-

The sponsor has increased the credit enhancement on the senior support class of notes on offer in order to offset the slightly higher risk to investors.

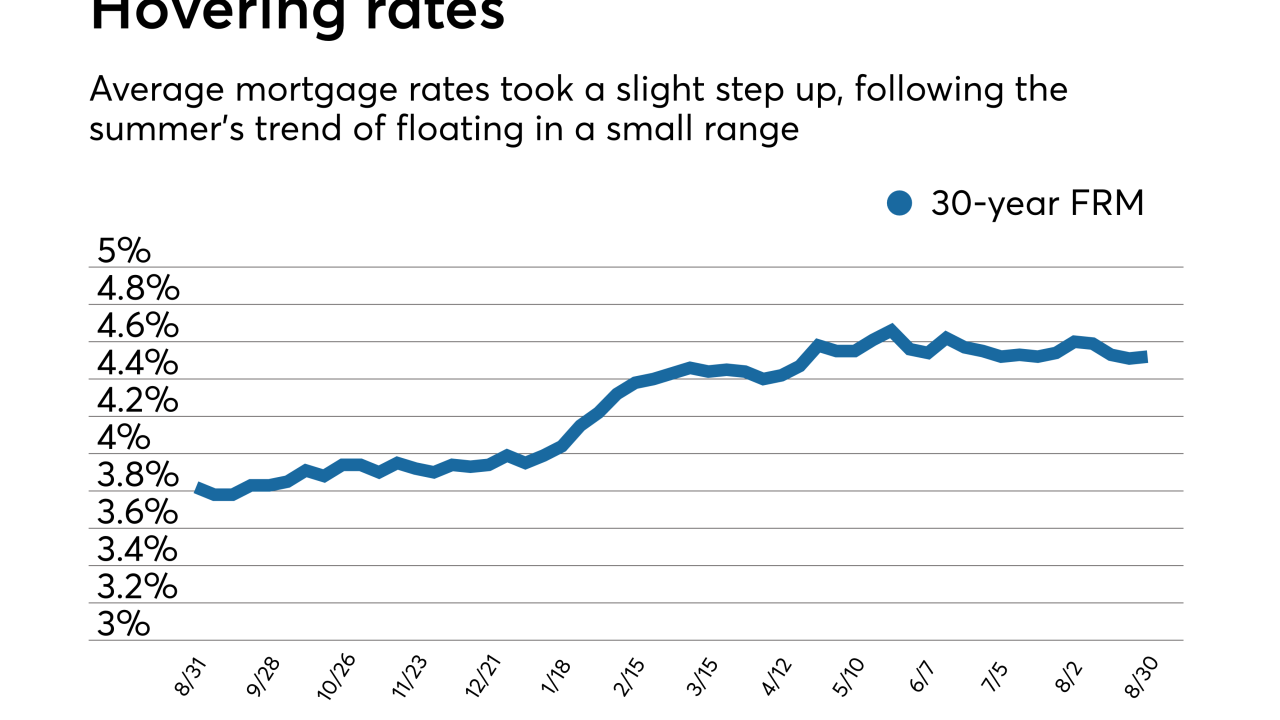

August 31 -

Mortgage rates took small steps up after hitting a four-month low, but continued hovering around the same range they have all summer, according to Freddie Mac.

August 30 -

The Congressional Budget Office has found that restructuring the mortgage market would save the government billions of dollars but may increase the cost of housing.

August 27 -

Mortgage rates decreased for the third straight week and reached their lowest level since mid-April, according to Freddie Mac.

August 23 -

The agency said the market for larger rental investors may not need additional liquidity from Fannie Mae and Freddie Mac.

August 21 -

Mortgages originated to finance apartments and other income-producing properties managed to generate an overall year-to-year increase in the first half, even though there are declines in some parts of the market.

August 21 -

Top U.S. housing regulator Mel Watt is privately reassuring people close to him that he will keep his post as authorities investigate an employee's claims of sexual harassment. Now, his accuser is heightening the pressure — speaking out publicly for the first time.

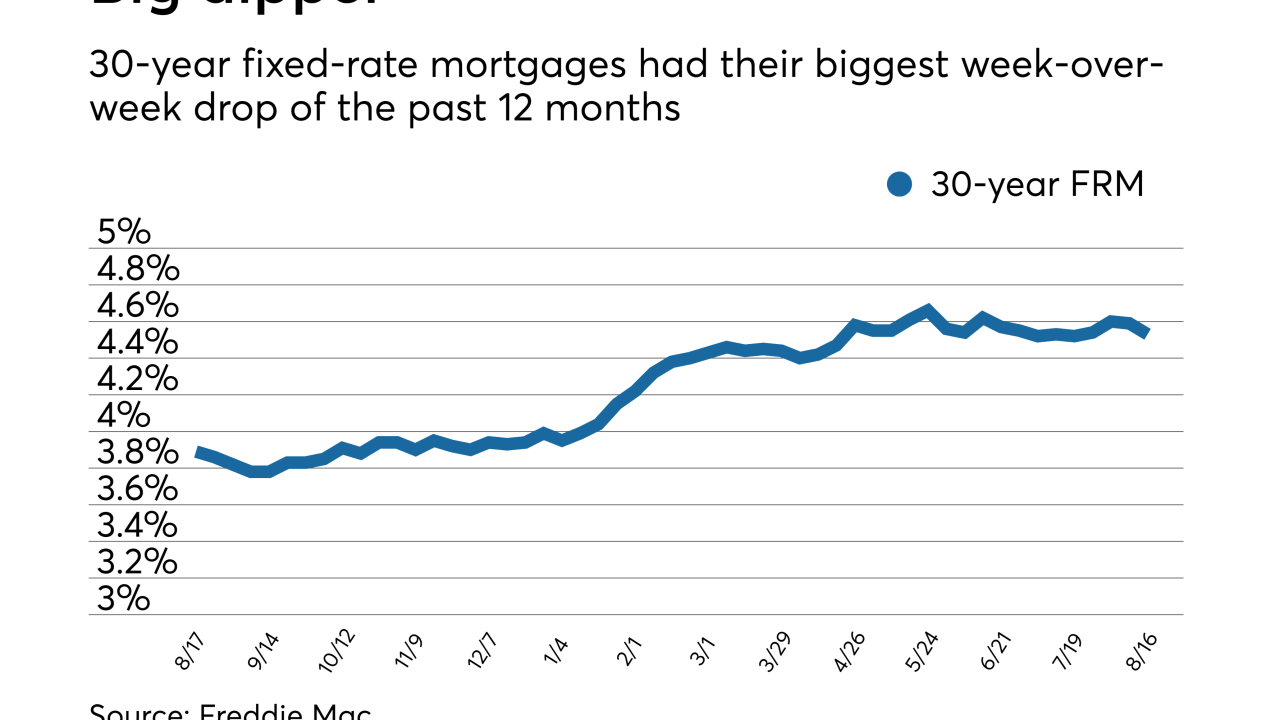

August 20 -

Average mortgage rates fell, including the largest week-over-week drop of the past 12 months, but homebuyer demand stays mum, according to Freddie Mac.

August 16 -

The regulator of the government-sponsored enterprises has substantial authority to intervene as a legislative stalemate continues.

August 14 -

The percentage of low down payment loans using private mortgage insurance continues to grow, and should continue as more first-time homebuyers get conforming loans, according to Keefe Bruyette & Woods.

August 14 -

Mortgage rates took a small step back due to affordability pressure after climbing for the past two weeks, according to Freddie Mac.

August 9 -

The House Financial Services Committee has scheduled an FHFA oversight hearing for September in the wake of waste, fraud and abuse allegations.

August 8 -

The mortgage giants Fannie Mae and Freddie Mac would have to draw as much as $78 billion in the event of a serious economic crisis, according to stress test results released Tuesday by the housing regulator.

August 7 -

The biggest impact may be to focus the administration’s efforts on selecting a nominee to succeed Director Mel Watt, whose term ends in January.

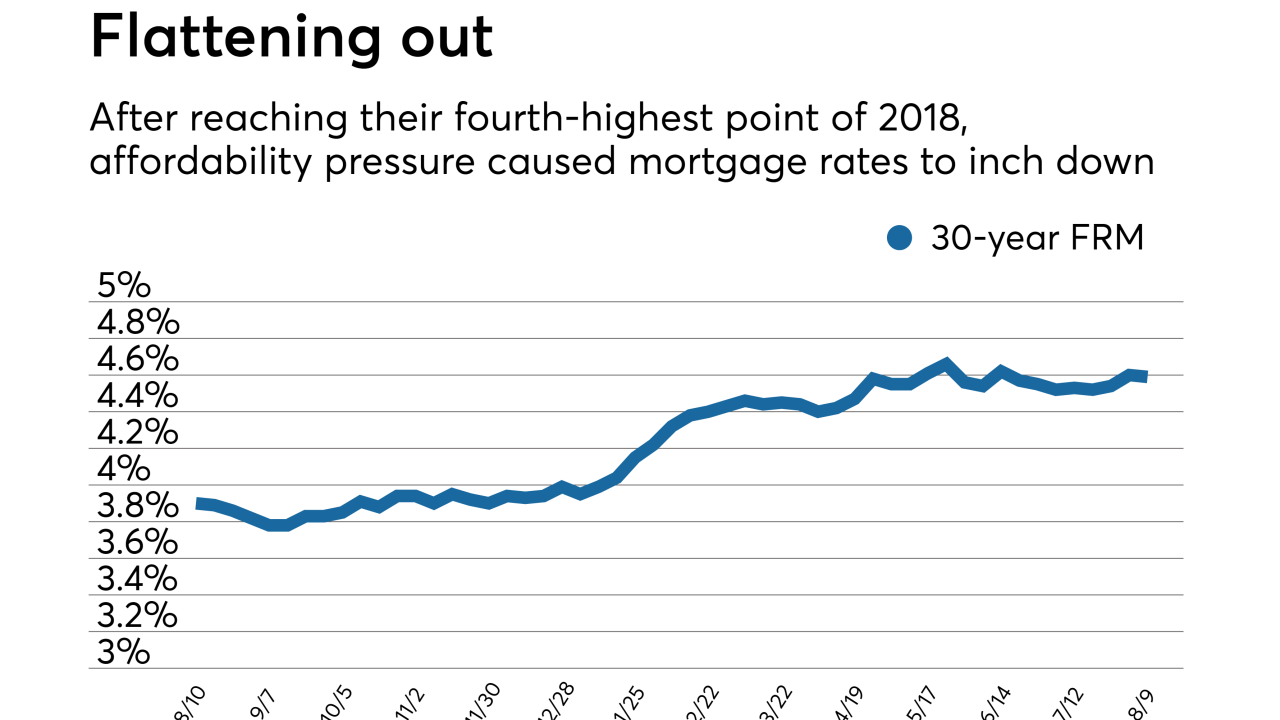

August 7 -

Mortgage rates rose to their highest level in seven weeks and fourth-highest of 2018, thanks to strong economic trends, according to Freddie Mac.

August 2 -

Fannie Mae and Freddie Mac remain in conservatorship nearly a decade after the financial crisis, and there’s still no end in sight.

August 1 Calvert Advisors LLC

Calvert Advisors LLC -

Freddie Mac produced modest second-quarter results, reflecting a stabilizing business that CEO Donald Layton compared to a utility company.

July 31 -

The agency said multiple stakeholders had requested more time to evaluate the proposal.

July 31 -

The D.C. movers and shakers at the center of the financial crisis — and the government’s response — have all moved on to new positions. Here's a look at what they did afterward.

July 30 -

Mel Watt's term as director of Federal Housing Finance Agency ends in January, but his exit may be accelerated if the accusations in a new report prove true.

July 27IntraFi Network