-

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Purchase mortgage application volume reached its highest level in almost nine years as homebuyers took advantage of what might be a fleeting window for lower interest rates.

January 16 -

The standards for mortgage lending constrained in December, as a drop in conventional credit brought availability to its lowest point since February 2017, according to the Mortgage Bankers Association.

January 10 -

Consumers reacted in a big way to falling interest rates as mortgage applications increased 23.5% from one week earlier, according to the Mortgage Bankers Association.

January 9 -

Lagging construction, rising interest rates and the broader economy don't really bode well for buyers of commercial real estate, but most CRE lenders still expect originations to increase in 2019, according to the Mortgage Bankers Association.

January 8 -

Employment at nondepository mortgage companies dropped considerably in November, as the combined effects of lower volumes and seasonal slowing reduced hiring needs.

January 4 -

Despite mortgage rates continuing their two month downslide, applications decreased 9.8% from two weeks ago due to market uncertainty, according to the Mortgage Bankers Association.

January 3 -

With its bolstered fundraising cache, the Mortgage Bankers Association Political Action Committee should hold an increased influence over the industry's policy and regulation issues in the coming year.

January 2 -

By honing her ability to fix inefficiencies and identify new profit opportunities, Mary Ann McGarry broke down gender barriers and found success as CEO of Guild Mortgage. The key, she says, is remaining adaptable and collaborative without losing focus on end goals.

December 28 -

Adjustable-rate mortgages in November had their highest share of closed loans since Ellie Mae started tracking this data in 2011 as rates for 30-year loans reached 5.15%.

December 19 -

Mortgage applications decreased 5.8% from one week earlier, although rates fell during the period to their lowest point in three months, according to the Mortgage Bankers Association.

December 19 -

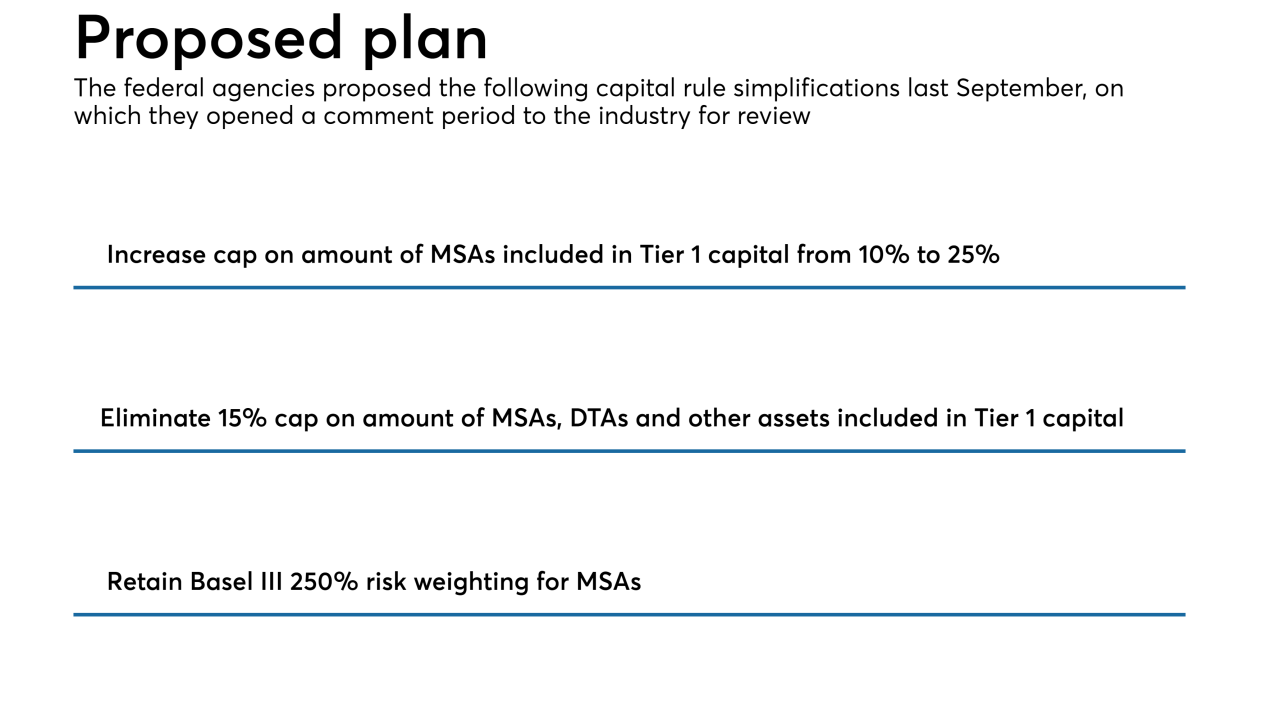

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

Mortgage applications to purchase newly constructed homes continues to decline, driven by affordability concerns among potential buyers, the Mortgage Bankers Association said.

December 13 -

Mortgage applications rose 1.6% from one week earlier as falling interest rates contributed to a boost in refinance activity, according to the Mortgage Bankers Association.

December 12 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

The number of workers employed by non-depository mortgage companies experienced a typical seasonal drop month-to-month, but employment remained higher than a year ago due to the persistence of competitive hiring practices.

December 7 -

Mortgage credit available to consumers increased in November by 1.1% from the previous month as lenders offered more conventional products with expanded underwriting criteria, the Mortgage Bankers Association said.

December 6 -

Mortgage applications rose for the second straight week as key interest rates fell back toward 5%, according to the Mortgage Bankers Association.

December 5 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

The performance of loans included in commercial mortgage-backed securities improved for the fifth consecutive quarter, with delinquencies down 179 basis points over the time frame, according to the Mortgage Bankers Association.

December 4