-

The supply of homes for sale in Atlanta continued to fall, which helped push prices higher last month, according to several reports.

November 29 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

While affordability remains a challenge with the continued strain on housing supply, purchasing power took a big leap in September thanks to a rise in income and descending interest rates, according to First American Financial Corp.

November 27 -

Central Texas could be on pace for a ninth straight year of record-setting home sales, according to new data from the Austin Board of Realtors.

November 25 -

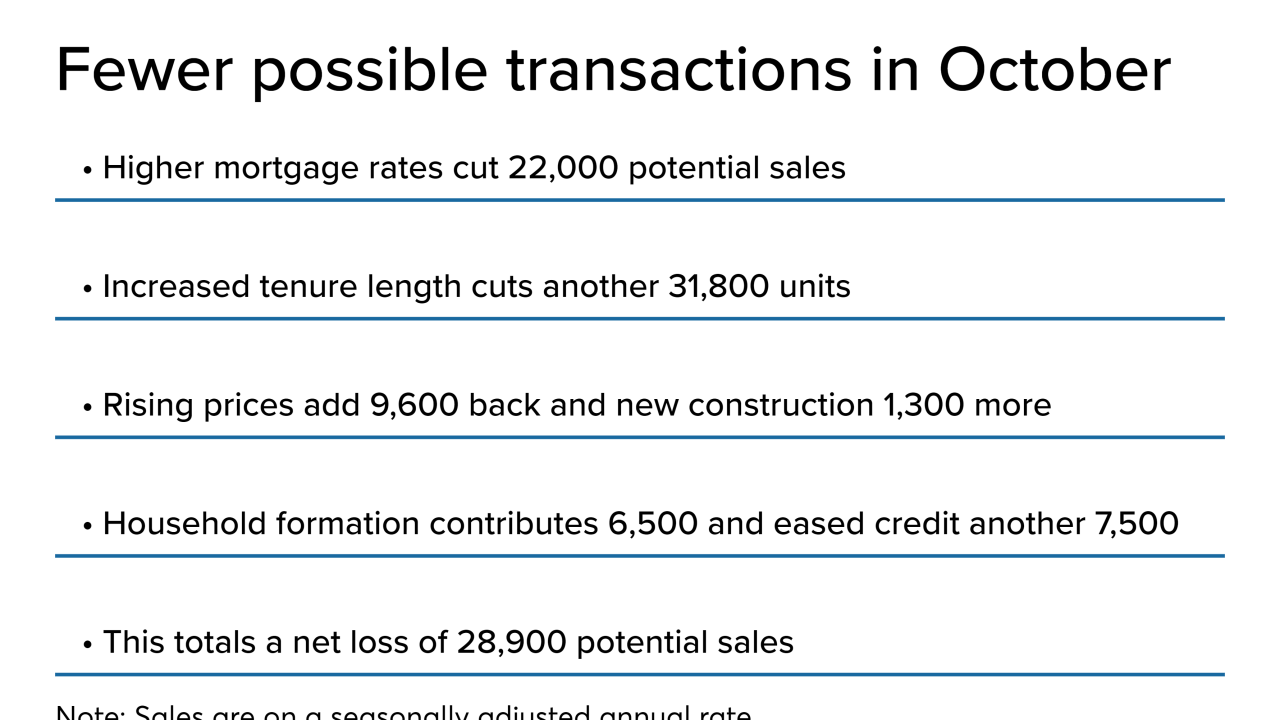

Existing-home sales outperformed their estimated potential for October on improved consumer buying power since the start of 2019 and lower mortgage rates, First American said.

November 20 -

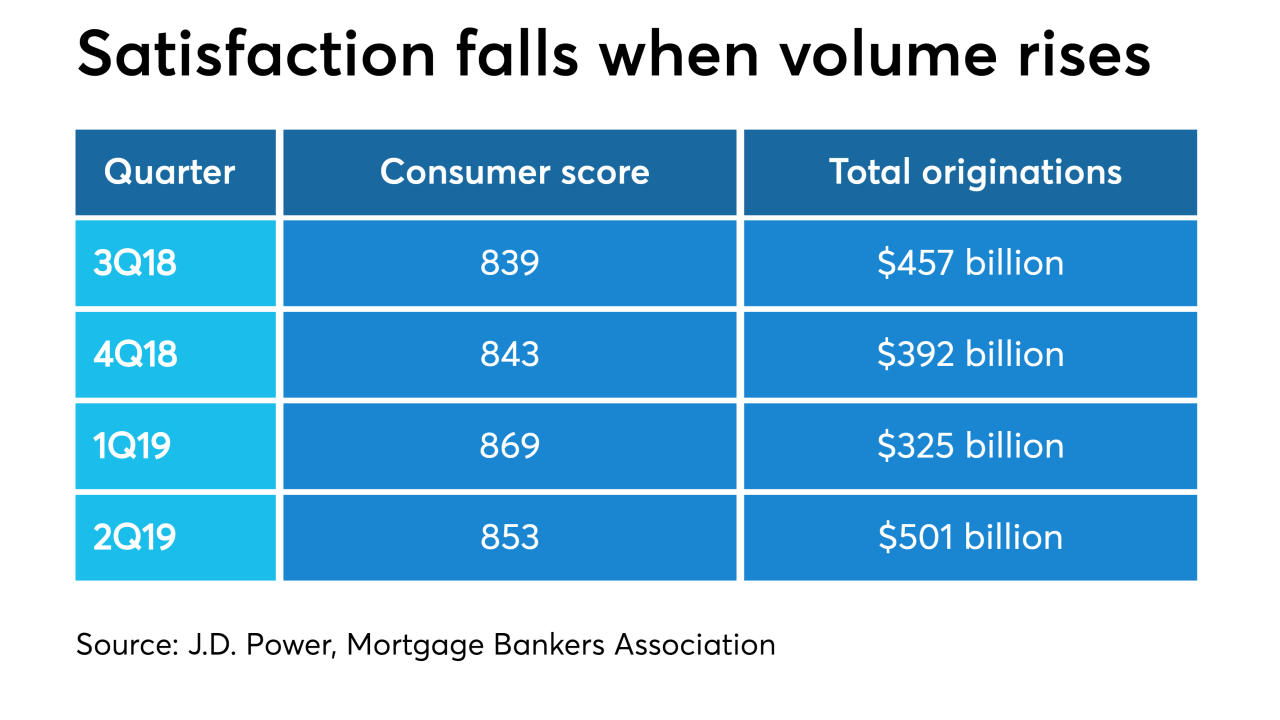

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

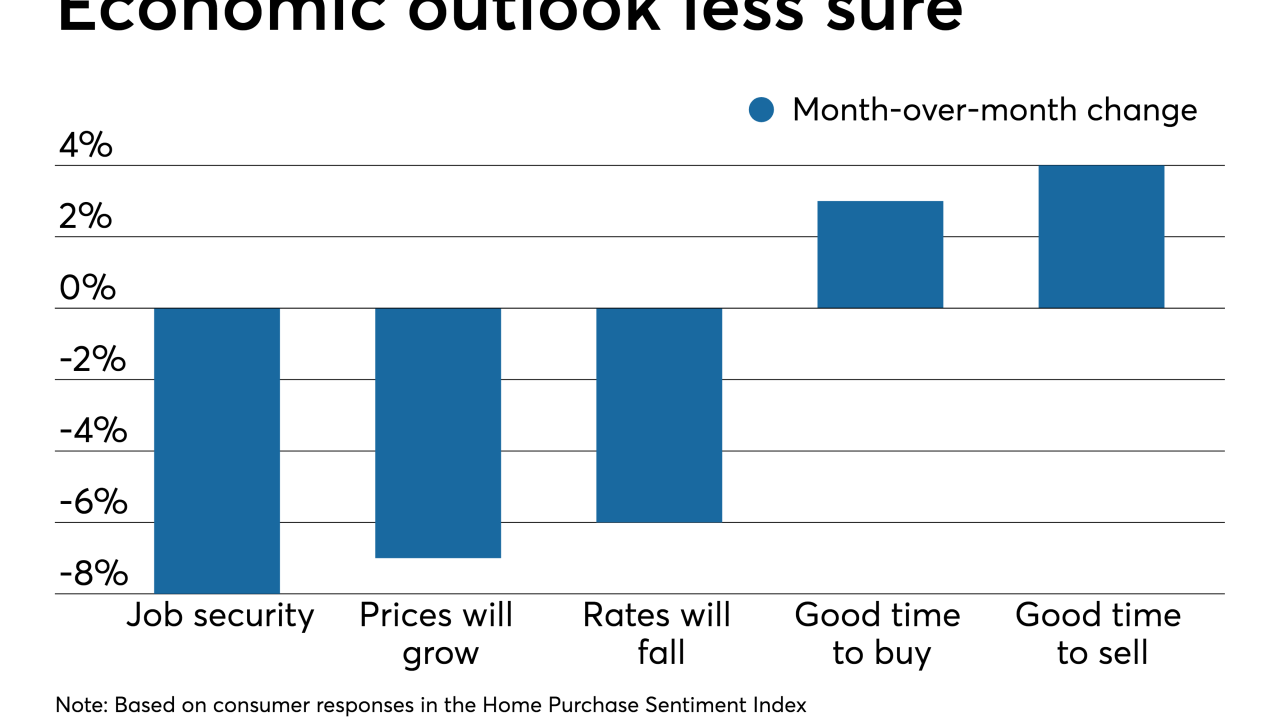

Though still comparatively strong, consumer confidence in the housing market dropped again in October in response to economic uncertainty and lack of affordability, according to Fannie Mae.

November 7 -

Southern California house prices continued rising in September, although gains remain the smallest since the housing recovery began in the spring of 2012, new data shows.

November 7 -

Compass launched its bridge loan services program, aimed at giving homeowners more purchasing power and opportunity to buy a new house before selling theirs.

October 22 -

Home sales continued to perform in line with their potential in September and indicators suggest housing will keep flourishing through the fourth quarter, according to First American.

October 18 -

Bankers in St. Louis weren't surprised when mortgage data released this summer showed a drop in loans made between 2017 and 2018.

October 7 -

Consumer confidence in the housing market remains relatively strong, but economic uncertainty is testing its resiliency, according to Fannie Mae.

October 7 -

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 1 -

Existing-home sales exceeded their market potential again in August, and the improvement may continue for some time before there's a correction, according to First American.

September 18 -

Soaring home prices are pushing homebuyers out of walkable neighborhoods into those that are more car-dependent, Redfin said.

August 30 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29 -

While affordability continues to affect homebuyers, rising income combined with descending interest rates and decelerating housing values boosted the purchase market, according to First American.

August 27 -

Here's a look at 12 of the nation's most affordable housing markets, based on the lowest shares of median local income needed to buy a house in the area, according to Redfin.

August 20 -

July's existing-home sales lived up to their potential after falling short the previous month, but that potential remains limited because tenure continues to increase, according to First American.

August 20 -

Foreign buyers have cooled on the U.S. residential home market, dropping investments by more than one-third over the previous year and spending less in expensive California.

August 12