-

Mortgage application activity increased 1.4% from one week earlier despite rising interest rates, according to the Mortgage Bankers Association.

July 6 -

The renewed debate on reforming Fannie Mae and Freddie Mac is focused on how small and midsize banks would be affected.

July 5 -

The Trump administration's Justice Department was expected to be less aggressive in its pursuit of False Claims Act cases against the mortgage industry. Instead, its focus has shifted to Federal Housing Administration-insured reverse mortgages.

July 3 -

From the largest banks to the smallest independents, policymakers want to hear the mortgage industry speak with one voice in the critical efforts to reform the government-sponsored enterprises.

June 29 Cunningham & Co.

Cunningham & Co. -

Both parties appear interested in a deal on housing finance reform, but tough fights are ahead.

June 29 -

Mortgage application activity fell by 6.2% this week, driven by a 9% decrease in refinancings, according to the Mortgage Bankers Association.

June 28 -

Mortgage application activity increased slightly from one week earlier, according to the Mortgage Bankers Association.

June 21 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

New home purchase application activity bounced back in May as sales of these properties increased by 5.6% compared with April.

June 15 -

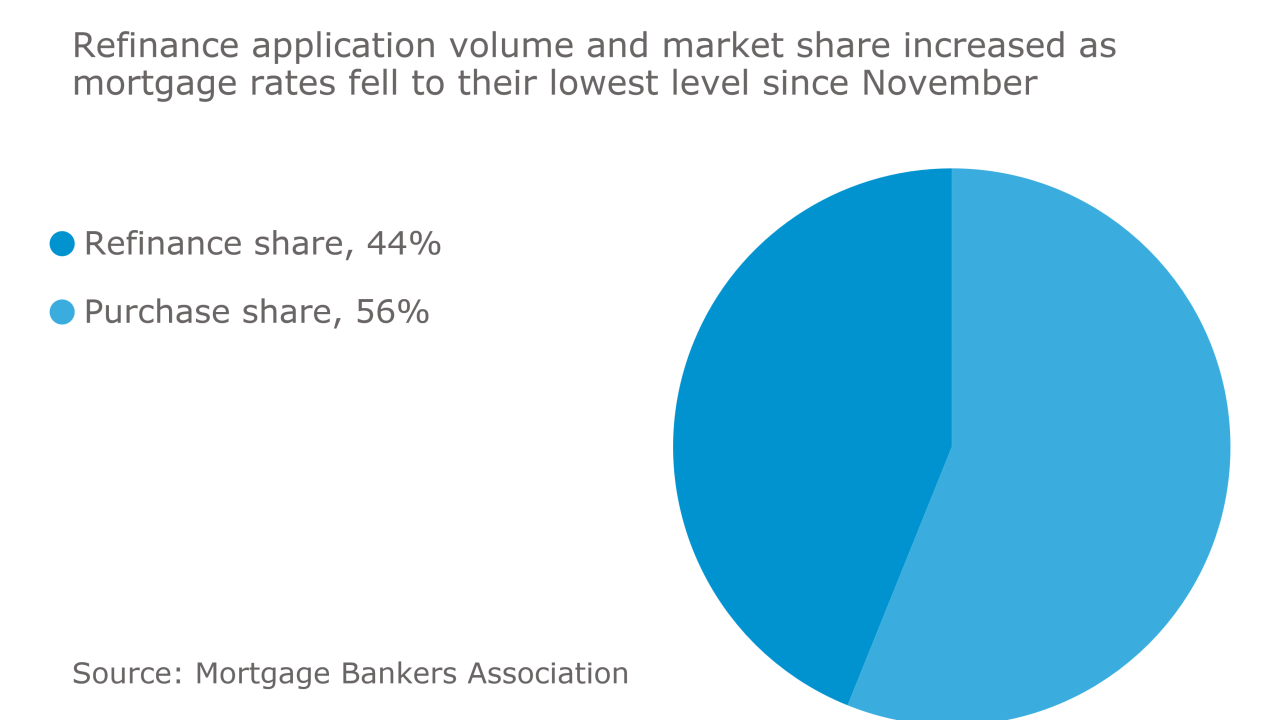

Mortgage applications increased 2.8% from one week earlier as refinancings hit their highest level since November, according to the Mortgage Bankers Association.

June 14 -

New entrants in mortgage servicing are rethinking how business is done, creating more division between holders of mortgage servicing rights and the entities that actually manage loans.

June 13 -

Mortgage credit availability declined in May as lenders reduced the number of government-guaranteed products they market by nearly 2%.

June 9 -

Lower rates led to an increase in both purchase and refinance applications compared with the previous week. according to the Mortgage Bankers Association.

June 7 -

Production expenses averaged $8,887 per loan for independent mortgage bankers in the first quarter as there were fewer originations to absorb the costs.

June 6 -

From pockets of growth in a shrinking refi market to the possibility of REITs buying agency risk-sharing securities, here's a look at recent market shifts that major industry players are focused on right now.

June 5 -

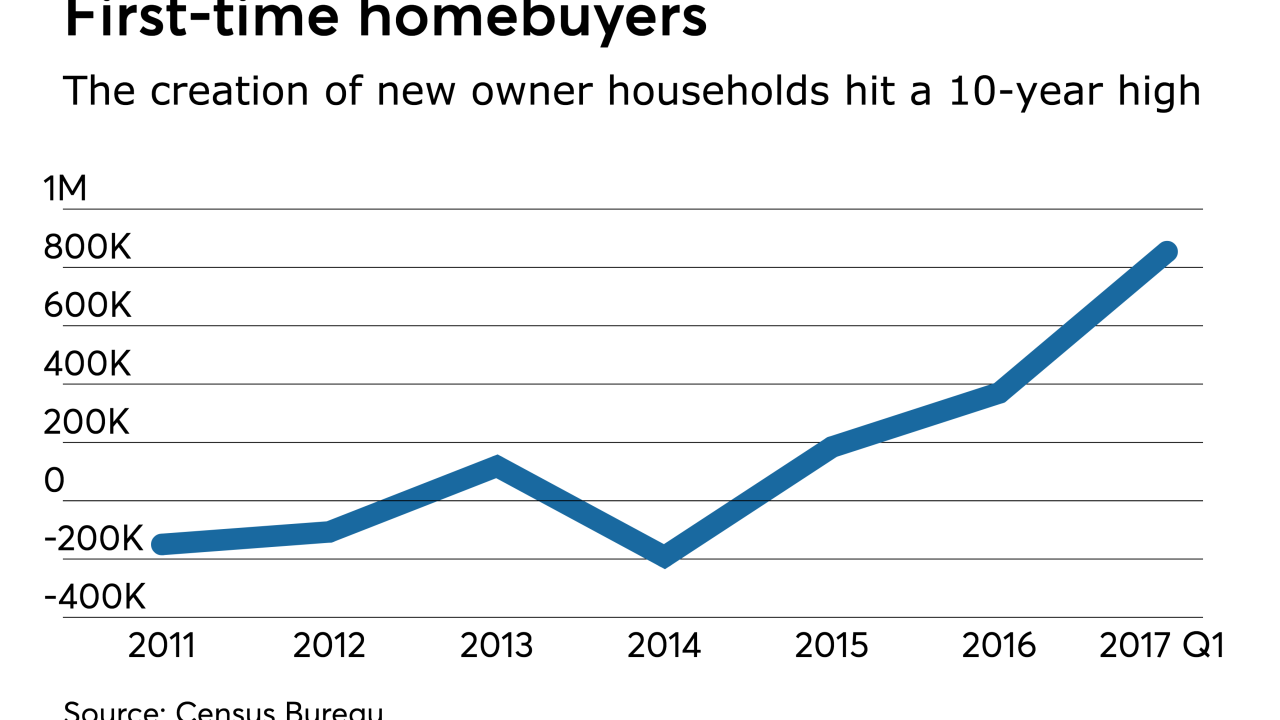

For the first time in a decade, new-owner households created in the first quarter were higher than the creation of renter households.

June 2 -

A new tariff on Canadian lumber threatens to further disrupt homebuilding at a time when lenders are increasingly concerned about a purchase mortgage resurgence that has failed to materialize.

June 1 -

Application volume decreased 3.4% from one week earlier, according to the Mortgage Bankers Association.

May 31 -

Application volume increased 4.4% from one week earlier as rates hit their lowest level in seven months, according to the Mortgage Bankers Association.

May 24 -

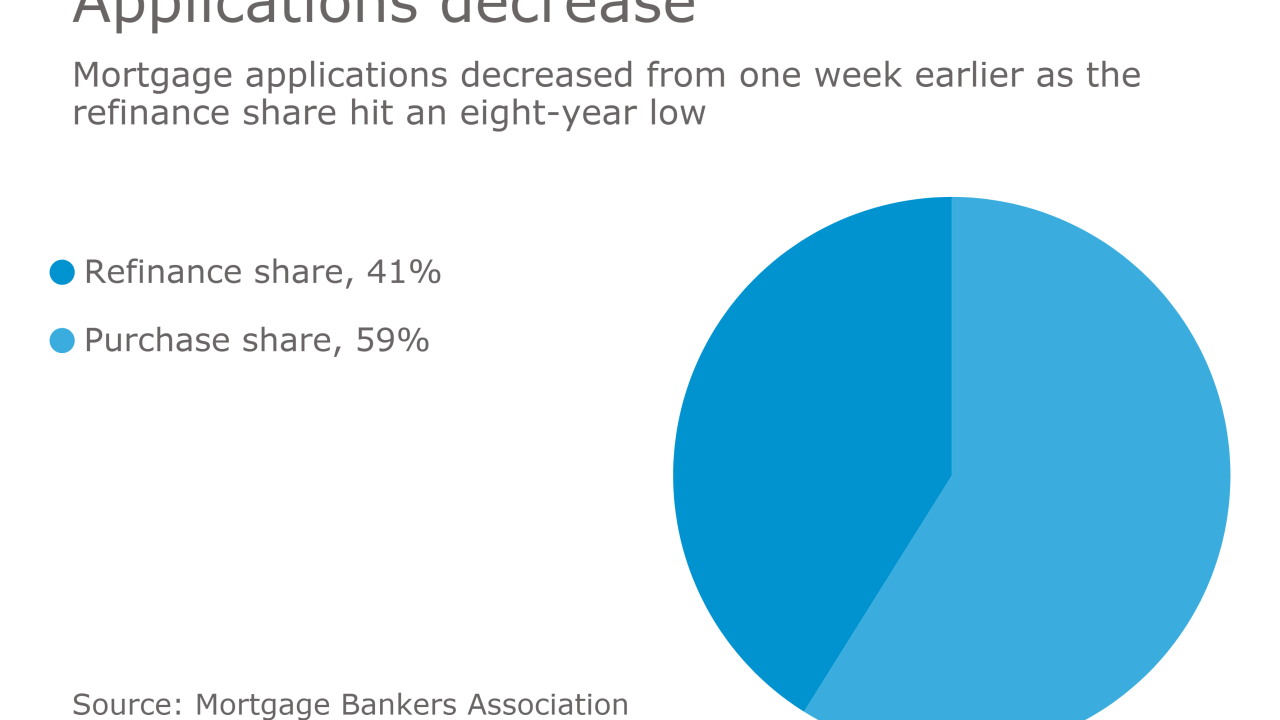

Mortgage applications decreased 4.1% from one week earlier as the refinance share hit an eight-plus-year low, according to the Mortgage Bankers Association.

May 17