-

Mortgage rates ticked up slightly this week, but whether consumers are able to take advantage of them for purchases and refinancings depends on who looks at the data.

May 7 -

A once-in-a-century pandemic, widespread lockdowns and economic woe — none of it was enough to keep Bay Area home prices from going up.

May 6 -

After a March that still showed some signs of normalcy, April was less kind to Tampa Bay's real estate market as the coronavirus pandemic continued to plummet consumer confidence and disrupt the economy in new and dramatic ways.

May 6 -

This scenario has been seen before. A sudden shock to the economy. Jobs lost. Lenders in trouble.

May 4 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

It's now definitive: Before coronavirus hit, the Seattle area's home market was hotter than almost anywhere else in the country.

April 29 -

Mass layoffs and furloughs due to COVID-19 disproportionately affected Asian, black and Latino workers, and, in turn, will impact their housing security the most, according to Zillow.

April 28 -

The coronavirus outbreak has shuttered business and kept people hunkered down in their homes. Perhaps unsurprisingly, it's also resulted in a market that experts describe as essentially frozen in place.

April 23 -

Mortgage rates were little changed this week as the markets reacted positively to various economic measures coming out of Washington, according to Freddie Mac.

April 23 -

As federal stimulus checks land in bank accounts in coming days, a sobering reality may hit many Bay Area residents — the money will cover less of their housing costs than anywhere else in the country.

April 16 -

Mortgage rates slipped this week as the coronavirus keeps affecting the overall U.S. economy, according to Freddie Mac.

April 16 -

In the Philadelphia metropolitan area, new listings are down almost 43% from March 1 to April 5, when the number of new listings typically grows by roughly 52%, according to Zillow.

April 15 -

Mortgage rates remained flat from last week, but are expected to fall further as they continue to lag changes in 10-year Treasury yields, according to Freddie Mac.

April 9 -

Mortgage rates dropped for the second consecutive week, falling 17 basis points, but that is not attracting homebuyers back into an uncertain market, according to Freddie Mac.

April 2 -

The actions taken by the Federal Reserve to calm the financial markets was key to the drop in mortgage rates this week, according to Freddie Mac.

March 26 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

For Central Texas' long-sizzling housing market, 2020 is the year the unexpected catastrophic global event — the typical caveat in the region's otherwise ongoing rosy market forecasts — has actually come calling.

March 20 -

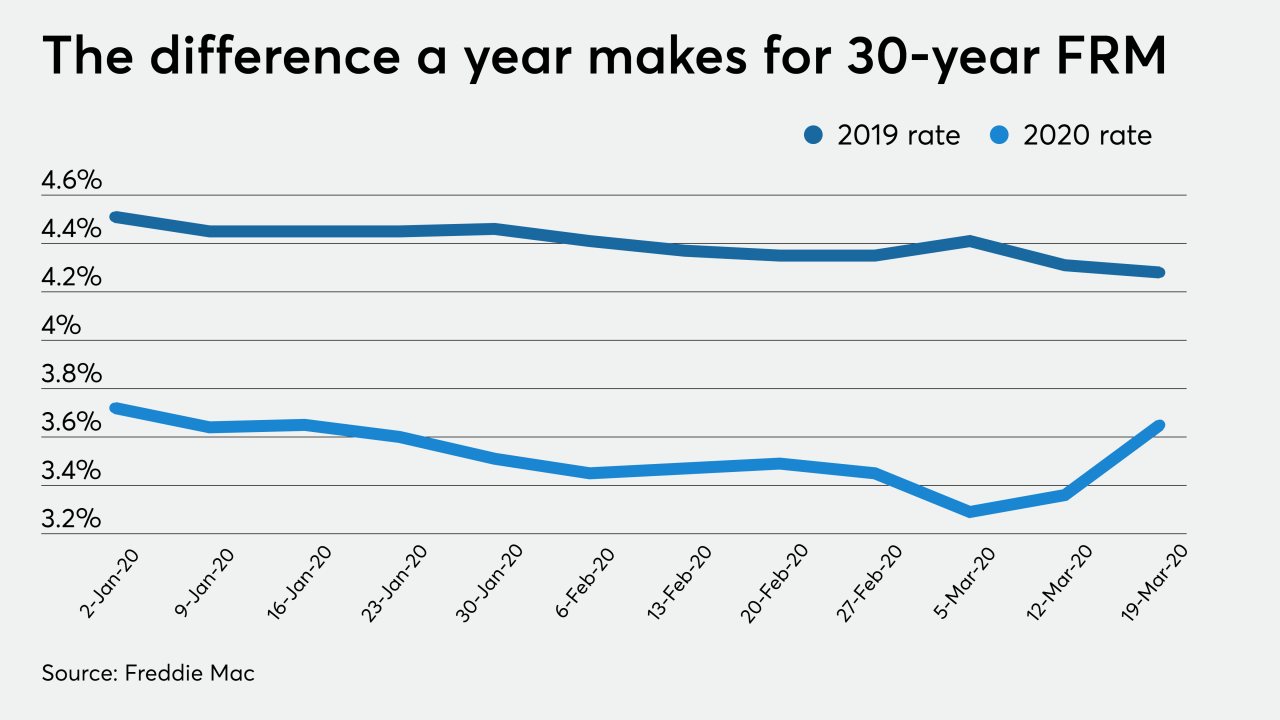

Mortgage rates rose sharply this week as originators looked to manage the overwhelming demand from consumers, according to Freddie Mac.

March 19 -

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

March 12 -

To help the housing crunch, a growing consensus of economists believe adding homes on lots where one already exists would benefit affordability and incrementally boost supply, according to Zillow.

March 9