-

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

Nondepository mortgage companies cut another 1,500 workers in March as the housing market's peak season got underway, suggesting that even with business potentially picking up, lenders remain cautious about hiring.

May 3 -

Growing wages combined with flat mortgage rates handed homebuyers' increased affordability with a 2.4% boost in purchasing power for February, according to First American Financial Corp.

April 29 -

Title underwriters and other vendors reported year-over-year declines in business activity (although some reported improved profitability), but lower interest rates made them optimistic about their prospects going forward.

April 26 -

If favorable interest rates and rising consumer incomes continue, market potential for home purchases will be boosted in the short term, according to First American Financial.

April 22 -

From the middle of the country to the Pacific Northwest, here's a look at cities where consumers wield the most purchasing power for the upcoming home buying season, based on changes in housing values compared to local wages and mortgage rates.

April 12 -

Income-related mortgage application fraud risk has the potential to increase as competition rises among buyers during the peak spring season, First American said.

March 29 -

The gap between potential and actual existing home sales is narrowing even though supply shortages still vex the market, according to First American’s latest report.

March 21 -

From New York to Seattle, here's a look at cities with the best homebuyer purchasing power for the upcoming competitive spring market, based on changes in house values compared to local wages and mortgage rates.

March 11 -

A strong spring home purchase season is likely to further increase mortgage loan application defect risk, which already spiked in the past two months, according to First American.

February 28 -

Rising household incomes paired with December's drop in mortgage rates gave consumers their largest monthly jump in home buying power since 2013, according to First American Financial Corp.

February 25 -

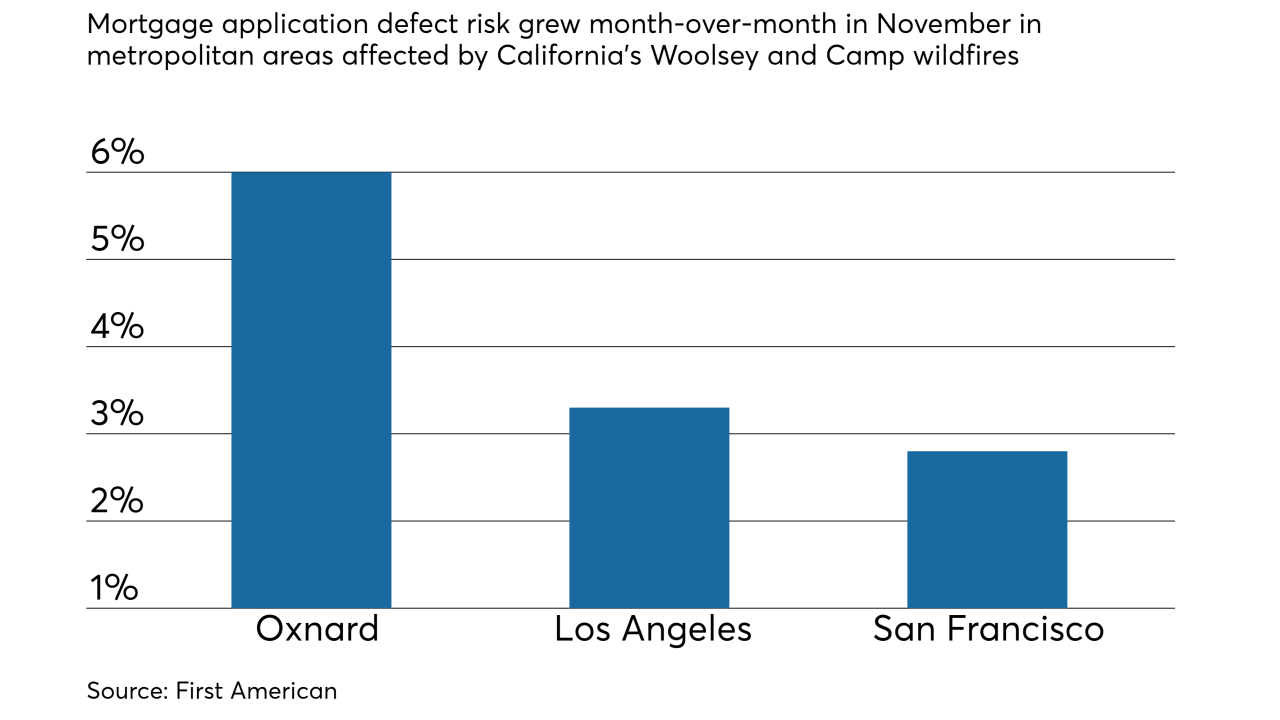

Mortgage application defect risk was at its highest level in four years because of higher interest rates as well as natural disasters during the latter part of 2018, according to First American.

January 31 -

Property values have continued rising across the country, but six cities bucking the national trend are leading a shift in the housing market, which could lessen affordability hurdles for homebuyers, according to First American Financial Corp.

January 28 -

The stock market's volatility during December helped to improve the potential for existing-home sales, although housing's performance remains well below its capacity, First American Financial said.

January 22 -

The housing shortage could end and oversupply may become an issue when a large percentage of baby boomers finally reach the point where they leave their homes, a recent report suggests.

January 11 -

Millennials comprise the largest cohort of homebuyers as most have entered their prime purchasing years, and they just might shake up migration patterns in 2019, according to First American Financial Corp.

January 7 -

Mortgage application fraud risk continued growing for the fifth consecutive month, and the recent California wildfires are partly to blame, according to First American Financial Corp.

December 27 -

Ordinarily, declining property sales will cool the costs for housing. But existing-home sales have been underperforming their potential for 40 straight months and property values are still on the rise, according to First American Financial Corp.

December 17 -

There was an 8% year-over-year increase in mortgage loan application defect risk in California during October and that should rise further because of the wildfires that devastated the state, First American said.

December 3 -

Here's a look at 12 cities with slower home price appreciation and more favorable mortgage rate and wage conditions, offering purchasing power advantages to consumers.

November 28