-

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

The government-sponsored enterprises are moving ahead with a new mortgage application that omits a previously planned language question, but are looking to serve limited English proficiency borrowers in another way.

October 24 -

Economic uncertainty continued to affect mortgage rates, which rose to their highest level in 12 weeks, according to Freddie Mac.

October 24 -

Renovation spending is decelerating faster than expected this year, but could slow with more deliberation than previously anticipated next year, according to Harvard University's Joint Center for Housing Studies.

October 18 -

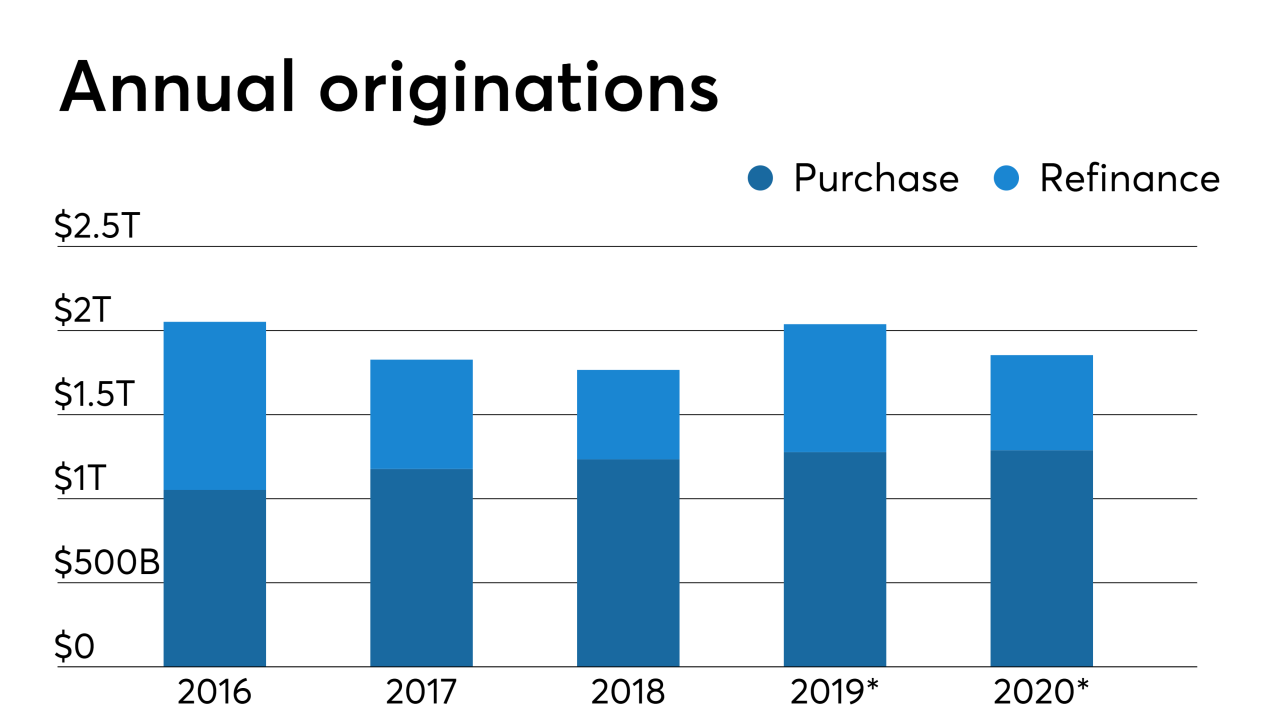

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

Strong economic trends like an improved employment outlook and rising homebuilder sentiment helped to drive average mortgage rates up 12 basis points from a week ago, according to Freddie Mac.

October 17 -

Freddie Mac is postponing the date it will make using its Servicing Gateway platform mandatory, and adding new requirements related to chargeoffs and interactions with document custodians.

October 11 -

Weaker-than-expected economic data led to a decline in mortgage rates this week, although consumer attitudes remain strong, and should continue to drive increased home purchase demand, according to Freddie Mac.

October 10 -

A year after Fannie Mae launched its first credit-risk transfer securitization using a real estate mortgage investment conduit, Freddie is now electing to also opt for a REMIC format in offloading the credit risk to private investors.

October 10 -

David Lowman, executive vice president of the single-family business at Freddie Mac, has informed the company he will be stepping down from his position on or about Nov. 1.

October 8 -

Allowing the mortgage giants to retain profits resolves a short-term capital shortfall, but how much capital they would need after exiting conservatorship is still the bigger question.

October 4 -

Economic issues were the biggest influence on average mortgage rates in the past week, although two trackers moved in different directions.

October 3 -

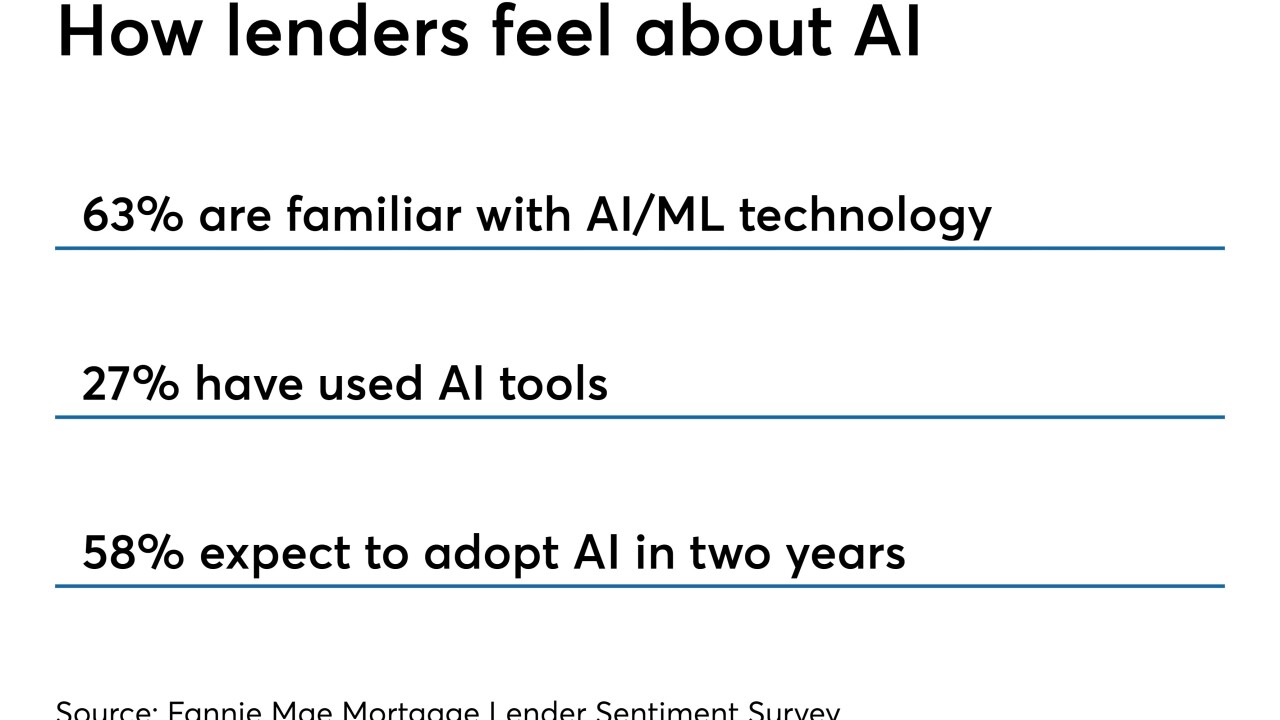

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

The Trump administration's thinking on housing is filled with conflicts and contradictions, a quilt work of at times irrational proposals that seem to be at odds with the real world of mortgage finance.

October 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Guild Mortgage, which originated loans on some of the first manufactured homes eligible for new lower-rate Fannie Mae financing, anticipates demand for this housing type will continue to grow this year.

October 1 -

Freddie Mac is increasing the number of companies offering merged reports from the credit bureaus through integrations with its Loan Product Advisor automated underwriting system.

September 30 -

The move to alter the government's preferred stock purchase agreements is the first major one under FHFA Director Mark Calabria's tenure to wind down the conservatorship of the government-sponsored enterprises.

September 30 -

The shareholders' claims against Fannie Mae and Freddie Mac's regulator mirror arguments in cases challenging the Consumer Financial Protection Bureau.

September 26 -

Freddie Mac's efforts to improve underwriting could include the use of a technology firm's artificial intelligence-driven consumer-risk modeling software that can expand access to credit, according to the Wall Street Journal.

September 26