-

But the sluggish pace of refinances brought down overall application numbers last week.

March 30 -

Refinance applications came in 54% lower than a year ago, but average loan sizes accelerated, with the purchase amount setting another record.

March 23 -

Purchases increased, but refinance activity cooled again due to rising rates.

March 16 -

Mortgage applications were up for the first time in over a month, with government refinances in particular seeing a sizable bump.

March 9 -

The overall number of applications decreased for the fourth straight week, but average loan sizes headed back up, according to the Mortgage Bankers Association.

March 2 -

Overall application activity was down by more than 40% compared with one year ago, the Mortgage Bankers Association found.

February 23 -

Credit availability also tightened in January, contributing to early 2022’s lending slowdown, according to the Mortgage Bankers Association.

February 16 -

Steadily climbing rates have contributed to a 40% decline in loan activity from one year ago.

February 9 -

But refinances came in 50% below levels from a year ago, with rate-and-term activity falling by over 40% in the third quarter of last year, according to TransUnion.

February 2 -

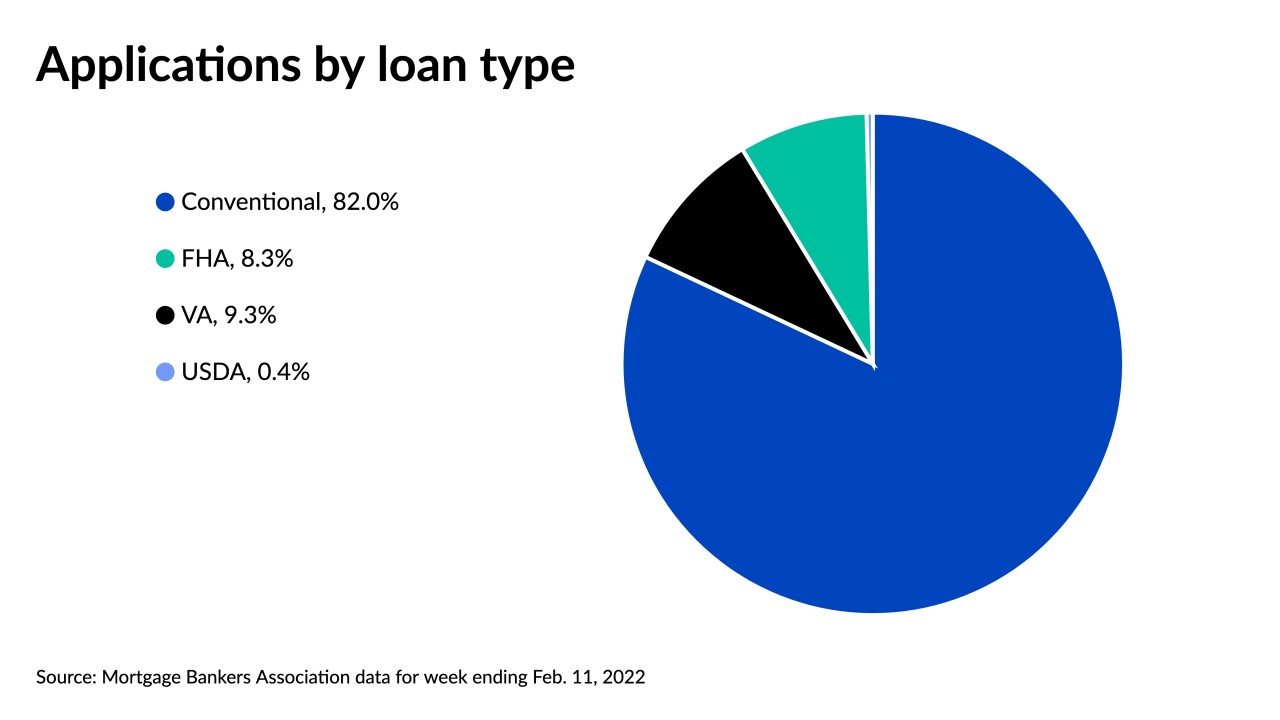

And a recent slowdown in government-backed loan issuance is pushing average purchase amounts to another record high.

January 26 -

Despite declining rates, refinancing volume fell, while purchases slowed even further after dipping to its lowest point in over a year.

August 4 -

A hike in guarantee fees charged to lenders for the companies’ backing of loans was due to expire this year, but lawmakers now want to extend it to raise $21 billion for the bipartisan package.

July 29 -

Two large government-sponsored enterprises added a notification period for tenants in collateral properties on Wednesday while a trade group and public agencies stepped up efforts to connect renters with aid.

July 28 -

Such applications have declined on an annual basis for the past three months, but overall weekly numbers increased due to a jump in refinances amid plummeting rates.

July 28 -

Despite lower numbers, refi applications continued trending strongly, while purchases fell close to lows from more than a year ago.

July 21 -

Purchase loans also increase, as their average size shrinks

July 14 -

Government-sponsored loans gain volume share, but overall numbers tumble to a point not seen since before the pandemic.

July 7 -

Limited housing supply, climbing rates cause applications to decline across the board.

June 30 -

Fewer borrowers are suspending payments for pandemic hardships but some who got back on track are having trouble again, and deadlines could spur a final round of new requests.

June 28 -

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25