-

Even if the U.S. economy slows during the rest of 2019, the outlook for the housing and mortgage market remains strong, said economists at Fannie Mae and Freddie Mac.

May 16 -

The trade dispute with China is likely to affect consumers' willingness to buy a home and apply for a new mortgage loan, according to the Mortgage Bankers Association.

May 15 -

While prepayment speeds on agency mortgage-backed securities rose in April, that increase should be short-lived as further significant interest drops are not expected, said a report from Keefe, Bruyette & Woods.

May 13 -

The Government Accountability Office called on Ginnie Mae to undertake four reforms to its operations, citing concerns regarding the ongoing shift in size and capitalization of mortgage-backed securities issuers.

May 10 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

Lenders and policymakers could further build on a recent surge in Asian-American homeownership if they took three steps, according to the Asian Real Estate Association of America.

May 9 -

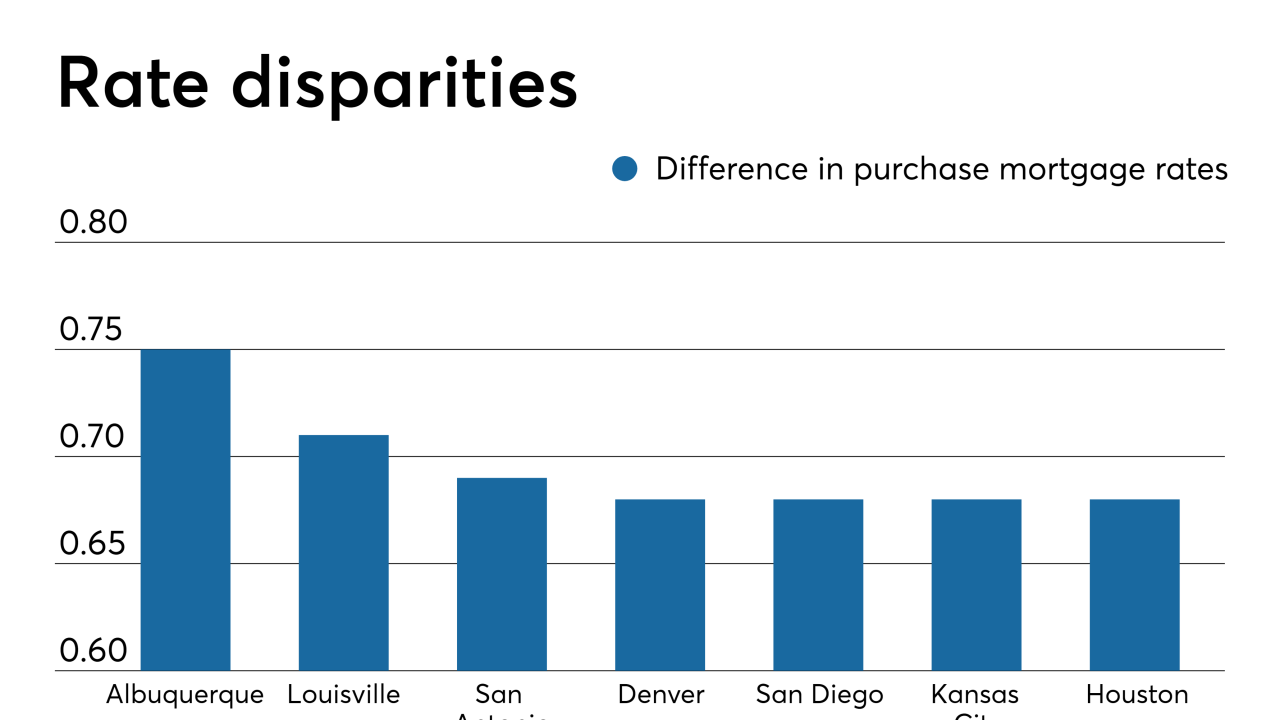

Lenders can help both the consumer save money and their own volumes by offering the most competitive rates or reducing their fees. Here's a look at the 12 housing markets borrowers save the most over the life of their loan by shopping around for a mortgage, according to LendingTree.

May 8 -

An increase in purchase activity drove the week-over-week rise in mortgage application volume as homebuyers entered the market while interest rates fell, according to the Mortgage Bankers Association.

May 8 -

Regions Bank, like many lenders, has seen its refinancing volume shrink dramatically as a percentage of overall originations over the last few years, prompting it to refocus its mortgage bankers on very different purchase originations.

May 7 -

Customer retention for mortgage servicers hit an all-time low at the start of the year, and a sensitive mortgage rate environment is only creating more competition, according to Black Knight.

May 6