-

Rising household incomes paired with December's drop in mortgage rates gave consumers their largest monthly jump in home buying power since 2013, according to First American Financial Corp.

February 25 -

Mortgage application defect risk was at its highest level in four years because of higher interest rates as well as natural disasters during the latter part of 2018, according to First American.

January 31 -

Property values have continued rising across the country, but six cities bucking the national trend are leading a shift in the housing market, which could lessen affordability hurdles for homebuyers, according to First American Financial Corp.

January 28 -

The stock market's volatility during December helped to improve the potential for existing-home sales, although housing's performance remains well below its capacity, First American Financial said.

January 22 -

The housing shortage could end and oversupply may become an issue when a large percentage of baby boomers finally reach the point where they leave their homes, a recent report suggests.

January 11 -

Millennials comprise the largest cohort of homebuyers as most have entered their prime purchasing years, and they just might shake up migration patterns in 2019, according to First American Financial Corp.

January 7 -

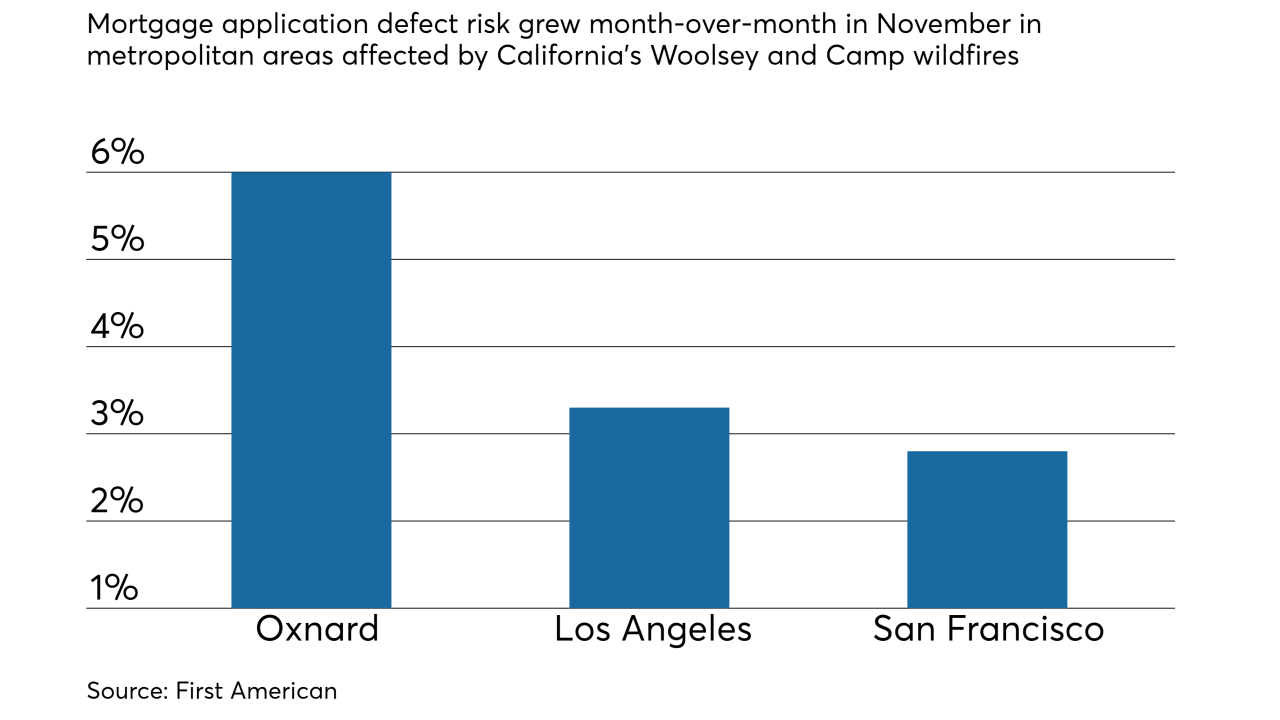

Mortgage application fraud risk continued growing for the fifth consecutive month, and the recent California wildfires are partly to blame, according to First American Financial Corp.

December 27 -

Ordinarily, declining property sales will cool the costs for housing. But existing-home sales have been underperforming their potential for 40 straight months and property values are still on the rise, according to First American Financial Corp.

December 17 -

There was an 8% year-over-year increase in mortgage loan application defect risk in California during October and that should rise further because of the wildfires that devastated the state, First American said.

December 3 -

Here's a look at 12 cities with slower home price appreciation and more favorable mortgage rate and wage conditions, offering purchasing power advantages to consumers.

November 28 -

Fintech adoption among real estate and title agents is accelerating, though their optimism on the housing market has tanked, according to First American Financial Corp.

November 27 -

Rising interest rates are holding back existing homeowners from listing their properties, driving the gap between existing and potential sales even as that disparity narrows, First American Financial said.

November 19 -

There was a 1.3% uptick in mortgage application defects in September from the previous month, with states affected by Hurricane Florence showing preliminary spikes in activity following the storm, according to First American.

October 26 -

All four national title insurance underwriters saw an increase in third-quarter net earnings compared with one year prior even as new orders declined because mortgage origination volume fell this year.

October 25 -

Property values have grown enough for households to establish equity and make a profit, but homeowners continue staying put, causing sales to underperform their potential.

October 18 -

First American Mortgage Solutions is stepping up its digital mortgage game by offering electronic closing capabilities.

October 16 -

Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

September 26 -

Future reductions in loan application defect risk are likely because of mortgage lenders' fintech investments, even as the purchase origination share grows, said First American Financial.

August 31 -

Tech-focused startups are knocking on the door of a $15 billion industry that's dominated by just four companies: Title insurance.

August 22 -

From Washington to Baltimore, here's a look at the 12 best housing markets for homebuyer purchasing power, where median house values and mortgage rates are more favorable.

August 6