Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The company will also be reducing its servicing portfolio.

January 10 -

Rohit Chopra, director of the Consumer Financial Protection Bureau, said the bank is "not making rapid progress" and hinted at the possibility of additional restrictions. But analysts saw positives for Wells in the $3.7 billion consent order.

December 20 -

Wells Fargo cut hundreds more mortgage employees Thursday, the latest in a series of reductions across the industry after higher interest rates brought the pandemic-era home-lending boom to halt.

December 1 -

Kristy Fercho, who's run the bank's home lending division since August 2020, will report directly to CEO Charlie Scharf and sit on the operating committee. Last year, she became the first Black person to chair the Mortgage Bankers Association, and she took the top spot in American Banker's Most Powerful Women to Watch this year.

November 1 -

The move will reduce the excess capacity in the field but the effects on servicing are likely to dampen the Federal Housing Administration market, Keefe, Bruyette & Woods said.

August 17 -

The bank plans to shrink its vast mortgage empire, which once churned out one of every three home loans in the U.S. and for a time made the bank the most valuable in the nation.

August 15 -

Wells Fargo CEO Charlie Scharf hired Mike Weinbach in 2020 as part of a broader organizational shake-up. The former JPMorgan Chase executive is leaving in mid-September as the consumer lending group transitions to a new leader.

July 11 -

Servicing gains failed to offset steep origination declines at the bank, which continues to battle allegations of racial discrimination.

April 14 -

Wells Fargo won an early round in a lawsuit accusing the bank of running a predatory mortgage lending scheme in the Atlanta area before the 2008 financial crisis and continuing to discriminate against minorities for more than a decade afterward.

March 29 -

This follows the publication last week of an investigation that found that the bank had in 2020 approved only 47% of applications to refinance mortgages completed by Black homeowners compared with 72% of those from White applicants.

March 17 -

Panorama Mortgage Group and Hunt Mortgage also appoint COOs, SitusAMC adds to its title sales team and non-QM lender Sprout finds head of TPO business with internal promotion.

February 25 -

Despite that year-over-year decline, the company beat analysts' expectations with fourth-quarter net income of $5.8 billion. Stronger commercial lending and lower expenses cushioned the blow in consumer credit.

January 14 -

The Office of the Comptroller of the Currency is seeking nearly $19 million from David Julian, Claudia Russ Anderson and Paul McLinko. The trial before an administrative judge is scheduled to begin in South Dakota on Sept. 13.

September 1 -

The bank's noninterest expenses fell by 8% in the second quarter — a sign that CEO Charlie Scharf is making progress in reining in spending that had been soaring in recent years amid heightened regulatory scrutiny. He ultimately hopes to reduce gross expenditures by $8 billion annually.

July 14 -

With the Colonial Pipeline attack still in the news, bank CEOs testifying at a recent hearing cited cyber risk as the biggest threat facing the industry. But members of Congress did not share those concerns, and instead were more focused on criticizing banks about overdraft fees and their level of investment in minority communities.

June 11 -

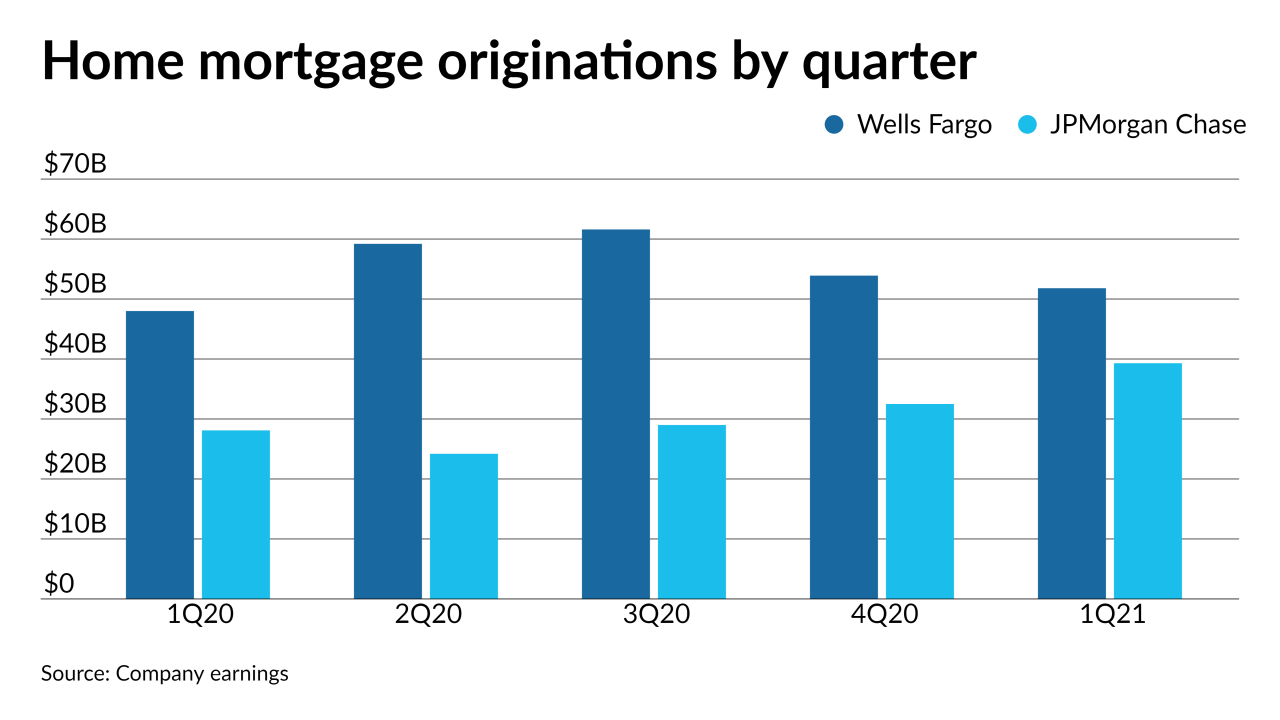

Their numbers suggest that the quarter’s home lending may be stronger than industry forecasts for a 6 to 13% decline.

April 14 -

The complaint alleged the bank discriminated by refusing to make a mortgage loan after learning it would be used to finance a group home for disabled people.

March 19 -

Three announced deals from Woodward Capital, Redwood Trust and Wells Fargo are set to price before the end of the month; additional transactions are expected soon from Morgan Stanley and Goldman Sachs.

March 9 -

CEO Charlie Scharf disappointed investors by failing to provide either a detailed road map for long-term expense reductions or say when he might release such a plan.

October 14