Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The notes are backed by $456.9 million in high-balance loans that meet qualified mortgage standards, according to ratings agency presale reports.

October 5 -

Customers suffered when they were placed in mortgage relief plans without their consent, the Massachusetts senator says. She urged the Federal Reserve to take the blunder into account as it weighs when to lift other sanctions against the bank.

October 1 -

Under fire for saying that the potential pool of talent is "limited," CEO Charlie Scharf issued a memo to employees Wednesday acknowledging that his words reflected his own "unconscious bias" and vowing to improve diversity in the bank's leadership.

September 23 -

Wells Fargo's top executive created a firestorm on social media over comments that the bank has had trouble meeting its diversity goals because there isn't enough minority talent.

September 23 -

Any roadmaps for client service that existed before the pandemic have changed, according speakers at DigMo2020.

September 15 -

The company's outgoing CFO discussed ways the asset cap is stunting growth, but provided no updates at an industry conference on when the restriction might be lifted or the types of jobs it will cut.

September 14 -

When it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

September 4 -

-

An internally built system called Advanced Listening analyzes phone calls, emails, text messages and more, identifying possible compliance violations, systemic issues and opportunities to improve processes, products and customer service.

August 20 -

Perry Hilzendeger’s new role as president of mortgage servicing for Home Point Financial is in line with a previous role he had, and follows broader executive changes at Wells.

August 14 -

Interest rates jumped from a new record low, while Fannie Mae and Freddie Mac were widely panned for imposing a refinance fee.

August 14 -

A former home mortgage consultant with the company alleges she was subjected to a lower compensation structure, awards and benefits compared to her male counterparts.

August 12 -

Deferrals on residential mortgages and home-equity loans have been a common theme at JPMorgan Chase, Bank of America, Wells Fargo and Citigroup since the start of the coronavirus pandemic.

August 5 -

With year-to-date issuance at $51.7 billion, investor demand appears to remain strong despite economic headwinds of the pandemic.

August 5 -

PREIT, which owns a number of large malls, is trimming the salaries of its CEO and chief financial officer while suspending dividend payments as part of a deal with its lenders to stave off default as the coronavirus pandemic continues to take its toll on the troubled company.

August 4 -

Democrats Elizabeth Warren of Massachusetts and Brian Schatz of Hawaii have sent a letter to CEO Charlie Scharf demanding a response to news reports that the bank has been placing borrowers into forbearance plans without their consent.

July 30 -

The national conversation around systemic racism has compelled large banks to withdraw support from the “disparate impact” proposal. But community banks maintain that the proposed reforms would reduce frivolous claims.

July 20 -

Rocket Cos. profits were over 35 times greater than what it disclosed for the first quarter.

July 17 -

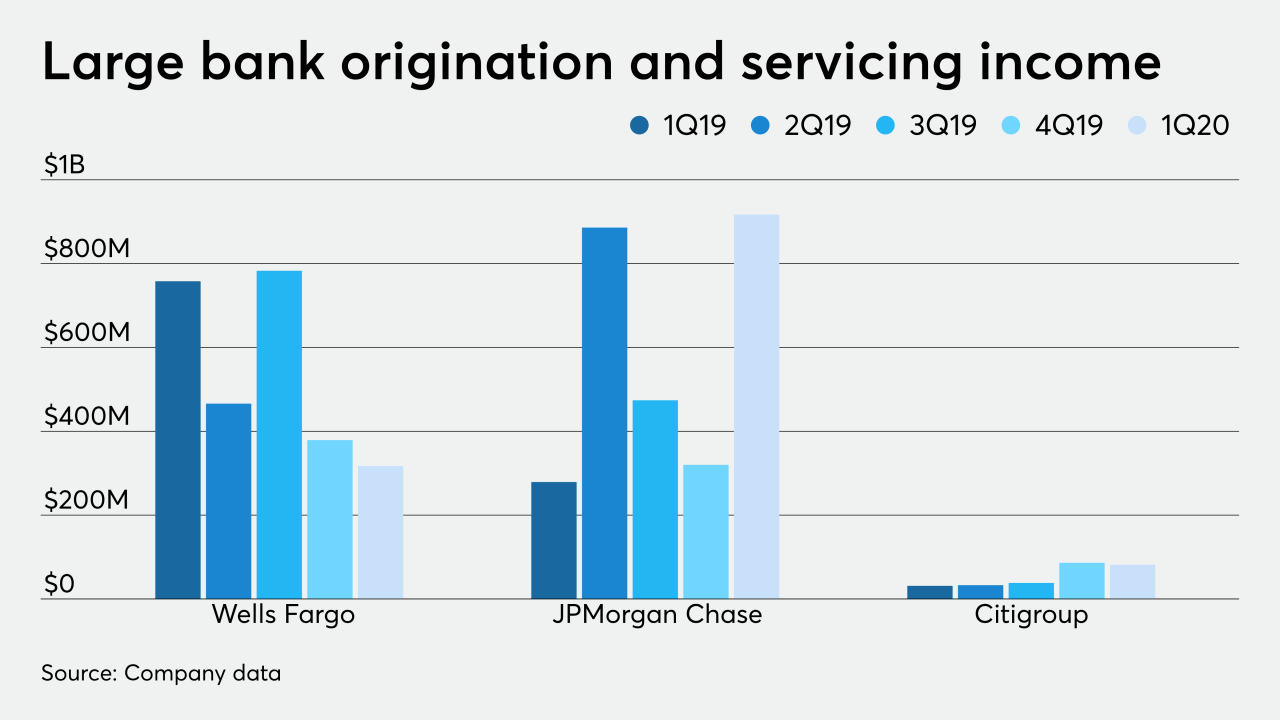

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

The amount far surpassed that of any other servicer required to purchase Ginnie Mae-backed loans that were 90 days past due.

July 13