-

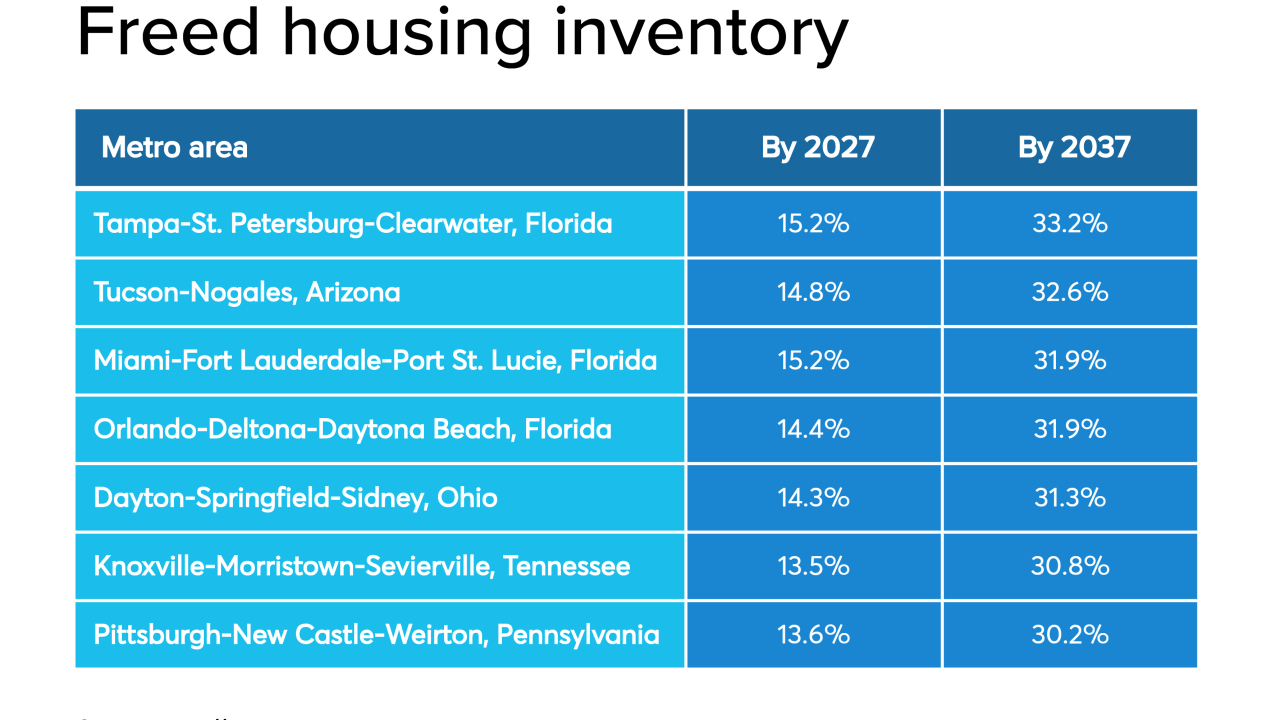

Over a quarter of occupied homes are expected to become available in the next two decades with baby boomers aging out, according to Zillow.

November 25 -

With unemployment still hovering close to all-time lows, the already limited supply of housing is getting bought up faster and lifting rent and home prices around the country, according to Zillow.

November 22 -

San Diego's home market got better for sellers in September.

November 22 -

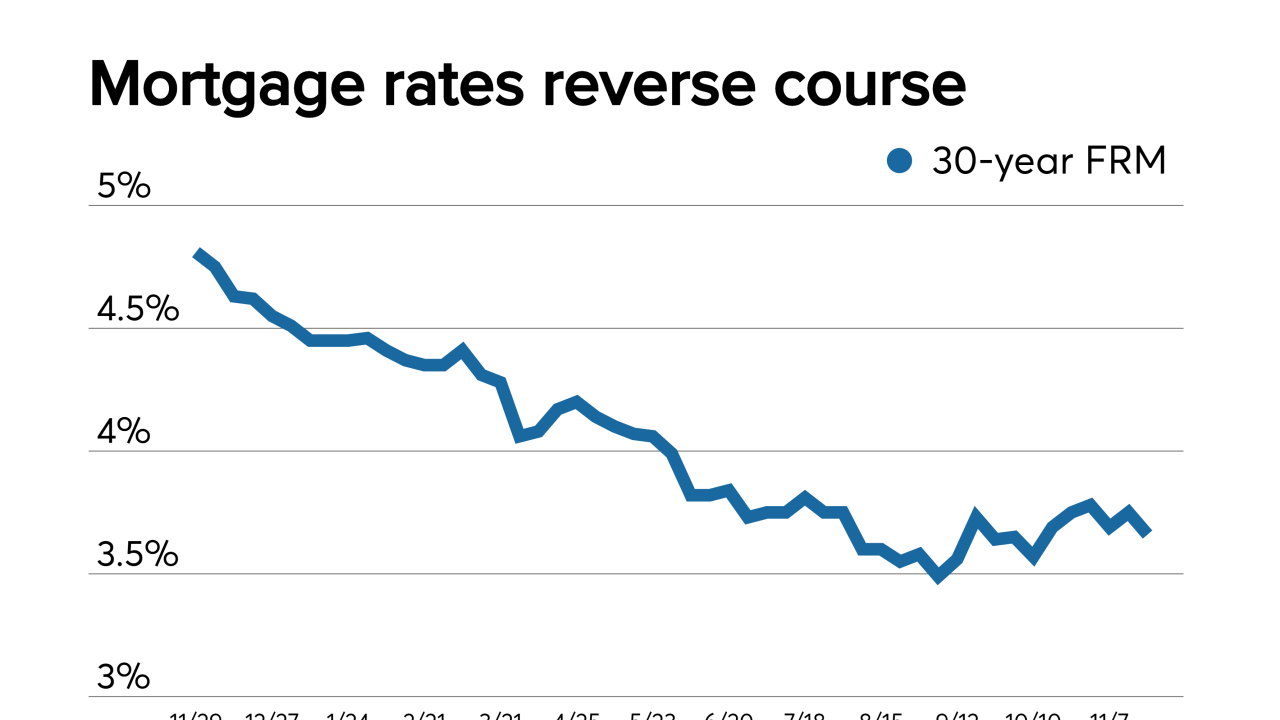

Mortgage rates fell this week, reversing a gradual upward trend, to reach their lowest level in six weeks, according to Freddie Mac.

November 21 -

Mortgage rates rose modestly this week as investors have a more positive view of the economy and so they are moving money out of the bond market, according to Freddie Mac.

November 14 -

Zillow Group reported third-quarter revenue that beat estimates as growing sales in its online marketing and home-flipping businesses sent shares higher in late trading.

November 8 -

Mortgage rates fell for the first time in four weeks, although given investor optimism over better economic news, it might be a blip, according to Freddie Mac.

November 7 -

Mortgage rates rose for the third straight week — which hasn't happened since April — driven by investors' reaction to positive news regarding trade, according to Freddie Mac.

October 31 -

Dallas-area home prices were up 2.8% from a year ago in the latest nationwide comparison.

October 30 -

Economic uncertainty continued to affect mortgage rates, which rose to their highest level in 12 weeks, according to Freddie Mac.

October 24 -

Strong economic trends like an improved employment outlook and rising homebuilder sentiment helped to drive average mortgage rates up 12 basis points from a week ago, according to Freddie Mac.

October 17 -

Most home sellers are stressed around issues involving time and money — two things they can't control — because those affect the purchase and financing of their next home, a Zillow survey found.

October 11 -

Weaker-than-expected economic data led to a decline in mortgage rates this week, although consumer attitudes remain strong, and should continue to drive increased home purchase demand, according to Freddie Mac.

October 10 -

Millennial homeowners and renters are more likely to stay in their home for a shorter period of time than similar aged people of previous generations, according to Zillow.

October 4 -

Economic issues were the biggest influence on average mortgage rates in the past week, although two trackers moved in different directions.

October 3 -

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 1 -

In the decade ending in June, close to $9 trillion in additional owner-occupied real estate wealth was gained by U.S. households. Pacific states, led by California, grabbed 37% of this gain.

October 1 -

September has been the most volatile month since March when it comes to 30-year conforming mortgage rates, with average weekly movements of 11 basis points up or down, according to Freddie Mac.

September 26 -

Mortgage rates had their largest week-to-week uptick since October 2018 as bond market investors reacted to positive news about the economy, according to Freddie Mac.

September 19 -

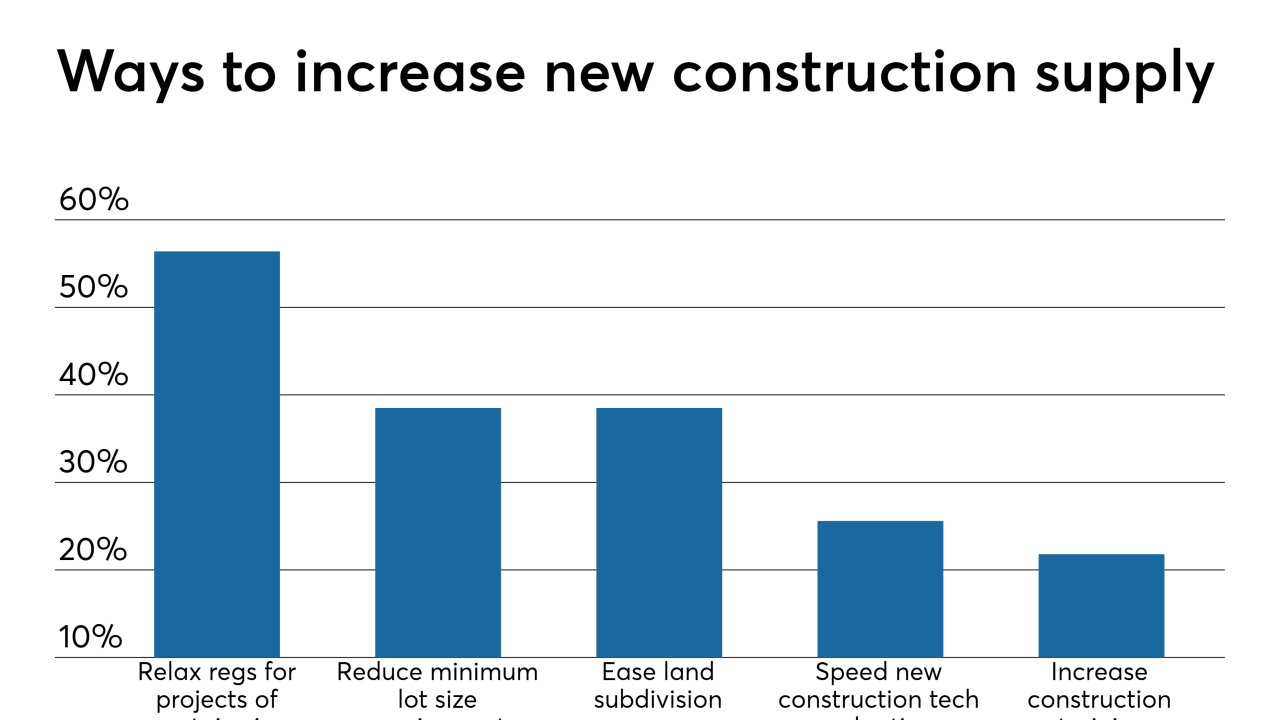

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16