-

The share of closed purchase loans remained flat in June, affected by the lack of homes for sale, according to Ellie Mae's Origination Insight report.

July 19 -

Mortgage loan application volume increased 6.3% last week as interest rates remained flat after a sharp gain during the previous 14-day period, according to the Mortgage Bankers Association.

July 19 -

Loan application activity for the purchase of newly constructed homes decreased 4% in June from the previous month, according to the Mortgage Bankers Association.

July 17 -

Rising mortgage rates hurt both refinance and purchase application activity as volume decreased 7.4% from one week earlier, according to the Mortgage Bankers Association.

July 12 -

Mortgage application activity increased 1.4% from one week earlier despite rising interest rates, according to the Mortgage Bankers Association.

July 6 -

Mortgage application activity fell by 6.2% this week, driven by a 9% decrease in refinancings, according to the Mortgage Bankers Association.

June 28 -

The purchase mortgage share increased 15 percentage points in the first five months of 2017 to 68% of all closed loans in May, according to Ellie Mae.

June 21 -

Mortgage application activity increased slightly from one week earlier, according to the Mortgage Bankers Association.

June 21 -

New home purchase application activity bounced back in May as sales of these properties increased by 5.6% compared with April.

June 15 -

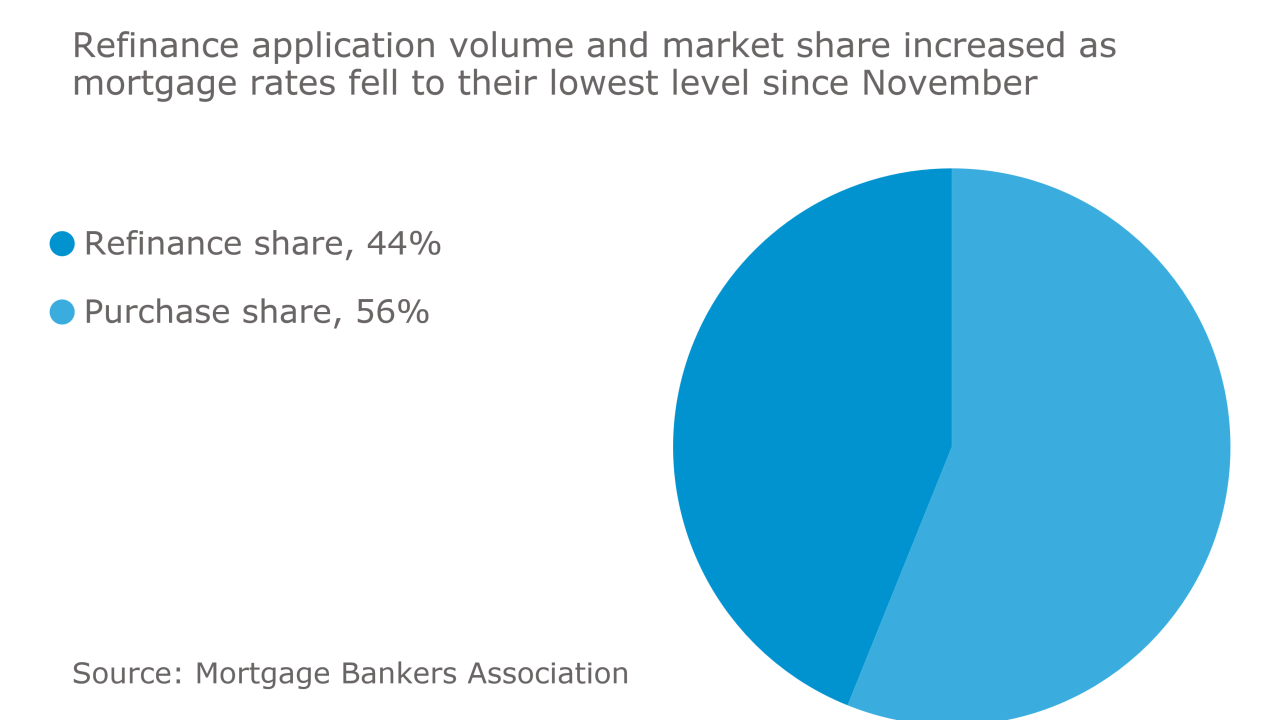

Mortgage applications increased 2.8% from one week earlier as refinancings hit their highest level since November, according to the Mortgage Bankers Association.

June 14 -

Lower rates led to an increase in both purchase and refinance applications compared with the previous week. according to the Mortgage Bankers Association.

June 7 -

A week after officials disclosed a 57% rise in Los Angeles' veteran homelessness, advocates say the U.S. Department of Veterans Affairs is delaying housing development on its West Los Angeles campus.

June 6 -

Application volume decreased 3.4% from one week earlier, according to the Mortgage Bankers Association.

May 31 -

Application volume increased 4.4% from one week earlier as rates hit their lowest level in seven months, according to the Mortgage Bankers Association.

May 24 -

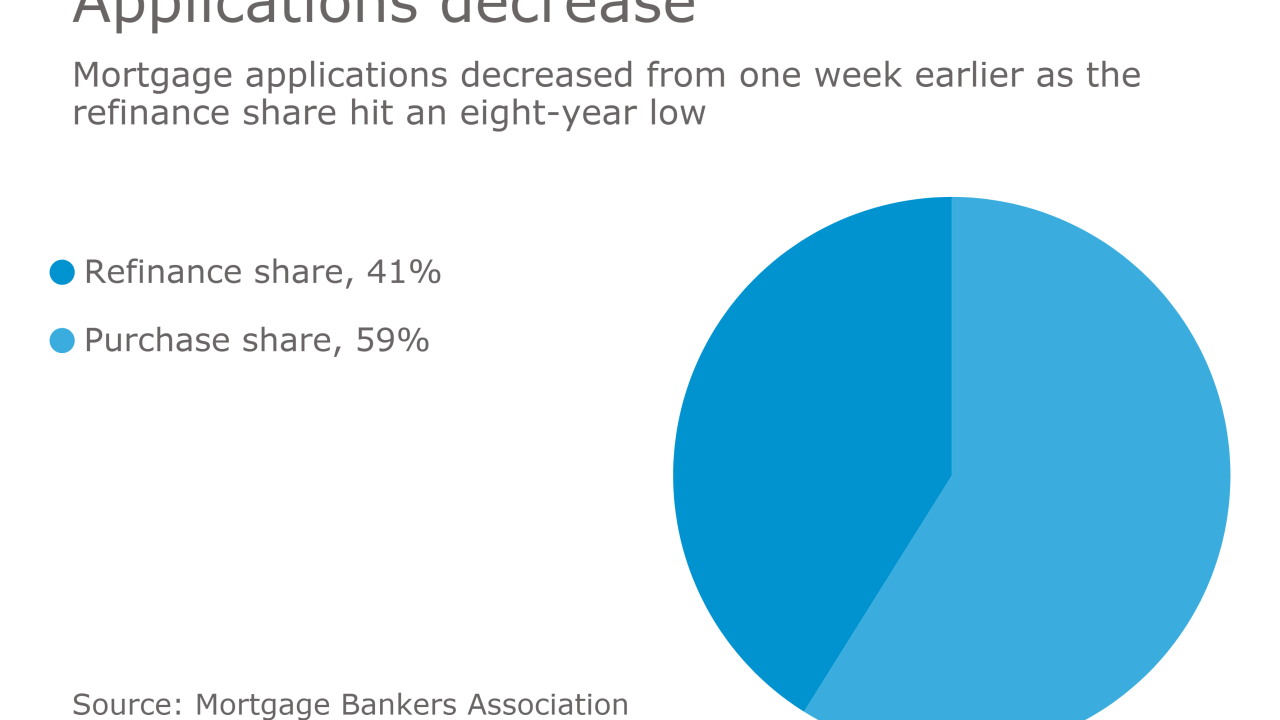

Mortgage applications decreased 4.1% from one week earlier as the refinance share hit an eight-plus-year low, according to the Mortgage Bankers Association.

May 17 -

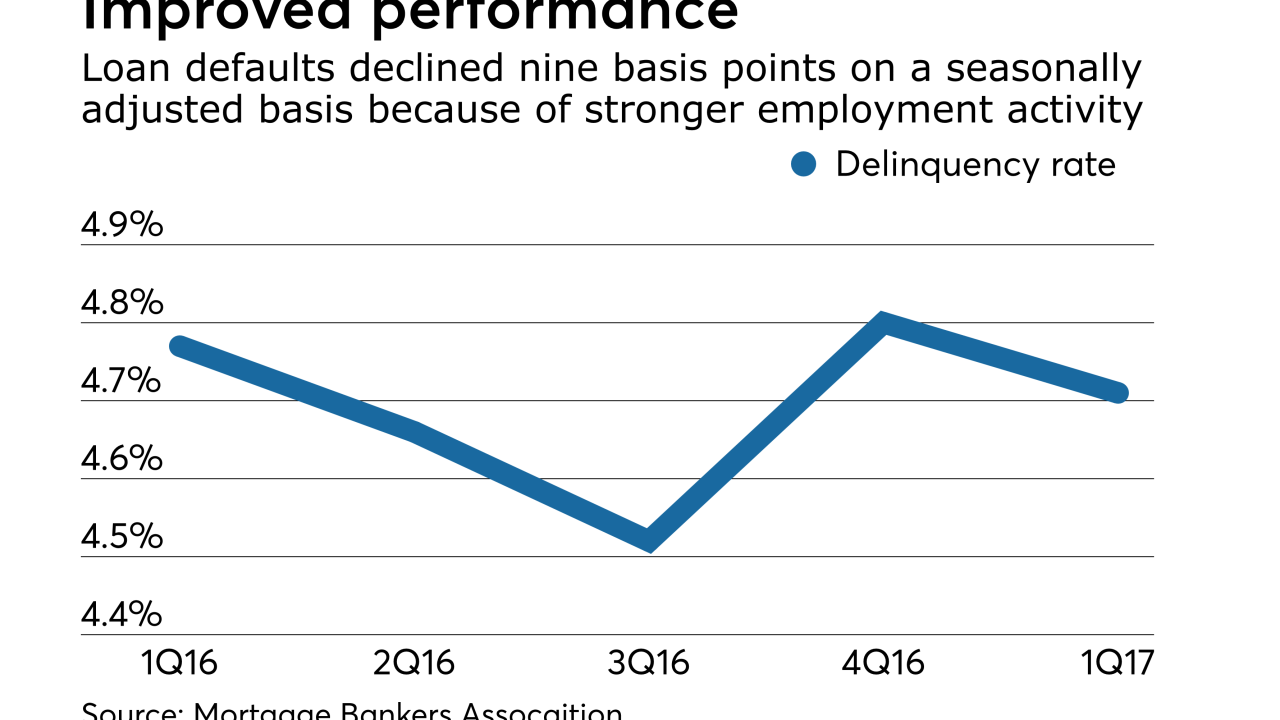

Lower defaults among government-guaranteed mortgage borrowers drove the overall delinquency rate down, the Mortgage Bankers Association said.

May 16 -

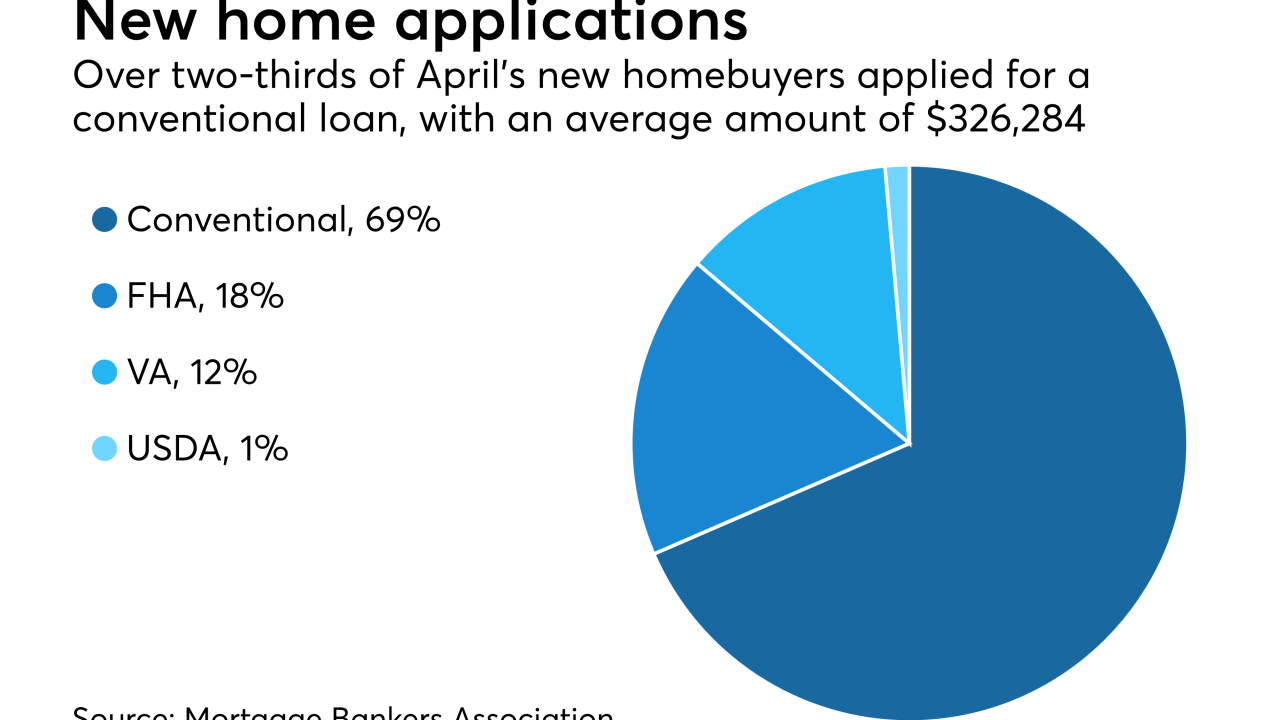

There were fewer new home purchase loan applications in April, as year-over-year activity declined for the first time in 2017.

May 15 -

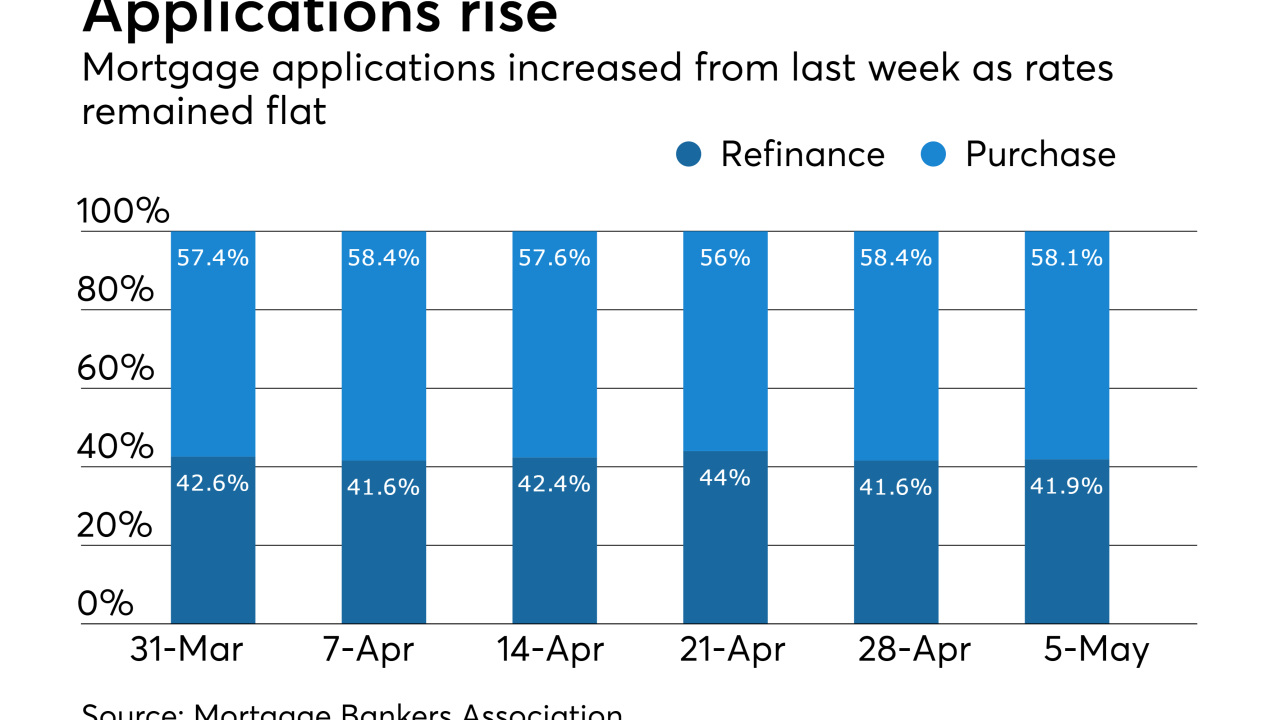

Mortgage applications increased 2.4% from one week earlier as there was little movement in interest rates, according to the Mortgage Bankers Association.

May 10 -

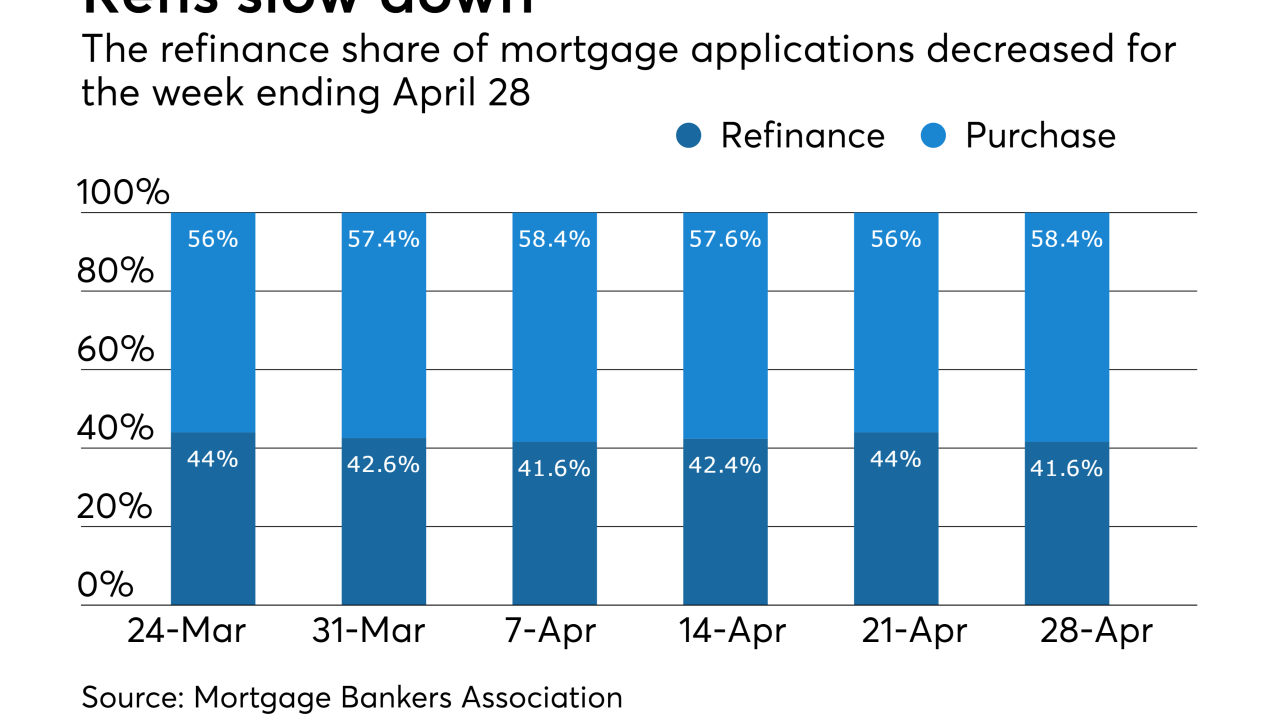

Mortgage application volume decreased 0.1% from one week earlier as refinance activity resumed its decline, according to the Mortgage Bankers Association.

May 3 -

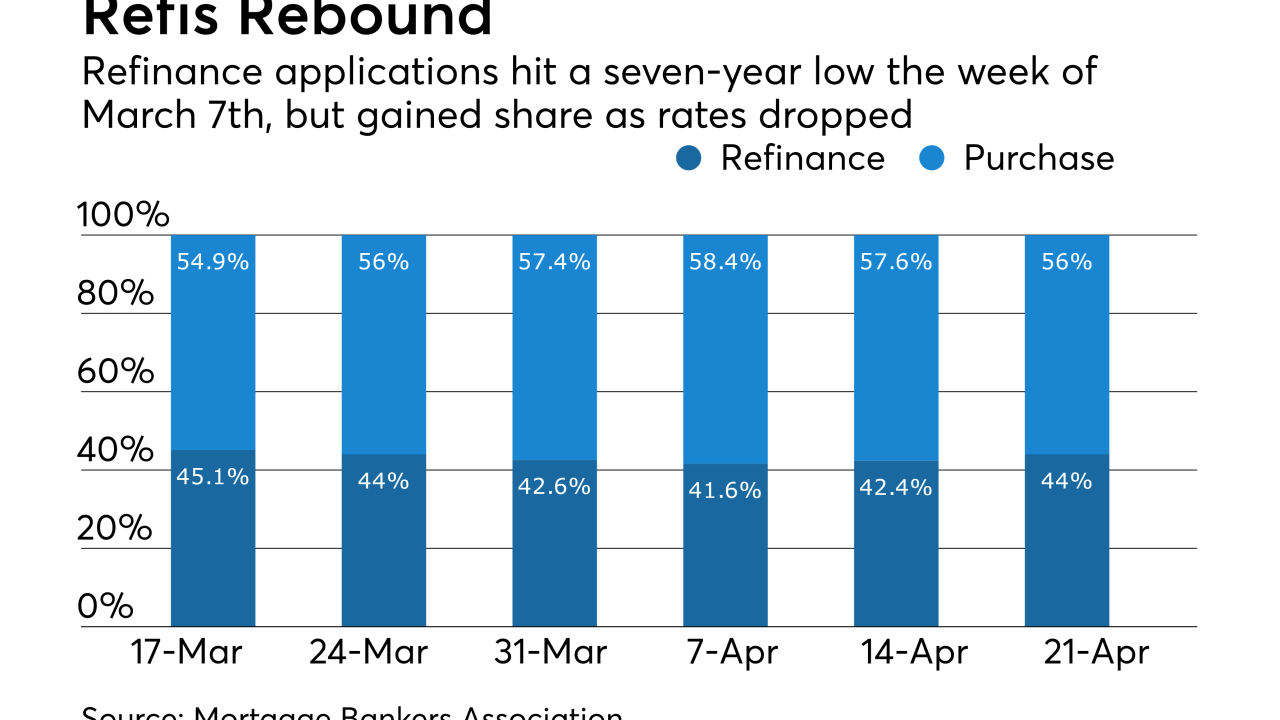

Mortgage application volume increased 2.7% for the week of April 21 as more consumers applied for refinance loans.

April 26