-

The number of loans going into coronavirus-related forbearance was down for the eighth consecutive week, as the growth rate fell 23 basis points between July 27 and August 2, according to the Mortgage Bankers Association.

August 10 -

Whether mortgage rates continue to decline may depend on Friday’s job numbers.

August 6 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

The overnight shift to working from home created a number of practical quandaries for mortgage firms large and small, according to a recent survey conducted by Arizent.

August 4 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

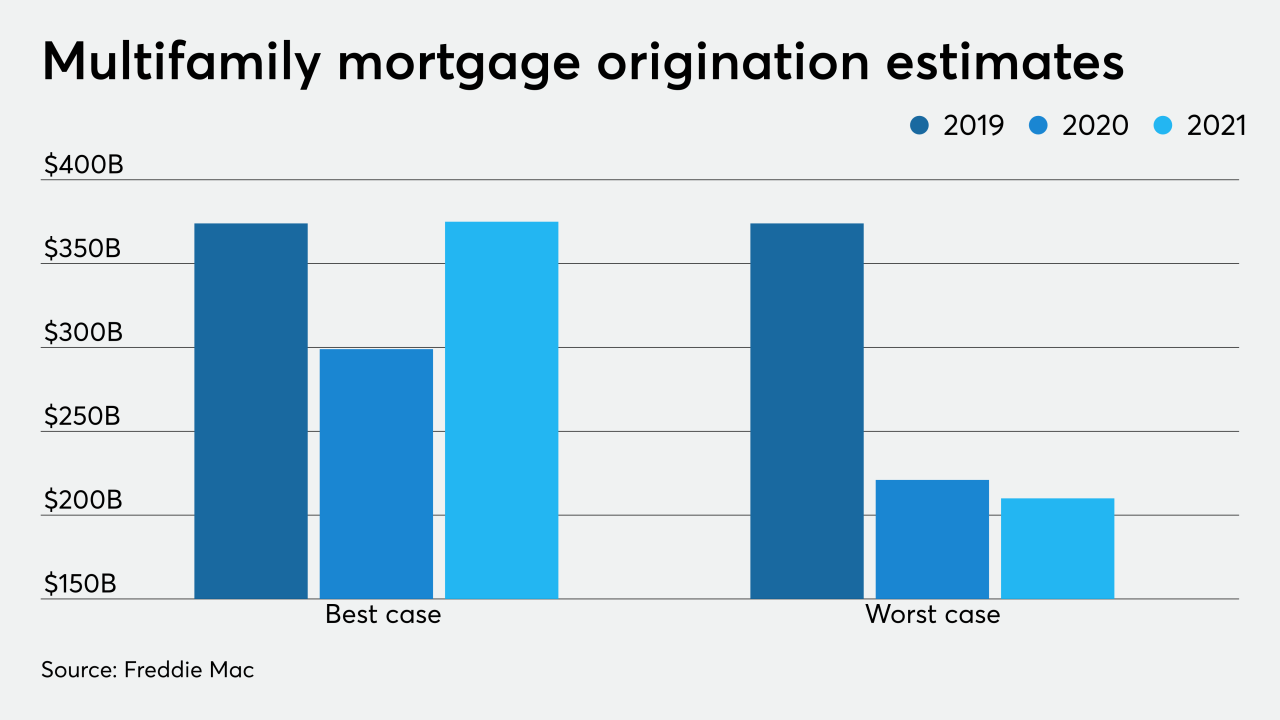

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

Mortgage applications decreased 0.8% from one week earlier as the latest spread of COVID-19 weighed on the minds of consumers looking to buy or refinance, according to the Mortgage Bankers Association.

July 29 -

The enhanced jobless benefits in the coronavirus relief law enacted in March helped limit delinquencies and maintain consumer spending, analysts say. In their follow-up stimulus plan, Senate Republicans want to cut those benefits from $600 to $200 a week.

July 28 -

The number of loans going into coronavirus-related forbearance dropped for the sixth consecutive week, as the growth rate fell 6 basis points between July 13 and July 19, according to the Mortgage Bankers Association.

July 27 -

Mortgage applications increased 4.1% from one week earlier as consumers continued to pursue both purchases and refinancings even as conforming rates rose from their record lows, according to the Mortgage Bankers Association.

July 22 -

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

July 20 -

Strong growth in refinance volume following several weeks of so-so activity drove a 5.1% week-to-week increase in mortgage applications, according to the Mortgage Bankers Association.

July 15 -

Mortgage applications to purchase new homes were up 54% compared to the same month the year before.

July 14 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13 -

However, those who aren't current bank customers need to have $1 million in a qualifying account.

July 10 -

Fercho will join Wells Fargo in August and report to Mike Weinbach, the bank's CEO of consumer lending.

July 9 -

The current refinancing boom might seem like the worst time to buy leads, but for some, it may be the best.

July 9 -

As the coronavirus created uncertainty for the housing market, underwriting standards tightened further in June.

July 9 -

For the first time in three weeks, mortgage application volume increased, this time by 2.2%, as purchase activity was up in a holiday-shortened week, according to the Mortgage Bankers Association.

July 8