-

Fannie Mae and Freddie Mac's regulator may have a travel kerfuffle of his own.

October 3 -

The majority of borrowers impacted by Hurricane Harvey have a significant amount of equity, while many in Hurricane Irma disaster areas have limited or negative equity, according to Black Knight Financial Services.

October 2 -

The Federal Housing Finance Agency's Duty to Serve program must increase manufactured housing lending in rural communities.

September 29 NeighborWorks America

NeighborWorks America -

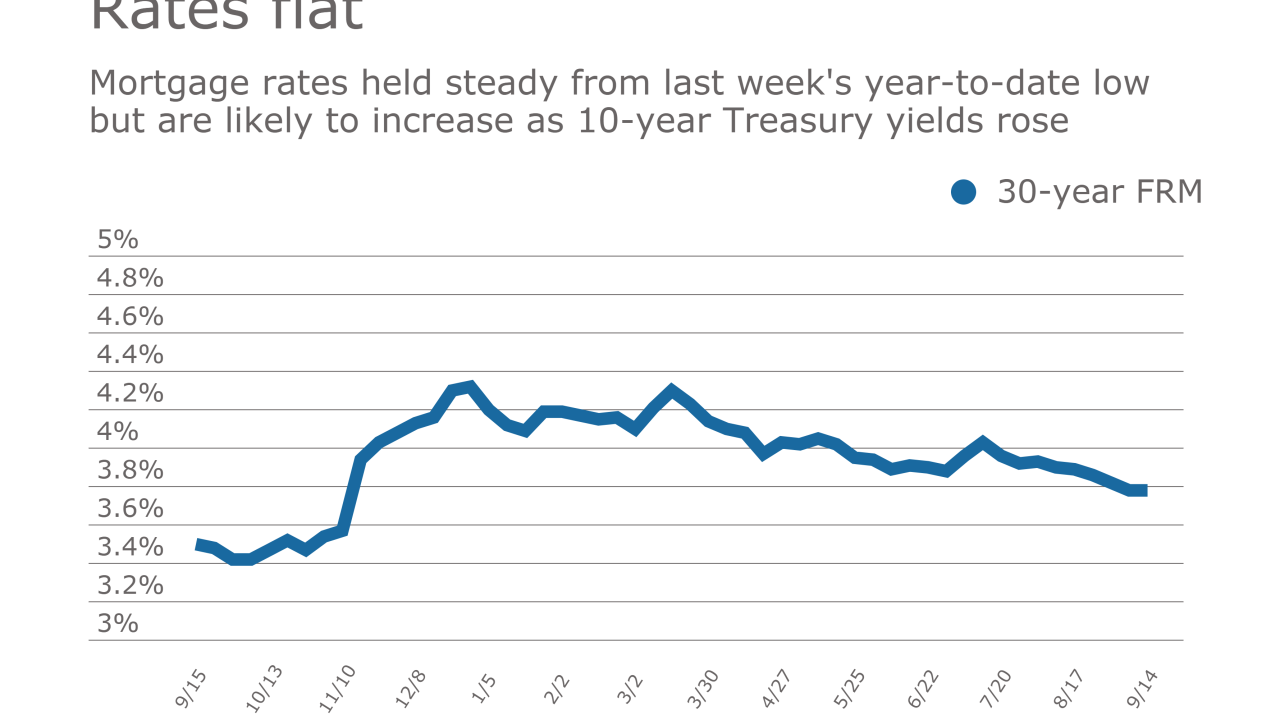

Mortgage rates remained unchanged from last week even through the 10-year Treasury yield first moved lower then spiked up during the period, according to Freddie Mac.

September 28 -

Sen. Bob Corker has been a key voice in the housing finance reform debate. His departure at the end of next year puts a deadline of sorts on his efforts to unwind and replace Fannie Mae and Freddie Mac.

September 26 -

The percentage of newly originated loans that are used to refinance an existing mortgage could shrink dramatically in 2018 as rates rise and burnout continues.

September 22 -

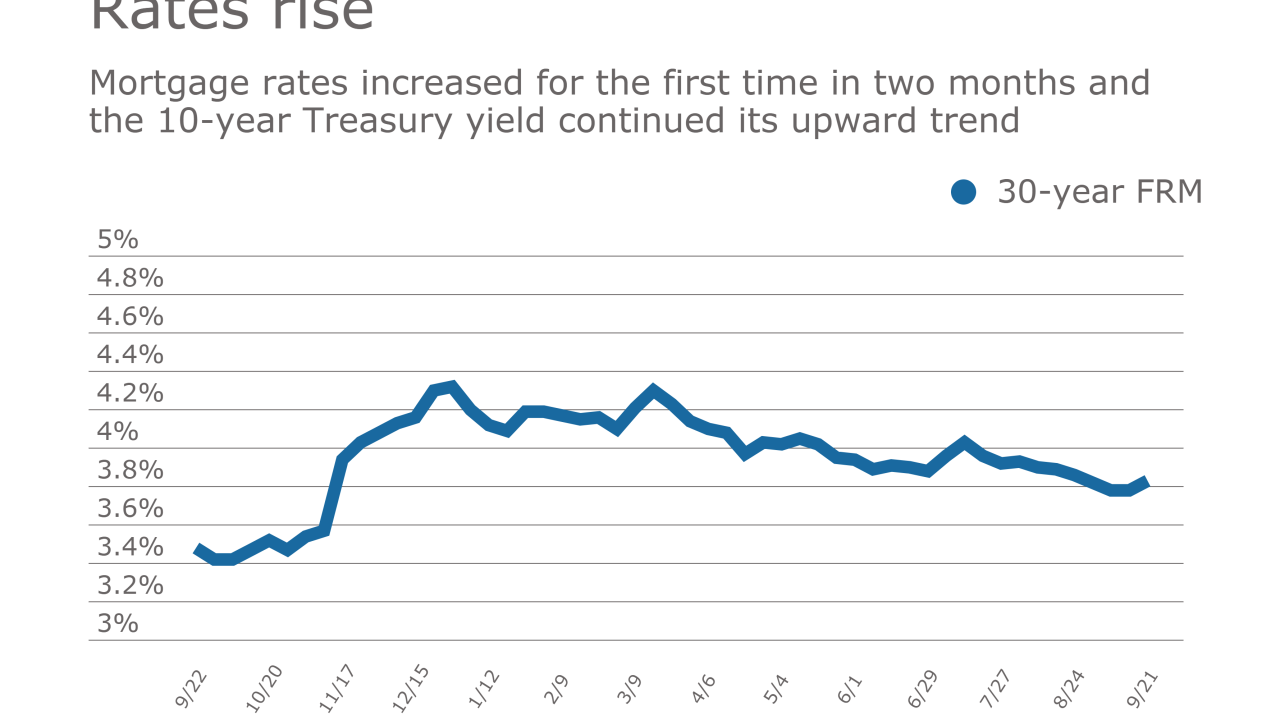

Mortgage rates increased for the first time in seven weeks, while the 10-year Treasury yield continued its upward trend, according to Freddie Mac.

September 21 -

Automated data validations are integral to a seamless digital mortgage experience. But the extent of data exposed in the Equifax breach raises questions about the risk of fraudsters exploiting those technologies to further compromise consumer data.

September 20 -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Mortgage rates remained unchanged from last week's year-to-date low but going forward they are likely to increase as 10-year Treasury yields rose.

September 14 -

If Fannie Mae's clear-boarding requirements prove effective, New York may follow Ohio's lead and move forward with a bill requiring it to be used more broadly on zombie properties.

September 8 -

Over one-quarter of all mortgages in the areas affected by Hurricane Harvey are likely to become delinquent because of the storm, according to an analysis from Black Knight.

September 8 -

Former Ginnie Mae President Ted Tozer will join securitization pioneer Lewis Ranieri at a new housing policy team at the Milken Institute.

September 7 -

Mortgage rates dropped to a year-to-date low for the third consecutive week as the 10-year Treasury yield also declined, according to Freddie Mac.

September 7 -

Ginnie Mae will help issuers with certain servicing obligations if more than 5% of their portfolios are in areas Hurricane Harvey has ravaged.

September 6 -

From payment forbearances to financing to start the rebuilding process, here's a look at five ways homeowners affected by Hurricane Harvey can get mortgage help.

August 31 -

Mortgage rates fell to a new low for the year this week, but are 38 basis points higher than they were one year ago, according to Freddie Mac.

August 31 -

If mortgage rates rise slowly as the economy continues to grow, the impact from the Fed’s unwind on housing likely will result in a decline in refinancing activity.

August 28 Fannie Mae

Fannie Mae -

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

Mortgage rates decreased for the fourth consecutive week and dropped to their lowest mark since November, according to Freddie Mac.

August 24