JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

JPMorgan Chase may jump back into a mortgage program that helps low-income Americans buy homes, mulling a return years after most banks pulled back from the business in frustration over billions of dollars in penalties.

February 5 -

The city's decision to drop a lawsuit alleging predatory ending by Wells Fargo, JPMorgan Chase, Bank of America and Citigroup highlights the challenges municipalities face in taking on deep-pocketed financial institutions.

February 4 -

JPMorgan Chase & Co.'s Mike Weinbach, chief executive officer of the home-lending business, is departing the firm after 16 years.

January 31 -

A bank, a drug store, another bank: Odds are, a stroll down a random Manhattan avenue devolves quickly into a retail snoozefest.

January 24 -

With most U.S. households spending more and paying their bills on time, their creditors are feeling more confident than ever.

January 17 -

Fourth quarter gain on sale margin moved in opposite directions at two of the nation's largest banks, falling 9% quarter-over-quarter at JPMorgan Chase, but increasing 25% at Wells Fargo.

January 14 -

High-grade corporate bonds bested mortgages by a wide margin in 2019 and are likely to outperform them again this year, according to JPMorgan Chase & Co.

January 6 -

Mortgage-bond investors will need to absorb about 26% more agency MBS supply in 2020 as both home sales and prices continue to climb, according to the average estimate of six of Wall Street's biggest dealers.

December 5 -

JPMorgan Mortgage Trust 2019-10 is a securitization of 388 prime-quality, large-loan mortgages that are mostly considered non-conforming, but meet qualified-mortgage (ability-to-repay) standards of the Consumer Financial Protection Bureau.

November 26 -

Lenders have bundled more than $18 billion worth of non-QM, private-label loans into bonds this year that they then sold to investors, a 44% increase from 2018 and the most for any year since the securities became common post-crisis.

November 18 -

JPMorgan Chase may be leading the next trend for banks seeking to shift risk away from their mortgage portfolios — if regulators give Wall Street the green light.

November 13 -

Warriors guard Jacob Evans' welcome-to-San Francisco moment came in late August.

October 25 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

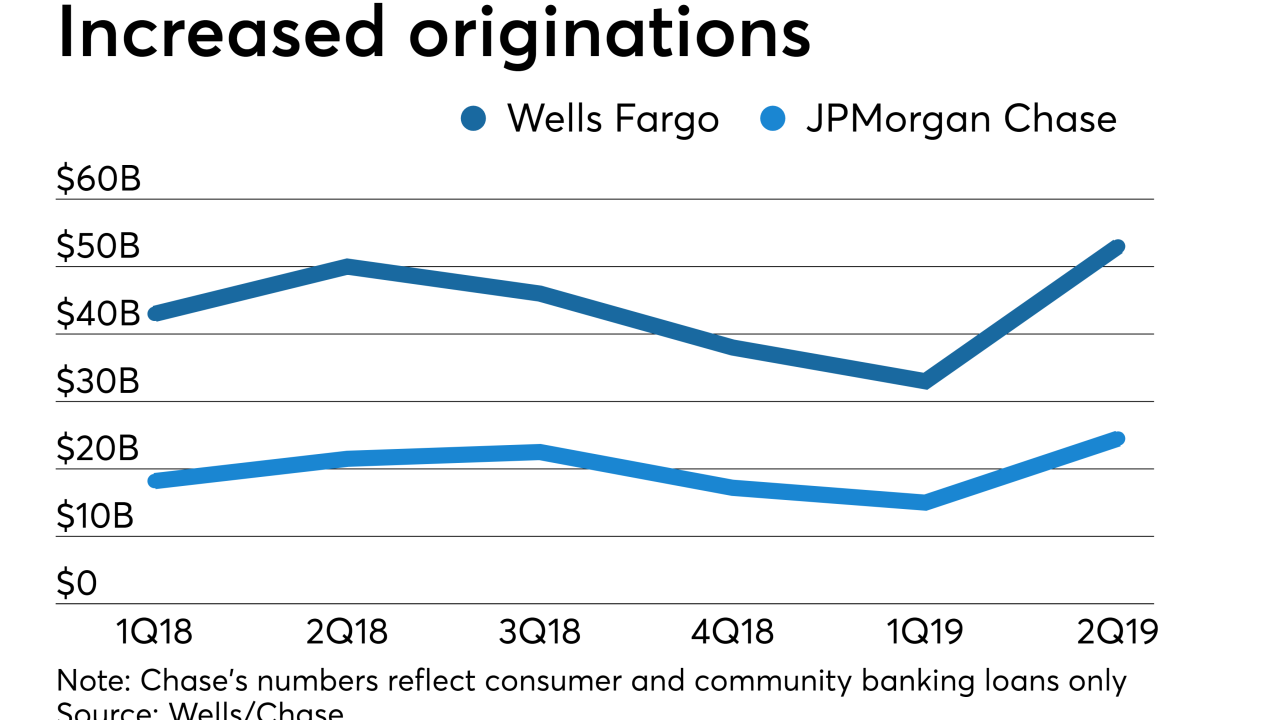

Origination volumes continued to drift upward at JPMorgan Chase and Wells Fargo in the third quarter as mortgage servicing rights values fell more sharply than some analysts expected.

October 15 -

The firm’s financial woes are mostly a result of overspending, but they have raised questions about how banks’ commercial real estate portfolios might fare if the coworking sector implodes.

October 7 -

With housing affordability still a prominent hurdle to homeownership, prospective buyers — especially millennials — now get creative in order to find suitable homes, according to Chase and the Property Brothers.

October 4 -

While no one is suggesting that the plan will help banks regain the share they've ceded to nonbanks, bankers believe that stabilizing Fannie Mae and Freddie Mac could at least help them keep what they have.

September 24 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

Many banks have already scaled back home lending or even left the business. With profit margins shrinking, inventories of homes at crisis levels and competition from nonbanks intensifying, that’s unlikely to change.

May 29