-

Mortgage rates posted a fourth consecutive week of increases, but Freddie Mac remains bullish in its outlook for this spring's home purchase season.

April 25 -

If favorable interest rates and rising consumer incomes continue, market potential for home purchases will be boosted in the short term, according to First American Financial.

April 22 -

Mortgage rates rose for the third consecutive week, but home purchases are up as well, to their highest level in nine years, according to Freddie Mac.

April 18 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

The new head of the agency regulating Fannie Mae and Freddie Mac will be at the forefront of reforming the housing finance system.

April 15 -

A bipartisan proposal would allow for the removal of the FHFA director if the agency approves CEO salary increases at Fannie and Freddie beyond $600,000.

April 12 -

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

The residential mortgages being reinsured are less risky, by several measures, than its previous deal; none of the borrowers have ever missed a payment.

April 11 -

Multifamily and commercial lenders had another banner year in 2018, when closed-loan originations rose 8% to a high of $574 billion.

April 11 -

Mortgage rates rose slightly for the second consecutive week, but should remain low for the foreseeable future, which will aid the purchase market, according to Freddie Mac.

April 11 -

HomeStreet Bank could receive nearly $190 million in total for selling $14 billion in mortgage servicing rights to New Residential and PennyMac, and selling its home loan centers to Homebridge.

April 8 -

B. Riley FBR initiated equity coverage on Fannie Mae as the chances for privatization of the government-sponsored enterprises improved in a housing finance reform package.

April 5 -

Housing finance reform could give banks an advantage and challenge nonbanks if it reduces Fannie Mae and Freddie Mac's involvement in the mortgage market, according to Moody's Investors Service.

April 4 -

The administration official will serve a five-year term as Fannie Mae and Freddie Mac's chief regulator.

April 4 -

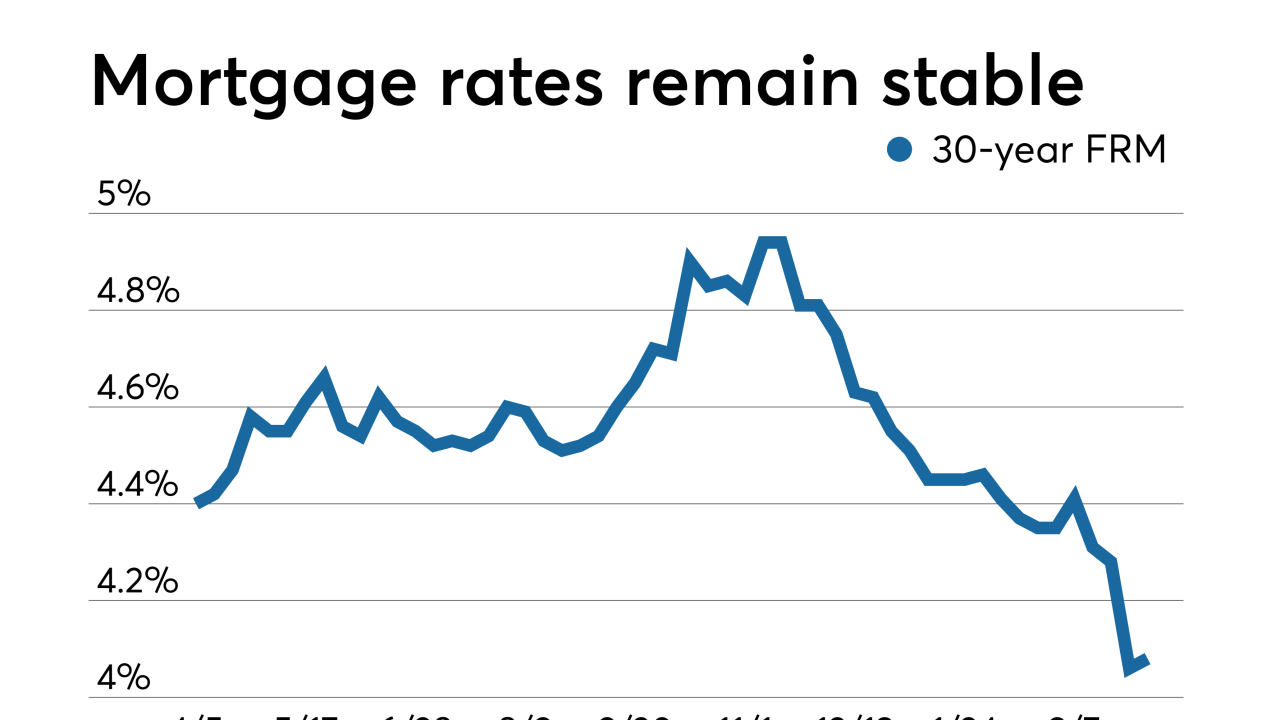

Mortgage rates held steady after several weeks of declines, during which there was the largest weekly drop in more than 10 years, according to Freddie Mac.

April 4 -

This time, investors required Radian to hold on to the first 2.5% of losses it covers on the pool; by comparison, the insurer’s previous deal, Eagle Re 2018-1, had a lower “attachment” point of 2.25%.

April 3 -

After a brief delay, the agency’s acting director signed off on Fannie Mae and Freddie Mac contributing to the National Housing Trust Fund and Capital Magnet Fund.

April 3 -

From where to find borrowers that competitors overlook, to how to adjust strategies when interest rates change course, top producers are adapting when market conditions change.

April 3 -

Rep. Gregory Meeks of New York signaled which legislative provisions Democratic leaders would accept in a bipartisan housing finance package.

April 2 -

Bank of America is setting aim at low- to moderate-income and multicultural homebuyers and communities with the launch of its Neighborhood Solutions affordable homeownership initiative.

April 2