-

Mortgage applications increased slightly from one week earlier even as rates reached their highest level since July, according to the Mortgage Bankers Association.

October 30 -

Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

October 23 -

Mortgage applications increased 0.5% from one week earlier, although interest rate instability affected consumers' ability to get the best price for their loan, according to the Mortgage Bankers Association.

October 16 -

The Department of Veterans Affairs distributed more than $400 million in refunded home loan fees after finding exempt borrowers were mistakenly charged due to clerical errors related to their disability status.

October 10 -

Mortgage applications jumped 5.2% from one week earlier as a drop in rates caused another surge in refinances, according to the Mortgage Bankers Association.

October 9 -

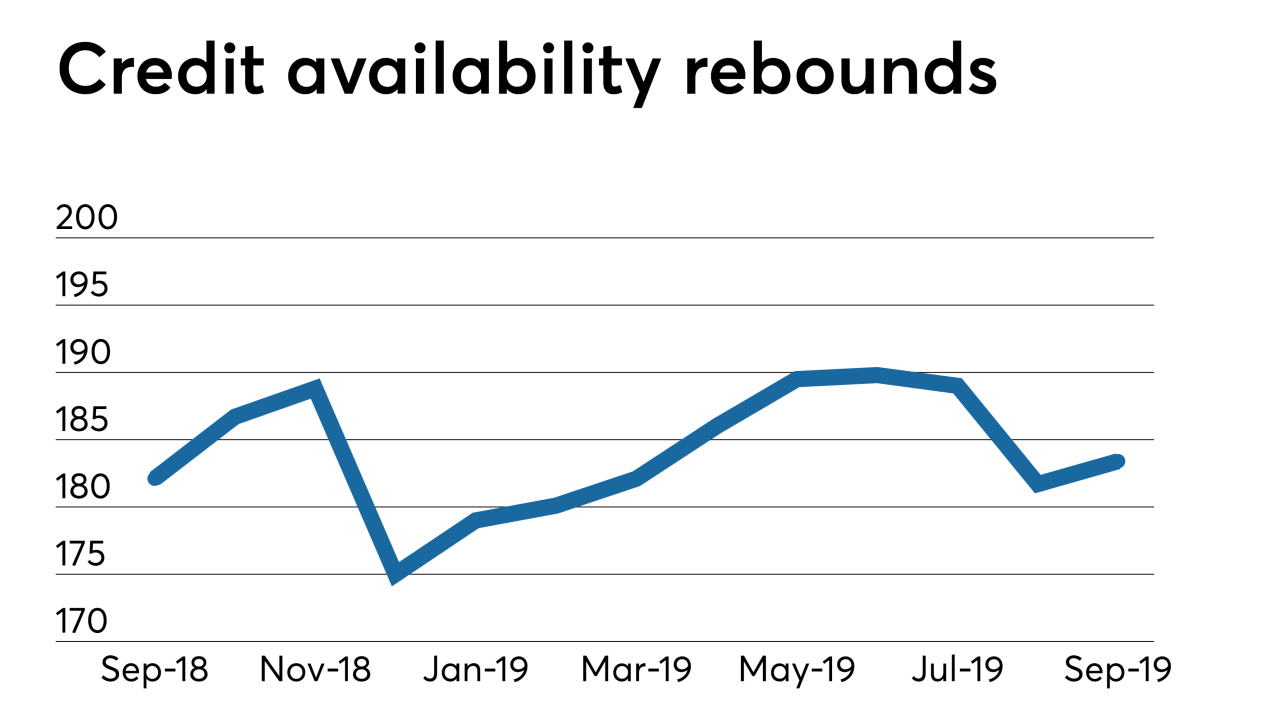

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

NewDay USA, a lender specializing in loans to veterans and military service members, is addressing rate-driven increases in refinancing by hiring more than 100 workers who are new to the business.

October 7 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

Mortgage applications increased 8.1% from one week earlier as conventional mortgage rates fell under 4% again, according to the Mortgage Bankers Association.

October 2 -

The recent spike in mortgage interest rates reduced home purchase application activity last week, contributing to a 10.1% decline in total activity, according to the Mortgage Bankers Association.

September 25 -

Mortgage applications decreased 0.1% from one week earlier as conforming and jumbo interest rates climbed back above 4%, which slowed refinance activity, according to the Mortgage Bankers Association.

September 18 -

The low mortgage rates of August drove new homebuyers to cannonball into the purchase market compared to the year before, according to the Mortgage Bankers Association.

September 17 -

A mortgage industry executive with ties to a firm penalized in a U.S. predatory lending crackdown is being considered by the Trump administration to run Ginnie Mae, according to people familiar with the matter.

September 17 -

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12 -

A swell of refinance demand amid a low mortgage rate environment pushed lender profit margin outlooks to the highest level since the first quarter of 2015, according to Fannie Mae.

September 11 -

Mortgage applications increased 2% on an adjusted basis from one week earlier driven by gains in the purchase market while refinance activity was flat, according to the Mortgage Bankers Association.

September 11 -

Mortgage applications fell 3.1% from one week earlier even with another decrease in rates, according to the Mortgage Bankers Association.

September 4 -

Mortgage rates rose for the first time since the middle of July, but that, along with continued consumer worries about the economy, helped to reduce application activity from the prior week.

August 28 -

Mortgage application volume fell last week as the small drop in interest rates slowed refinancing activity, while economic worries likely kept purchasers out of the market, according to the Mortgage Bankers Association.

August 21 -

Wide short-term swings in interest rates — and loan prepayments — that we've all witnessed have serious secondary effects on consumers, lenders, investors and also policymakers.

August 19 Whalen Global Advisors LLC

Whalen Global Advisors LLC