-

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

With would-be sellers too spooked to list their homes and would-be buyers held up due to social distancing orders, home price appreciation accelerated in April. And it could continue into the summer.

June 2 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

Pre-pandemic, home-buying power was high, but few are likely to buy a home today given a host of uncertainties regarding coronavirus, First American said.

April 27 -

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

From the crossroads of America down to the bayou, here's a look at 12 housing markets where it's the most financially prudent to buy a home rather than rent, according to First American.

April 16 -

While the housing market will suffer from the COVID-19 crisis, it's stronger than it was in during its last crash in 2008, according to First American Financial.

March 31 -

Title underwriters won’t be hit as hard by the coronavirus as other insurers, but related economic changes will challenge them, Fitch Ratings said, in assigning a negative outlook to the sector.

March 26 -

Investors' purchases of 10-year Treasurys after the Fed's 50 basis point short-term rate cut drove the yield below 1% for a period of time.

March 3 -

Mortgage loan application defect risk is at the lowest point since First American started tracking this data, strictly as a function of the shift to a refinance market.

February 28 -

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Loan application defect risk fell in December after stabilizing the prior month, but it's not dropping as it quickly as it once was, according to First American Financial.

January 30 -

December's potential for existing-home sales grew by 1.7% compared with November because of low mortgage rates, but in the future that factor could constrain the housing market, First American Financial said.

January 23 -

The drop in home buying power heightened the risk of misrepresentations on purchase mortgage loan applications during November, as consumers are more willing to fudge information in an uncertain market, First American Financial said.

December 30 -

Homebuyer purchase power took another big jump in October as wages grew and mortgage rates stayed low despite continuously tight housing inventory, according to First American Financial.

December 23 -

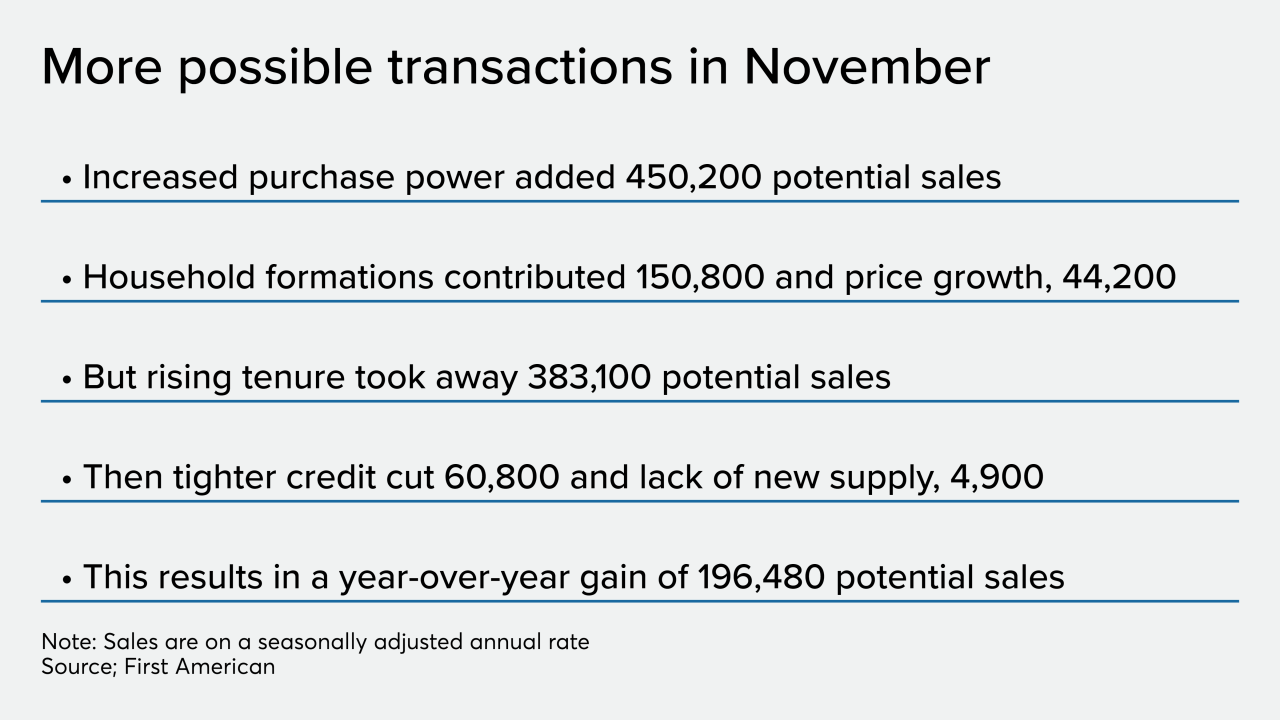

November was another month in the latter part of 2019 where actual existing-home sales outperformed their potential, but that momentum seems unlikely to continue in 2020, First American said.

December 18 -

From the Southeast to the Midwestern plains, here's a look at the 12 cities where first-time homebuyers can afford the largest share of houses for sale, according to First American.

December 12 -

Loan defect risk in purchase applications stopped falling and plateaued in October, according to First American Financial Corp.

December 2 -

While affordability remains a challenge with the continued strain on housing supply, purchasing power took a big leap in September thanks to a rise in income and descending interest rates, according to First American Financial Corp.

November 27 -

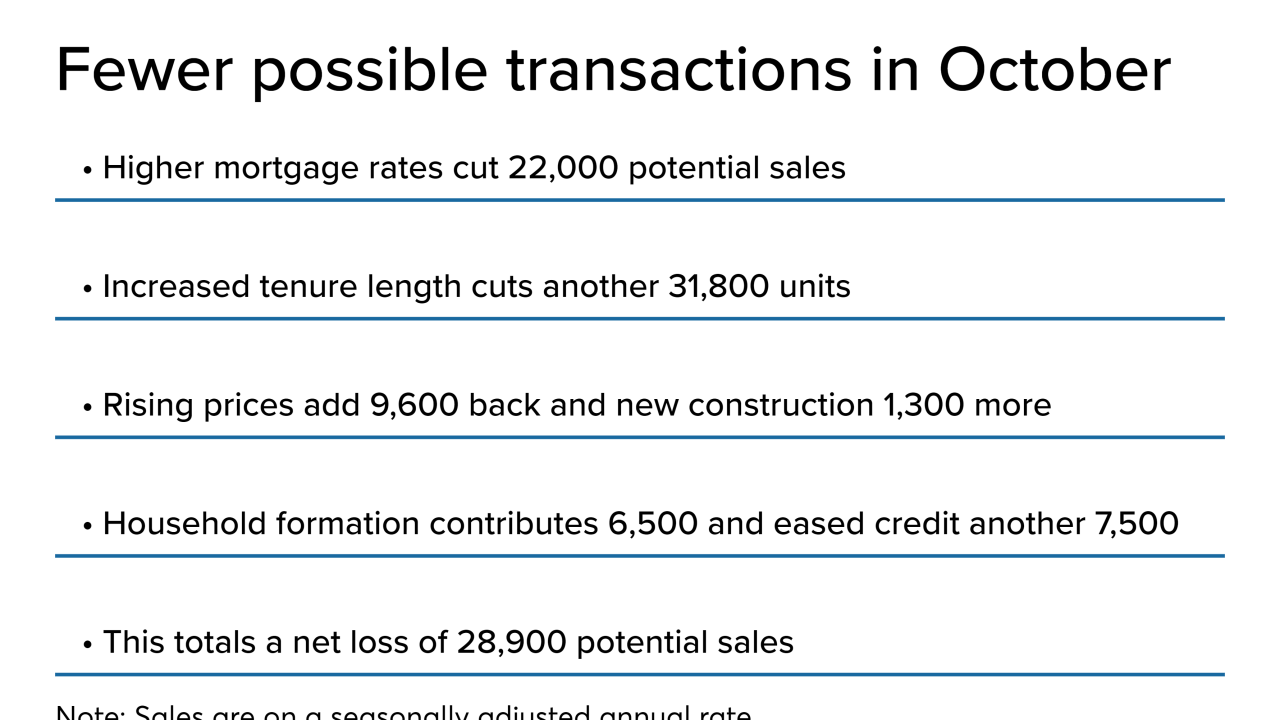

Existing-home sales outperformed their estimated potential for October on improved consumer buying power since the start of 2019 and lower mortgage rates, First American said.

November 20