-

Mortgage applications decreased 1.5% on a seasonally adjusted basis from two weeks earlier amid the annual end-of-year slowdown despite lower rates from global tensions, according to the Mortgage Bankers Association.

January 8 -

The nomination deadline for the 2020 Top Producers program is coming up soon.

January 8 -

Mortgage applications decreased 5.3% on a seasonally adjusted basis from one week earlier led by a decline in conventional refinance loan demand, according to the Mortgage Bankers Association.

December 26 -

Mortgage applications decreased 5% from one week earlier as, absent any rate incentive, activity slowed because of the holiday season, according to the Mortgage Bankers Association.

December 18 -

Even with an increase in both new and existing home construction activity during November, the slowdown over the previous 11 months will constrain inventory going into 2020, according to BuildFax.

December 16 -

Issuance of Ginnie Mae mortgage-backed securities slipped after several months of gains, but high volume still pushed the year-to-date total for 2019 ahead of 2018’s full-year figure.

December 16 -

Mortgage application activity increased 3.8% from one week earlier, with refinance volume for Federal Housing Administration-insured loans taking the spotlight, the Mortgage Bankers Association said.

December 11 -

The housing market is likely changing to predominantly repeat purchasers, even as growth in the first-timer buyer segment continued in the third quarter, a study from Genworth found.

December 10 -

The share of Department of Veterans Affairs-guaranteed loans in Ginnie Mae mortgage-backed securities issuance rose to 42% in the most recent fiscal year from almost 39%, and could continue to rise.

December 9 -

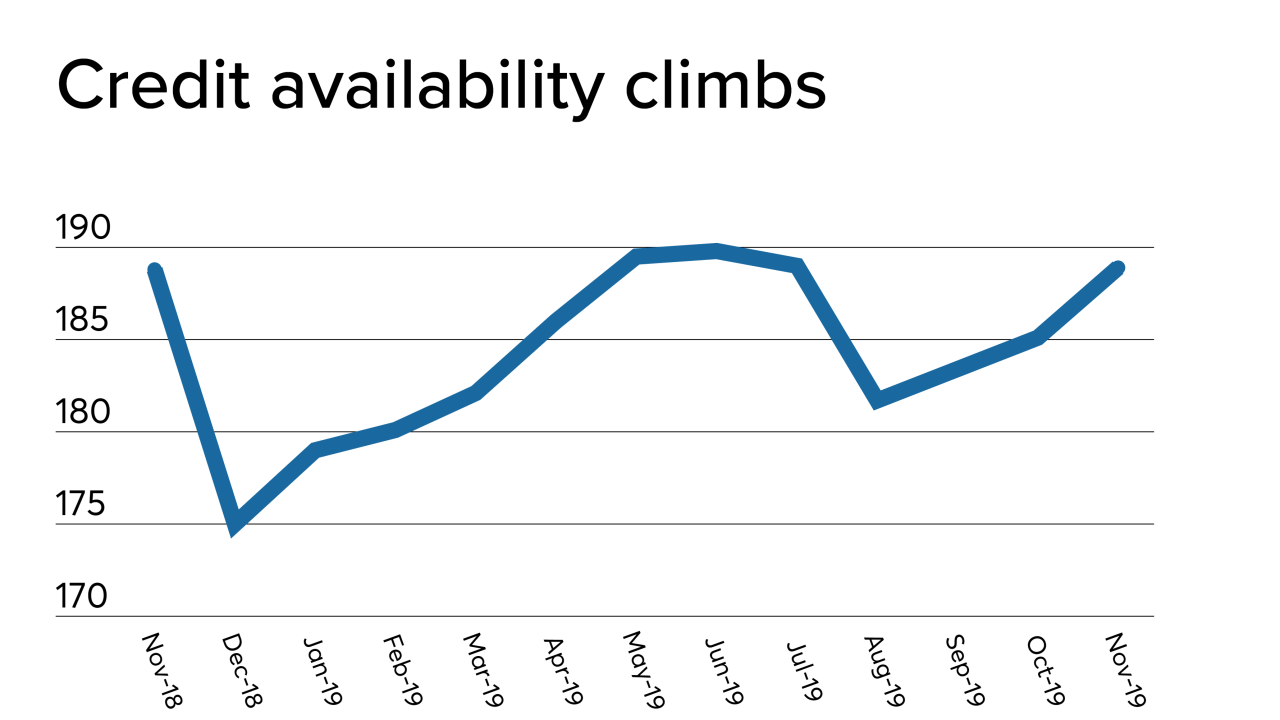

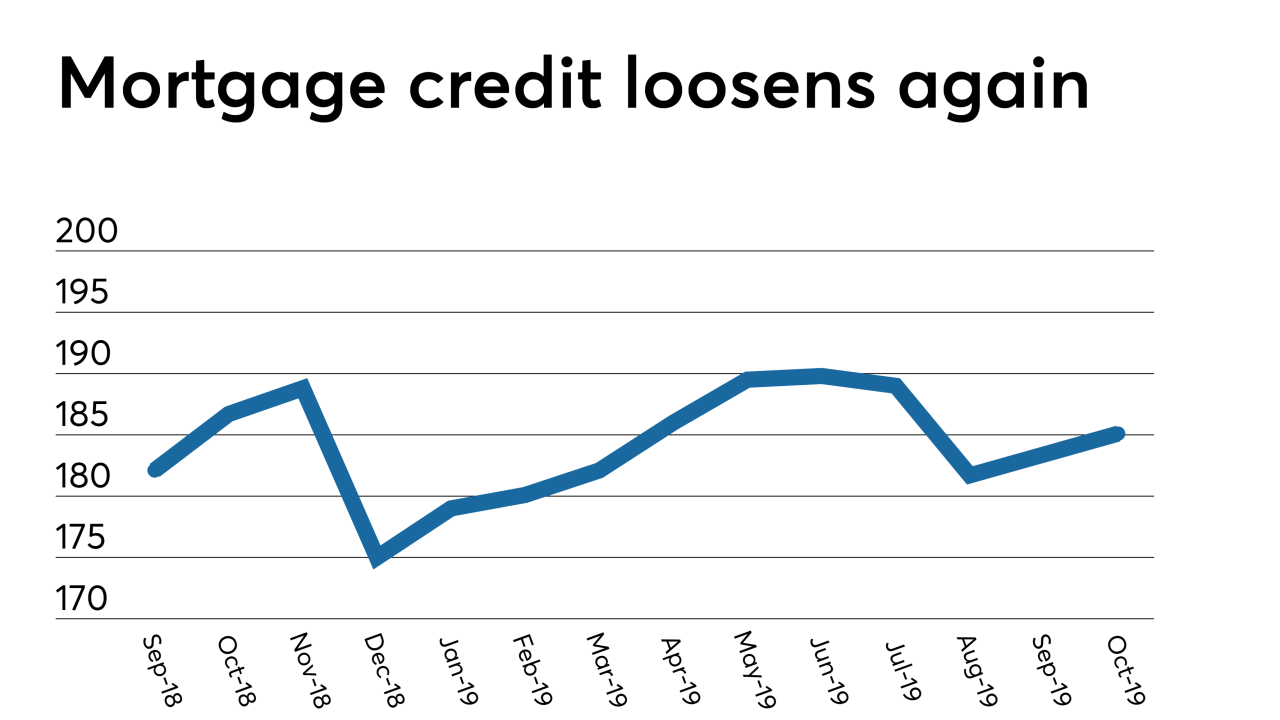

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

Purchase mortgage application activity is at its highest level since this summer on a seasonally adjusted basis, and should remain strong in December, according to the Mortgage Bankers Association.

December 4 -

Mortgage application activity rose 1.5% compared with one week earlier as interest rates remained below 4%, according to the Mortgage Bankers Association.

November 27 -

For the second consecutive week, mortgage application activity unusually moved in the same direction as interest rates, decreasing 2.2% from one week earlier, according to the Mortgage Bankers Association.

November 20 -

Loan applications to purchase newly constructed homes during October rose by nearly one-third year-over-year as sales reached their highest annual pace since the Mortgage Bankers Association started tracking this data.

November 19 -

Mortgage applications increased from one week earlier, although conforming loan interest rates moved back over 4%, according to the Mortgage Bankers Association.

November 13 -

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

It was activity at the upper end of the housing market that helped to keep mortgage application volume level with the previous week, the Mortgage Bankers Association said.

November 6 -

From the Tennessee-Kentucky border through coastal North Carolina, here are the 15 metro areas where millennial VA purchase-loan activity increased the most over the past fiscal year.

November 5