-

HomeStreet Bank could receive nearly $190 million in total for selling $14 billion in mortgage servicing rights to New Residential and PennyMac, and selling its home loan centers to Homebridge.

April 8 -

B. Riley FBR initiated equity coverage on Fannie Mae as the chances for privatization of the government-sponsored enterprises improved in a housing finance reform package.

April 5 -

Housing finance reform could give banks an advantage and challenge nonbanks if it reduces Fannie Mae and Freddie Mac's involvement in the mortgage market, according to Moody's Investors Service.

April 4 -

The administration official will serve a five-year term as Fannie Mae and Freddie Mac's chief regulator.

April 4 -

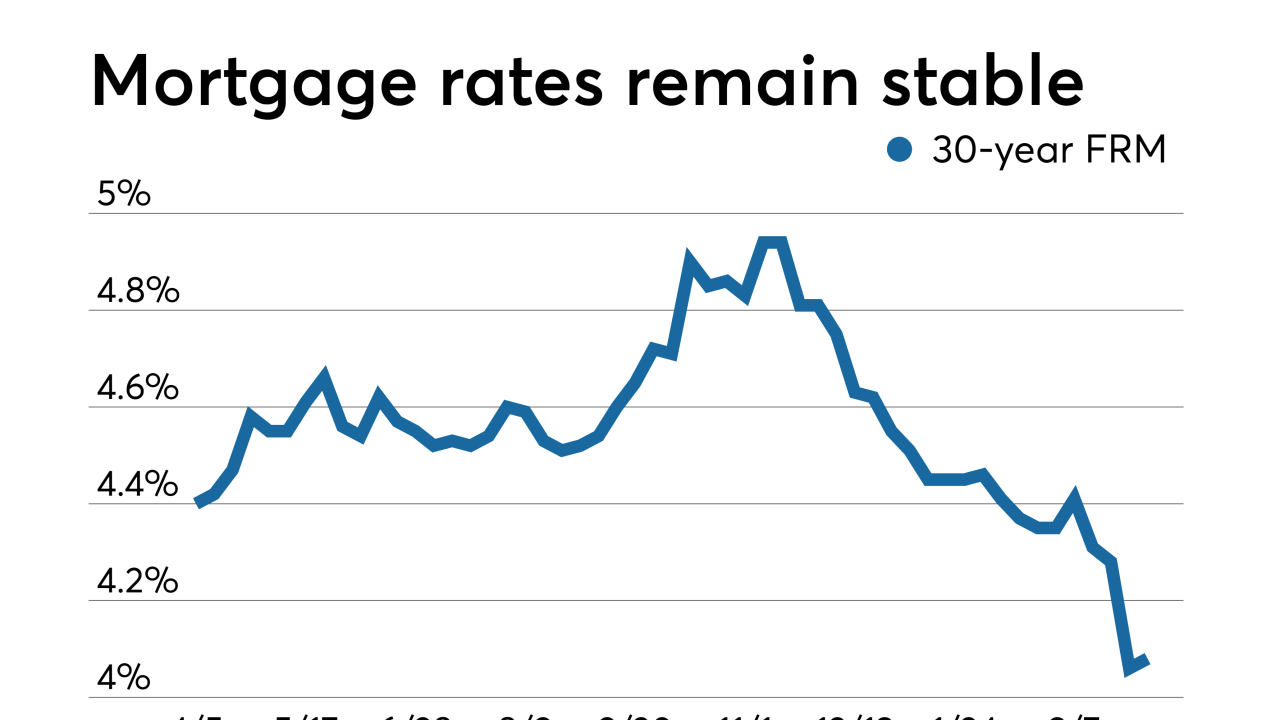

Mortgage rates held steady after several weeks of declines, during which there was the largest weekly drop in more than 10 years, according to Freddie Mac.

April 4 -

This time, investors required Radian to hold on to the first 2.5% of losses it covers on the pool; by comparison, the insurer’s previous deal, Eagle Re 2018-1, had a lower “attachment” point of 2.25%.

April 3 -

After a brief delay, the agency’s acting director signed off on Fannie Mae and Freddie Mac contributing to the National Housing Trust Fund and Capital Magnet Fund.

April 3 -

From where to find borrowers that competitors overlook, to how to adjust strategies when interest rates change course, top producers are adapting when market conditions change.

April 3 -

Rep. Gregory Meeks of New York signaled which legislative provisions Democratic leaders would accept in a bipartisan housing finance package.

April 2 -

Bank of America is setting aim at low- to moderate-income and multicultural homebuyers and communities with the launch of its Neighborhood Solutions affordable homeownership initiative.

April 2 -

An emerging gap between the government-sponsored enterprises on a Federal Housing Finance Agency scorecard item is prompting Fannie Mae to diversify its multifamily credit risk transfer efforts.

March 29 -

Freddie Mac exchanged existing bonds from its portfolio for mirror certificates for the first time, completing a key test that is central to the creation of a uniform mortgage-backed security.

March 28 -

Average mortgage rates fell by their largest amount in more than 10 years last week as bond yields fell in reaction to the March 20 Federal Open Market Committee meeting.

March 28 -

The Federal Housing Finance Agency is planning on finalizing its proposed capital requirements for the government-sponsored enterprises this summer, the agency's acting director said Wednesday.

March 28 -

American Banker's Rob Blackwell and Cowen’s Jaret Seiberg discuss Fannie Mae, Freddie Mac and the future of housing finance

March 27 -

The Federal Housing Finance Agency, by allowing Fannie Mae and Freddie Mac to split the CEO and president positions, let the companies dodge a congressionally mandated cap on executive salaries, the regulator's inspector general said.

March 27 -

As lawmakers discuss reform legislation, the president’s memo calls on agencies to draft both administrative and legislative reform options and deliver their reports “as soon as practicable.”

March 27 -

Senators dove into how to ensure housing finance reform serves lenders of all sizes, just as the Trump administration moved closer to crafting its own GSE plan.

March 27 -

The government-sponsored enterprises have continued to expand over the past decade, despite being in conservatorship. New leadership at the FHFA should reverse this trend.

March 26 American Enterprise Institute

American Enterprise Institute -

Lawmakers still have a long way to go before enacting housing finance reform, but the testimony could signal how future legislative talks will play out.

March 26