-

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

Mortgage applications increased 9.3% from one week earlier, fueled by low mortgage rates and the release of pent-up demand, according to the Mortgage Bankers Association.

June 10 -

With the impacts of the coronavirus in full bore, housing market experts predict home prices to fall in 2020.

June 8 -

Millennial refinance activity hit a new high-water mark behind historically low mortgage rates, up 40 percentage points from the year before, according to Ellie Mae.

June 3 -

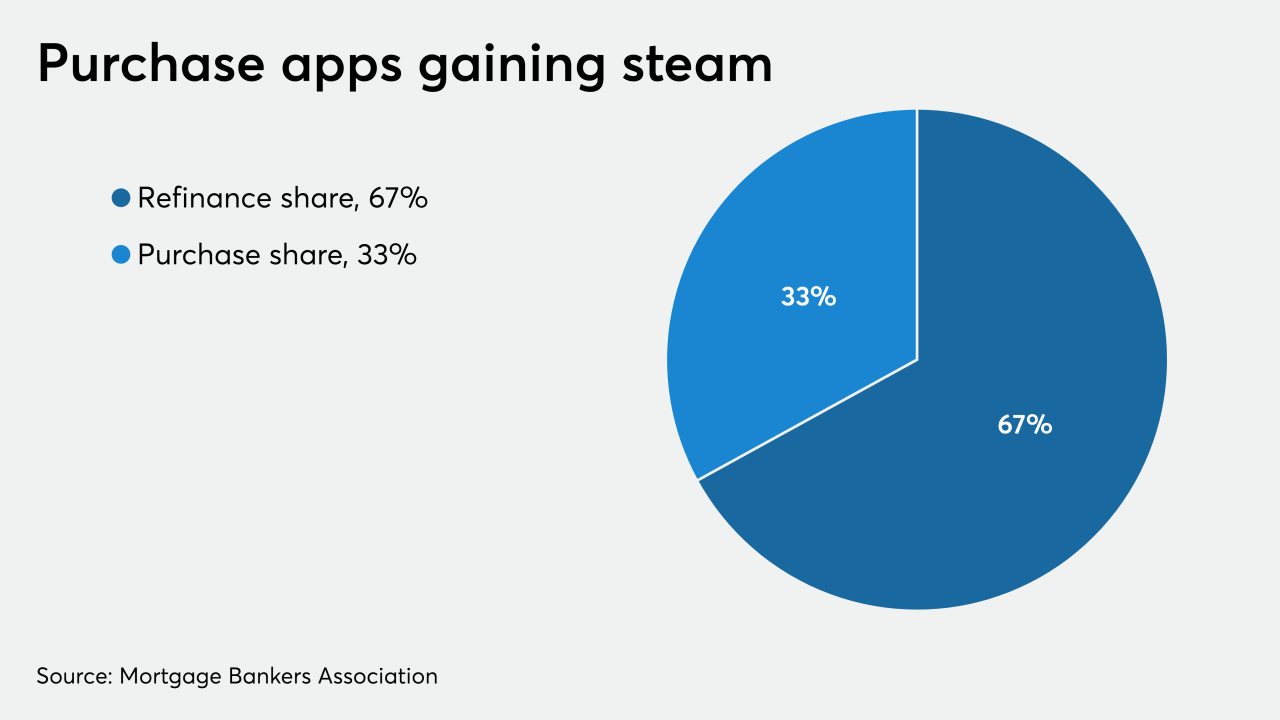

Purchase mortgage application volume continued its upswing as consumers acted on record low rates, but high unemployment and low inventory could hold home buying activity back in the future, the Mortgage Bankers Association said.

June 3 -

Mortgage investors have yet to enjoy robust returns this year despite the Federal Reserve providing $688 billion of support to the sector since mid-March.

June 1 -

The Federal Reserve's actions should keep interest rates down and bring home sales back in June, according to NerdWallet.

June 1 -

Mortgage applications increased 2.7% from one week earlier, as purchase volume is now outpacing the prior year's activity, according to the Mortgage Bankers Association.

May 27 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

The funds will allow the company to make further investment in its machine language technology.

May 21 -

The MBA also said it has been lobbying for a measure that would enable cash-out refinances in forbearance to be sold to the GSEs.

May 20 -

Mortgage applications decreased 2.6% from one week earlier, as tighter underwriting drove the refinance index to its lowest level since March, according to the Mortgage Bankers Association.

May 20 -

The Mortgage Bankers Association's forecast anticipates tremendous coronavirus stimulus-related debt coming on to the market.

May 19 -

Other safety measures taken to protect settlement agents and consumers include drive-up closings and overnight mail.

May 19 -

The Federal Housing Finance Agency clarified that borrowers with Fannie Mae- or Freddie Mac-backed mortgages who have entered into forbearance plans can be eligible for a refi or new purchase once they are considered “current” on their mortgage.

May 19 -

The economic contraction will keep mortgage rates low for the foreseeable future.

May 14 -

The commercial mortgage broker's move is part of its formation of a dedicated multifamily group.

May 14 -

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

The title insurer did not disclose the number of layoffs.

May 11 -

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

May 8