-

The housing market is likely changing to predominantly repeat purchasers, even as growth in the first-timer buyer segment continued in the third quarter, a study from Genworth found.

December 10 -

More private mortgage insurers reported significant year-over-year gains in new business during the third quarter, mainly driven by the increase in refinance volume.

October 31 -

Genworth Financial agreed to sell its Canadian unit to Brookfield Business Partners for C$2.4 billion ($1.8 billion) as it works to win regulatory approval for its acquisition by China Oceanwide Holdings Group.

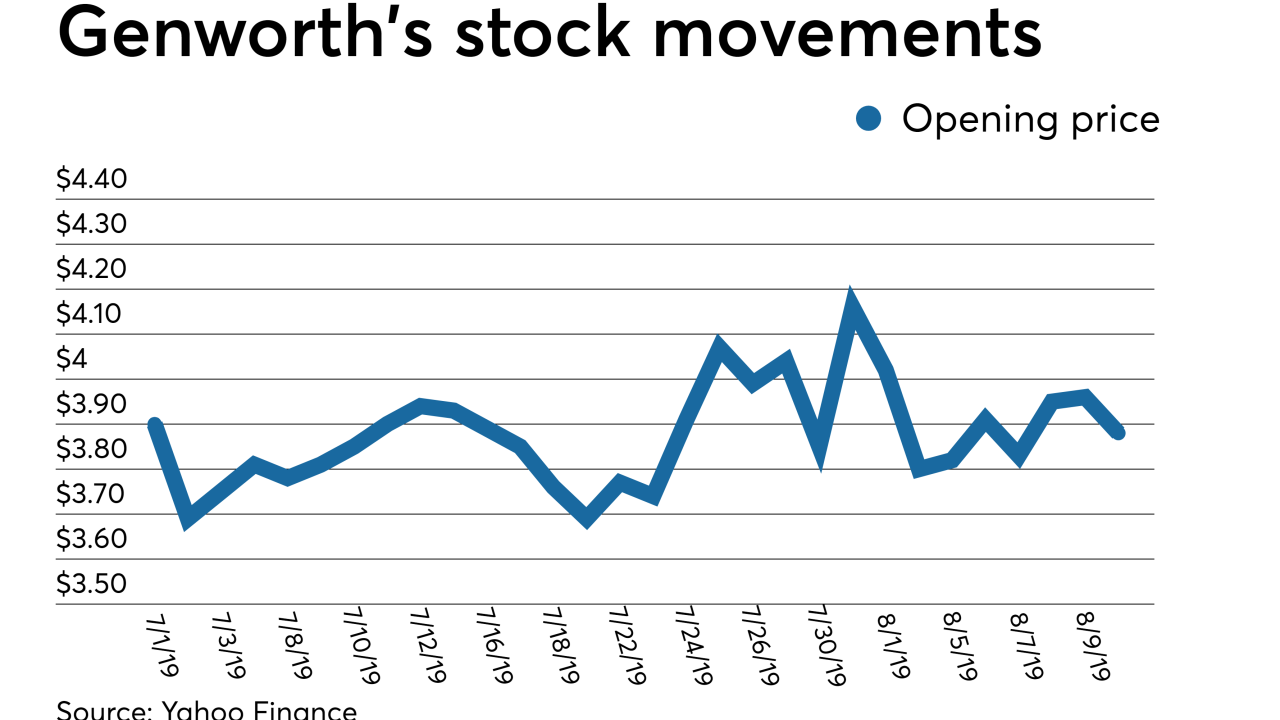

August 13 -

Genworth Financial's efforts to advance its sale to China Oceanwide hit a roadblock as bondholders did not respond to a consent solicitation for easing a possible Canadian mortgage insurance unit sale.

August 12 -

The oft-delayed sale of Genworth Financial might need new approvals from U.S. insurance regulators if and when it disposes of its Canadian mortgage insurance stake.

July 31 -

Genworth Financial is marketing its stake in Genworth MI Canada in a possible last-ditch effort to save the long-delayed proposed acquisition by China Oceanwide.

July 1 -

In a weak first quarter, housing activity held up better for first-time homebuyers than others, according to a new Genworth Mortgage Insurance report.

May 23 -

Private mortgage insurers can help to ease banks' compliance burden when it comes to the Current Expected Credit Loss accounting standard, an industry executive said.

May 22 -

Despite a lower rate of increase, 2019 equity gains could pull 350,000 households from being underwater on mortgages, according to CoreLogic.

March 7 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1 -

The six private mortgage insurers had a great year as they continued to grab market share from the Federal Housing Administration. Despite some headwinds, 2019 is shaping up to be another good year.

February 22 -

Genworth's U.S. mortgage insurance unit's adjusted operating income increased over the previous year as the lower corporate tax rate and lower loss ratio overcame a 9% reduction in new insurance written.

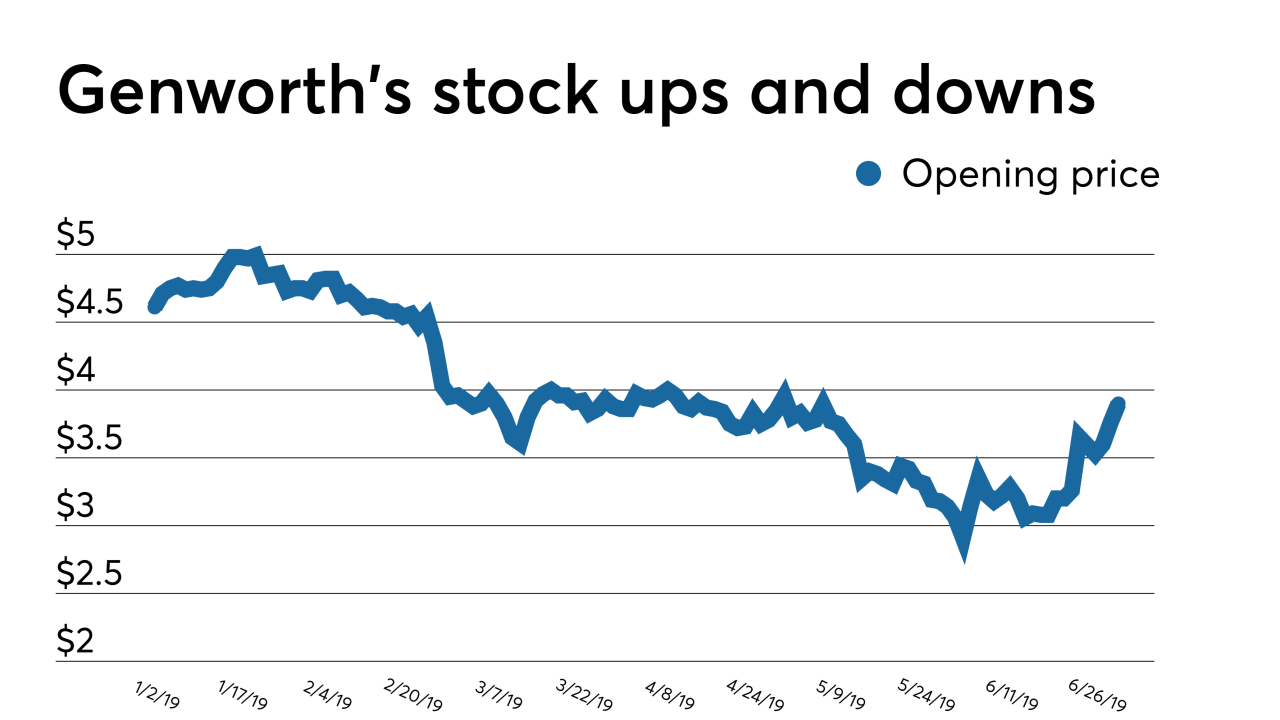

February 6 -

China Oceanwide's acquisition of Genworth has been postponed until March, prolonging uncertainty about the fate of the acquired company's U.S. private mortgage insurance unit that could be resolved by the deal.

January 31 -

Radian and Essent will make their "black box" mortgage insurance pricing methods live on Jan. 21, leaving MGIC as the only company yet to announce its adoption.

January 14 -

These days, no wedding is complete without a hashtag combining the happy couple's names. It got us thinking: Why not give mortgage industry M&A deals the same treatment?

December 26 -

Mortgage industry executives claim sparse affordable housing supply is the most impactful hurdle for first-time homebuyers entering the market in 2019, but the majority don't think regulatory policy will help the cause.

November 6 -

Earnings at four of the private mortgage insurers increased significantly over last year's third quarter even as total mortgage origination volume shrunk during the same time frame.

October 31 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

Arch MI U.S. returned to having the No. 1 market share among private mortgage insurers as it increased its new insurance written 15% over the previous year.

August 1 -

Greater consumer access to credit could help mortgage bankers replenish originations eroded by higher rates, but they are reluctant to depart from the status quo to provide it.

July 11