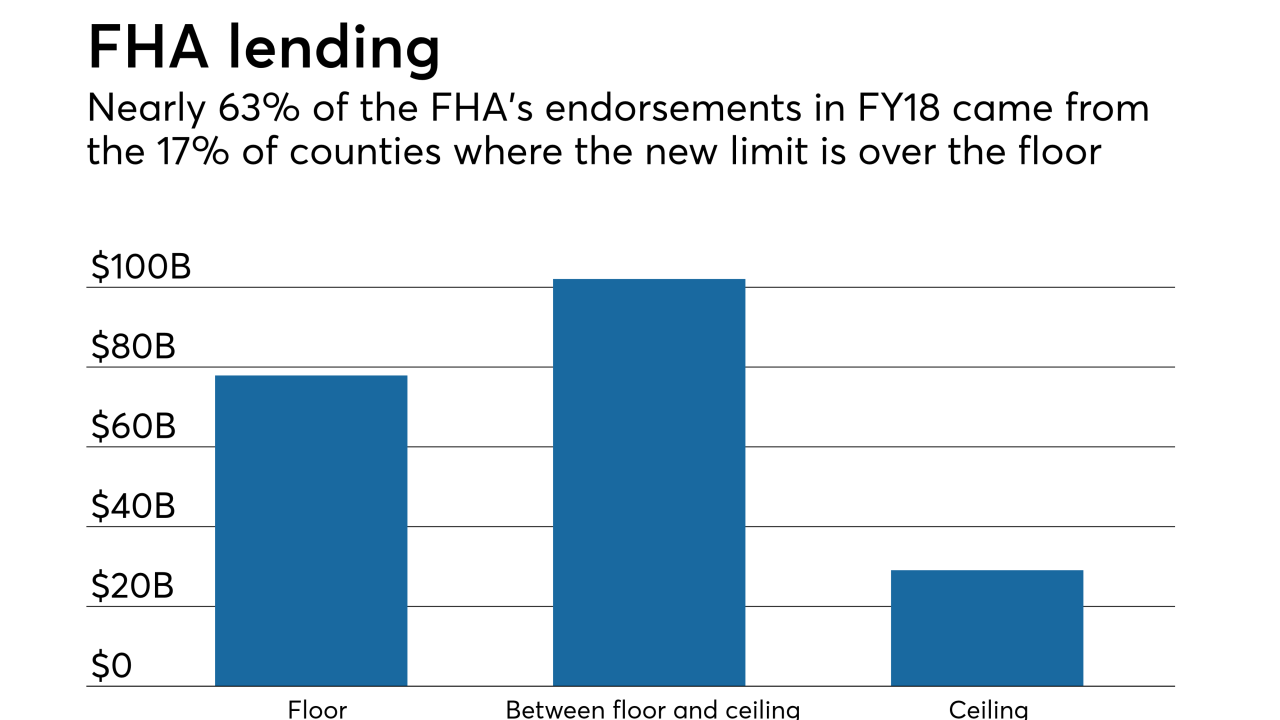

The Federal Housing Administration mortgage loan limit will increase by approximately 7% for next year, mirroring the rise for conforming loans.

December 14 -

The White House confirmed that it plans to nominate Mark Calabria as the next director of the Federal Housing Finance Agency.

December 12 -

Fannie Mae and Freddie Mac charged lenders slightly lower guarantee fees in 2017 for mortgages with riskier characteristics, according to a Federal Housing Finance Agency report.

December 10 -

The administration’s reported interest in having the White House aide run Fannie Mae and Freddie Mac's regulator signals a focus on constraining the mortgage giants’ role in the housing market.

December 10 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

The end of one-party rule in Washington could move the needle on efforts to devise a new housing finance framework.

November 18 -

A U.S. regulator's plan to boost capital in the mortgage-finance giants won't work unless investors get "compensated" for the billions of dollars the government has collected from the companies in recent years, one shareholder said.

November 16 -

Fannie Mae completed 10 traditional and front-end credit risk insurance transactions during 2018, sharing $2.6 billion of risk, including $192 million in its final deal of the year.

November 15 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

The Federal Housing Administration's life-of-loan premium discourages borrowers from refinancing into another FHA mortgage, damaging the stability of the insurance fund.

November 8 Potomac Partners

Potomac Partners -

Continued diversification of its business lines and better margins in its securitization activities helped Redwood Trust overcome steep mortgage origination declines and post nearly 14% annual growth in net income during the third quarter.

November 8 -

The Federal Housing Finance Agency is leaving the government-sponsored enterprises' multifamily caps for 2019 unchanged at $35 billion per agency, but is making other changes to prerequisites for excluded loans.

November 6 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2 -

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

Under the Federal Housing Finance Agency's plan, small Home Loan banks would face a new housing benchmark and a volume threshold for meeting the goals would be eliminated.

October 29 -

A Queens, N.Y., man who helped defraud mortgage lending units at Bank of America, Chase Bank and AmTrust is now facing 21 months in prison and three years of supervised release.

October 29