-

Electronic closings are a solution in efforts to limit people congregating, but there could be some state law concerns.

March 16 -

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

March 12 -

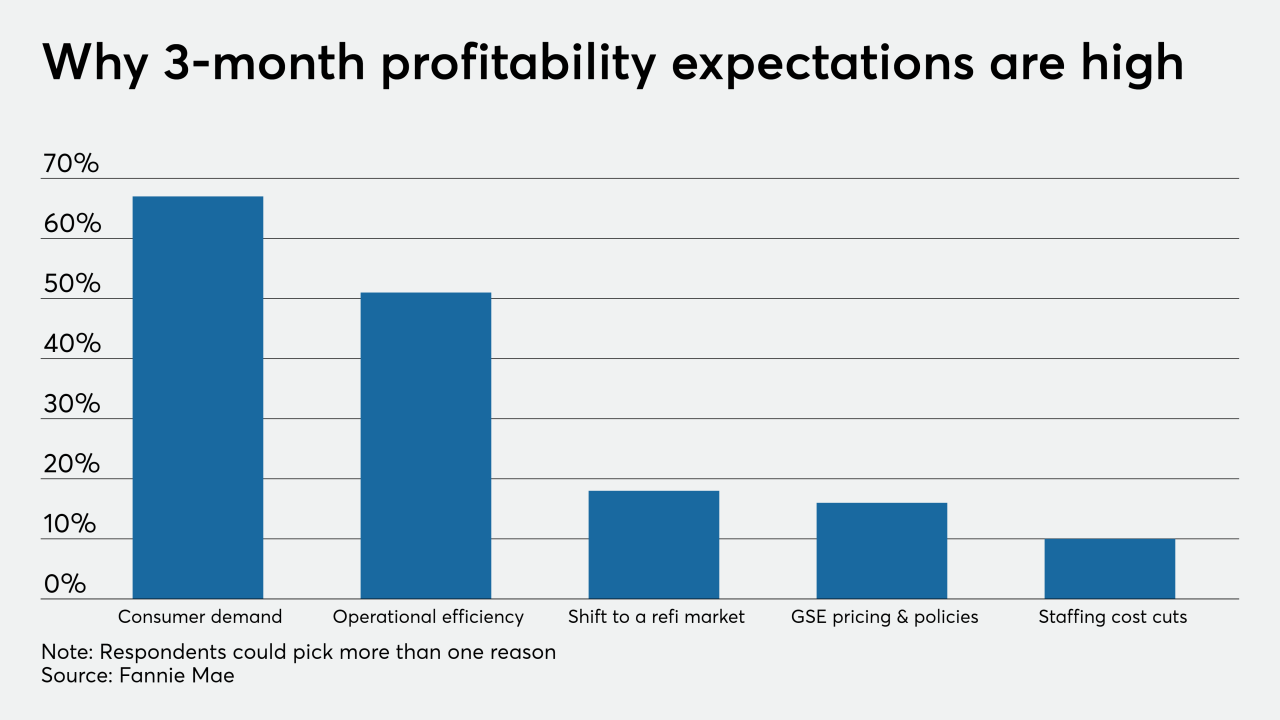

Companies in the mortgage business were already focused on processing a lot of loans and generating efficiencies before the latest uptick in business hit.

March 12 -

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

March 12 -

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market.

March 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

March 11 -

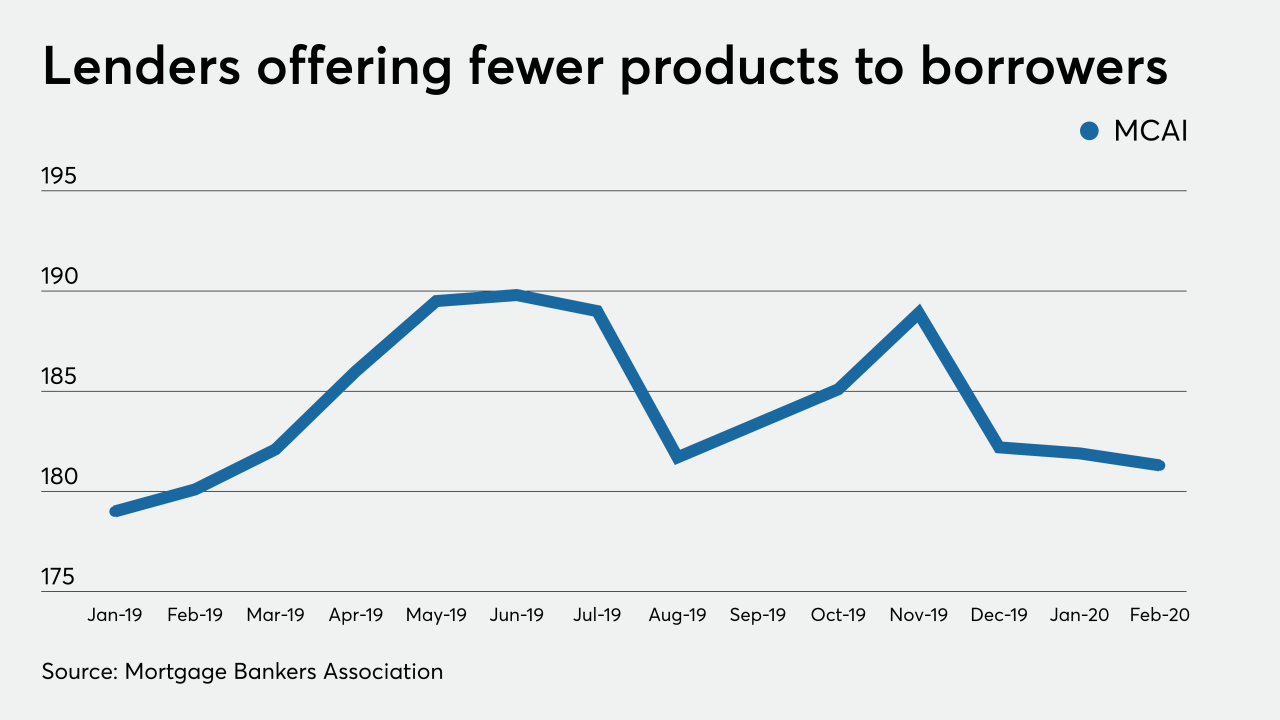

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

From credit unions to banks, loan officers in South Florida are on the phones with homeowners, many of whom have one question: When can I refinance my mortgage?

March 9 -

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

March 9 -

It's hard to overstate just how wild bond markets have gotten amid the coronavirus scare, forcing traders to rethink what's possible.

March 6 -

Mortgage interest rates dropped this week to the lowest level on record, fueling an already hot spring housing market and triggering a refinance boom in the Twin Cities.

March 6 -

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

March 5 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

A drop in interest rates in response to the coronavirus outbreak is adding urgency to a hiring spree across the mortgage industry.

March 4 -

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

March 4 -

Investors' purchases of 10-year Treasurys after the Fed's 50 basis point short-term rate cut drove the yield below 1% for a period of time.

March 3 -

Servicers' struggle to retain borrowers mounted in the fourth quarter when a type of loan that is tough to recapture rose to a more than 10-year high, according to Black Knight.

March 2 -

JPMorgan Chase & Co. is shifting workers to handle an expected surge in demand for home loans as the American housing market looks forward to its strongest spring in at least a decade and the coronavirus sends mortgage rates lower.

February 28 -

Mortgage loan application defect risk is at the lowest point since First American started tracking this data, strictly as a function of the shift to a refinance market.

February 28 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26