-

While regulatory relief legislation would raise the asset threshold for “systemically important” banks, Federal Reserve Chairman Jerome Powell said the central bank could still apply prudential scrutiny to banks below that new cutoff.

March 21 -

There's too much momentum and too little debt for rising interest rates to derail the U.S. economic expansion or drive up the cost of home ownership.

March 14 -

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

Powell, a former investment banker who has served as a Fed governor, was confirmed by the Senate last month to a four-year term as chair of the central bank.

February 5 -

Senators overwhelmingly approved Jerome Powell to lead the Federal Reserve Board despite vocal opposition from some Democrats.

January 23 -

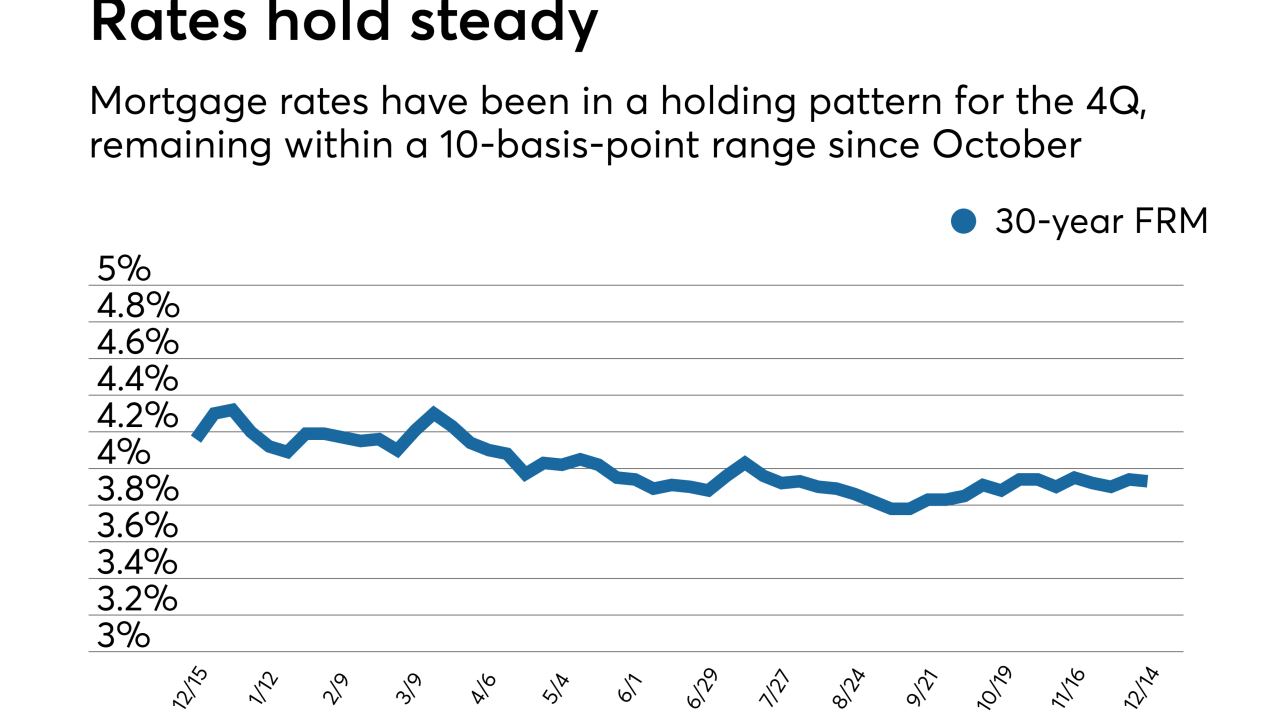

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Private mortgage insurers are better positioned to weather a flatter or even inverted yield curve than other financials from an investment perspective, a report from FBR Capital Markets said.

December 4 -

Consumer house-buying power, measuring how much one can purchase based on changes in income and interest rates, fell 2.1% year-over-year, but increased by 1.3% from the month prior, according to First American Financial Corp.

November 28 -

Federal Reserve officials meeting earlier this month saw an interest-rate increase in the near term even as divisions persisted over the policy path forward amid tepid inflation.

November 22 -

Many industry observers believe Federal Reserve Board Janet Yellen will retire from the central bank once her term as chair expires in February. But there are reasons she might stay.

November 3 -

Nonbank mortgage employment took its biggest drop since January following the recent hurricanes, according to the Bureau of Labor Statistics.

November 3 -

Fed Gov. Jerome Powell, who was first nominated to the central bank by former President Obama, is widely seen as a continuity choice.

November 2 -

Continued economic growth, a strong jobs market and higher wages will lead to a 7.3% increase in purchase origination volume next year, according to the Mortgage Bankers Association.

October 24 -

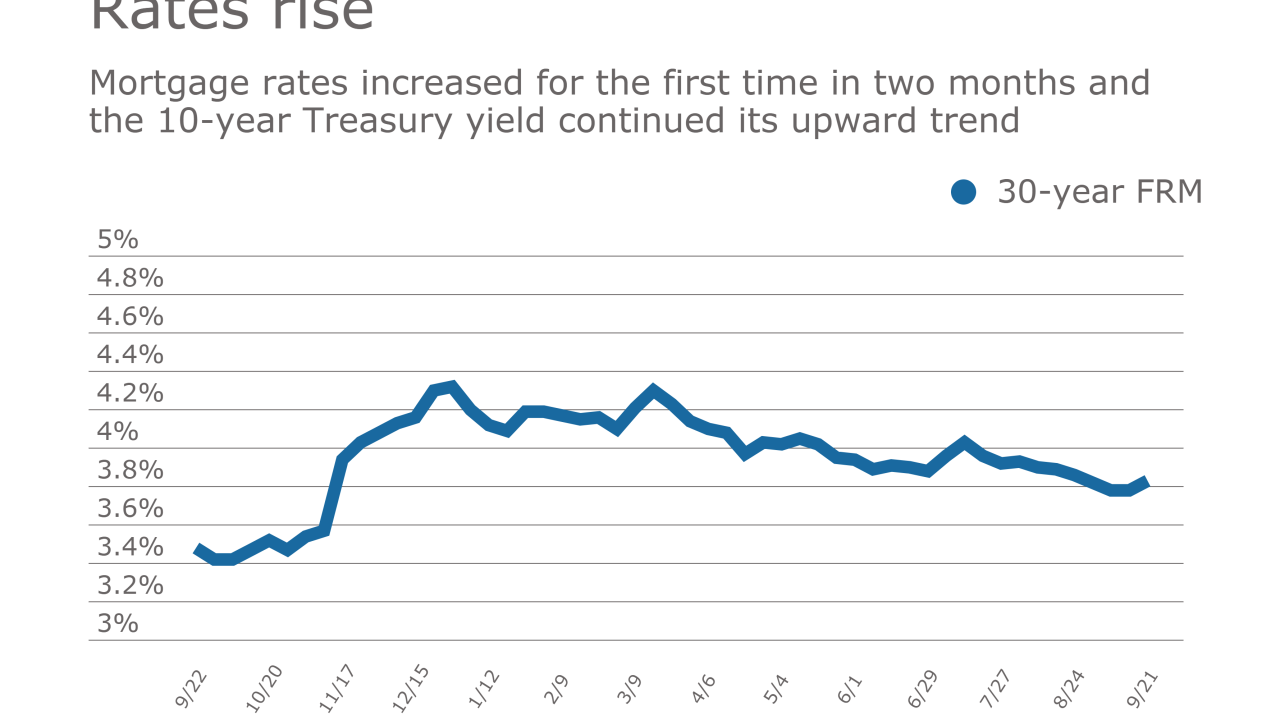

Mortgage rates posted their biggest week-over-week increase since July and the 10-year Treasury yield also rose, according to Freddie Mac.

October 12 -

Mortgage rates increased for the first time in seven weeks, while the 10-year Treasury yield continued its upward trend, according to Freddie Mac.

September 21 -

Federal Reserve Chair Janet Yellen said Wells Fargo’s treatment of customers was “egregious and unacceptable," hinting that more regulatory action was likely.

September 20 -

Mortgage rates dropped to a year-to-date low for the third consecutive week as the 10-year Treasury yield also declined, according to Freddie Mac.

September 7 -

Loan application defects were unchanged for July compared with June, the first time in eight months there has not been an increase, according to First American Financial Corp.

August 31 -

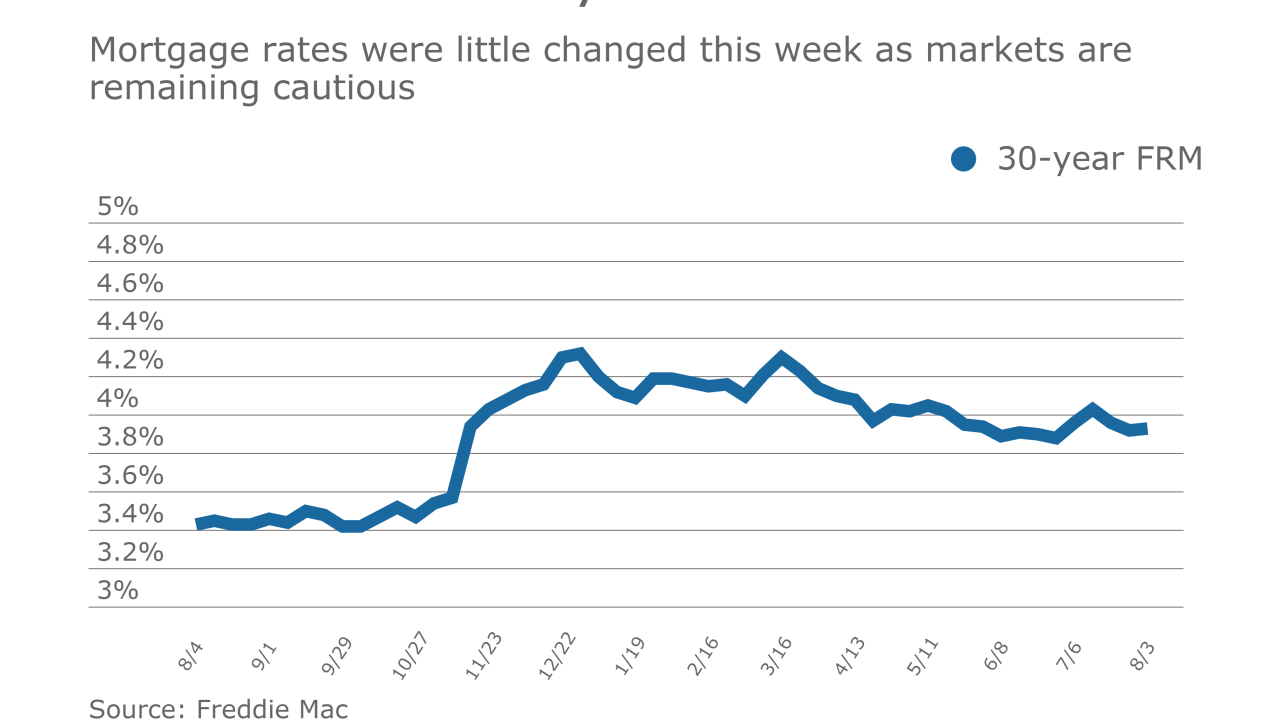

Mortgage rates were little changed this week after declining the previous two weeks, according to Freddie Mac.

August 3 -

Mortgage rates dropped for the second consecutive week, although the yield on the benchmark 10-year Treasury actually increased during the period, according to Freddie Mac.

July 27