-

Over the last 20 years, at least 145,000 Detroit properties have been put up for sale in the annual Wayne County Tax Auction, and, of that number, an estimated 50,000 properties were occupied at the time of foreclosure.

November 20 -

In the latest example of how companies that control a significant portion of the home buying process can weave digital innovations throughout the customer experience, online real estate and mortgage company Redfin will implement electronic closing technology from Notarize.

November 15 -

The decelerating pace of home price growth in October is helping offset the rise in mortgage rates, according to Quicken Loans.

November 14 -

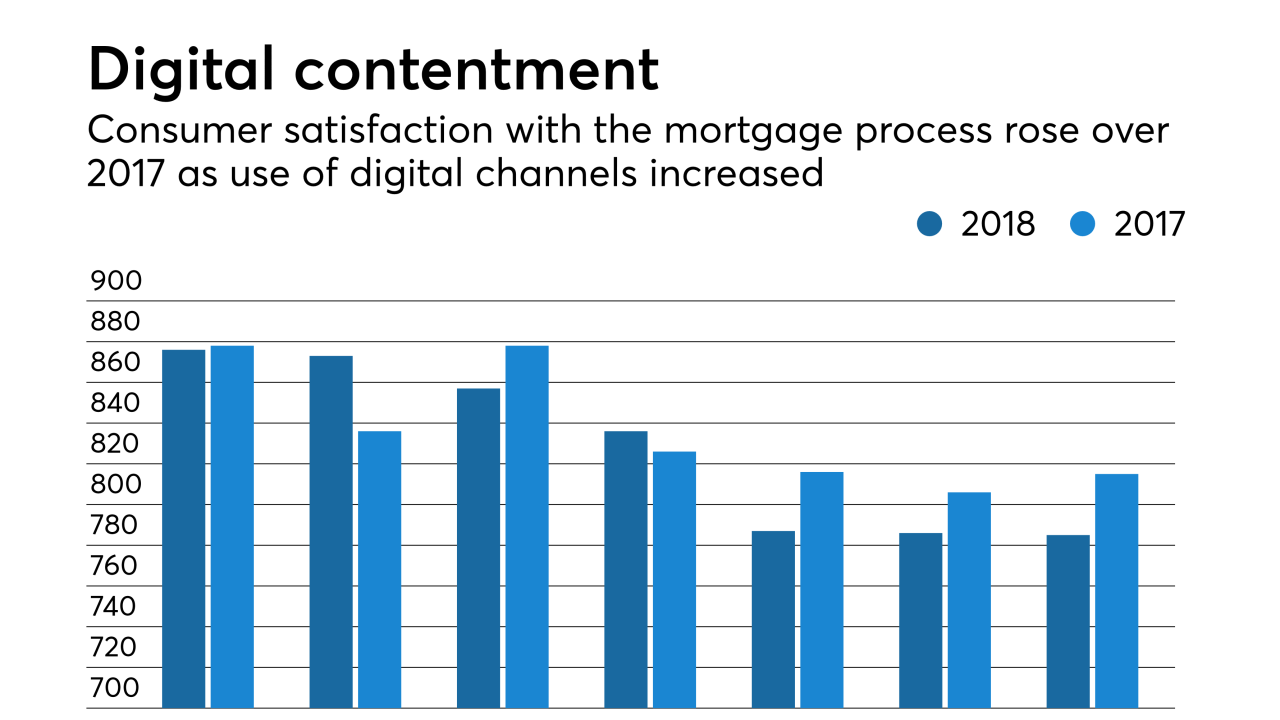

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

Amrock is calling for a new trial in its dispute with HouseCanary following a judge's denial of its motion to reverse an earlier decision in HouseCanary's favor.

November 1 -

While September had a steady yearly rise in home prices, the month-to-month growth is slowing down, according to Quicken Loans.

October 10 -

Bill Emerson, the vice chairman of Quicken Loans, said mortgage lenders need to give time to consider innovation and not be deterred by naysayers.

September 18 -

At Digital Mortgage 2018, Bill Emerson, the vice chairman of Quicken Loans and its parent company Rock Holdings, outlined a vision of dramatic digital disintermediation.

September 18 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

Moody's Investors Service downgraded JPMorgan Chase's prime jumbo mortgage originator assessment to its second-highest rating, citing the bank's growing reliance on correspondents with delegated underwriting authority and shortcomings in its technology infrastructure.

August 24 -

Private-label versions of the Federal Housing Administration's Home Equity Conversion Mortgage have spread to the point where a widely-used loan origination system has added technology to handle the product.

August 24 -

Amid a tight housing market and rising rates, mortgage brokers and wholesalers have been engaged in an intense competition for control over borrower relationships.

August 13 -

Quicken Loans subsidiary One Reverse Mortgage is rolling out a private-label alternative to the Federal Housing Administration's Home Equity Conversion Mortgage that offers higher loan limits and more flexible underwriting terms.

August 8 -

One of the biggest trade secrets cases in U.S. history took a bizarre turn, with the company that lost a $706 million jury verdict saying it uncovered "bombshell" evidence of fraud thanks to whistle blowers who used to work for the winning side.

July 24 -

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20 -

Overcapacity in the mortgage industry led to more competitive pricing in the first quarter, said Wells Fargo CEO Tim Sloan.

June 1 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

When it comes to purchasing a home, buyers have to put a lot of research and thought into any decision they make. From finding the best fit with a real estate agent, to how much work they are willing to do on move-in day, setting a budget and of course, picking the house itself.

May 1 -

From the latest developments in digital mortgages to information about agency technology implementation, here's a look at eight things we learned at the 2018 MBA Tech conference.

April 18 -

While the West Coast still reigns as the epicenter of technology development, the Detroit area has quietly emerged as a proving ground for digital mortgage innovations.

April 17