-

Mortgage interest rates dropped this week to the lowest level on record, fueling an already hot spring housing market and triggering a refinance boom in the Twin Cities.

March 6 -

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

March 5 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

A drop in interest rates in response to the coronavirus outbreak is adding urgency to a hiring spree across the mortgage industry.

March 4 -

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

March 4 -

Investors' purchases of 10-year Treasurys after the Fed's 50 basis point short-term rate cut drove the yield below 1% for a period of time.

March 3 -

Servicers' struggle to retain borrowers mounted in the fourth quarter when a type of loan that is tough to recapture rose to a more than 10-year high, according to Black Knight.

March 2 -

JPMorgan Chase & Co. is shifting workers to handle an expected surge in demand for home loans as the American housing market looks forward to its strongest spring in at least a decade and the coronavirus sends mortgage rates lower.

February 28 -

Mortgage loan application defect risk is at the lowest point since First American started tracking this data, strictly as a function of the shift to a refinance market.

February 28 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Mortgage application volume rose last week, but with the 10-year Treasury yield tanking in recent days, growth in refinancings for the current period is quite likely, according to the Mortgage Bankers Association.

February 26 -

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.

February 25 -

A rally in Treasuries that's driven 10-year yields toward record lows could have more room to run, a Goldman Sachs report said.

February 24 -

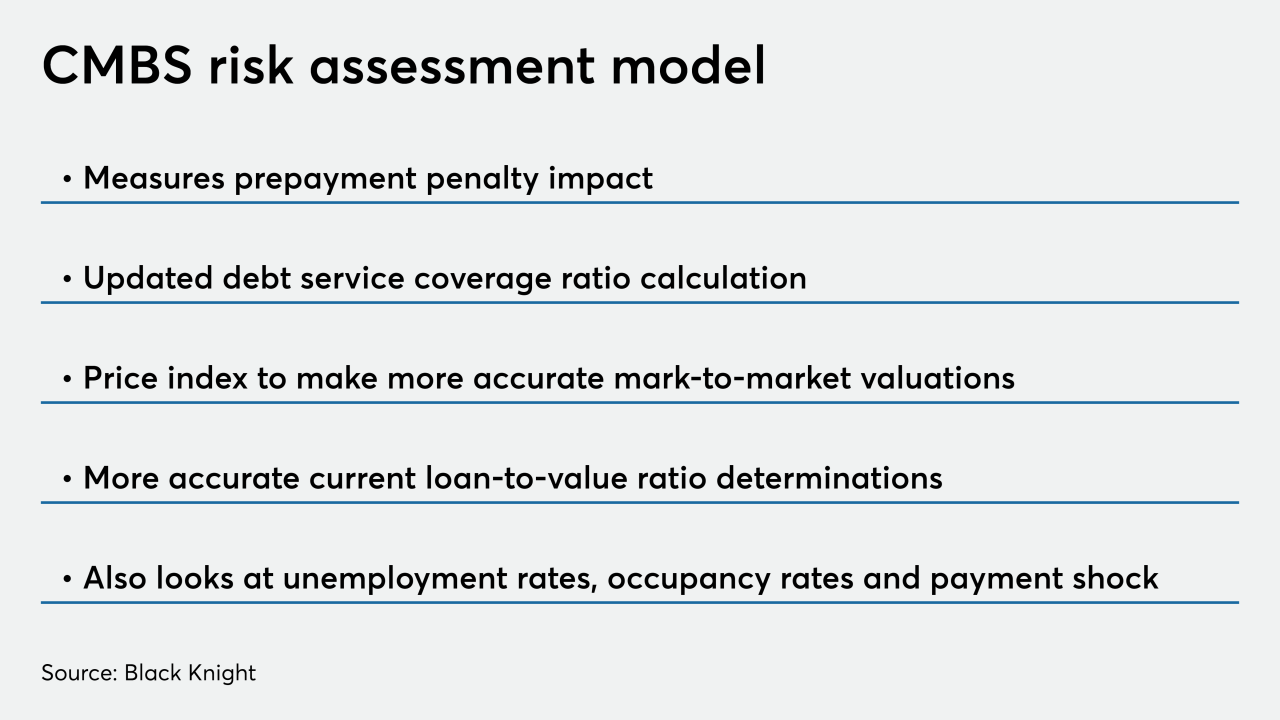

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

For the first time in 15 years, fewer than 2 million mortgaged properties lie in default or foreclosure status as of the end of January, according to Black Knight.

February 20 -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

Quontic has rolled out a streamlined non-qualified mortgage refinance product that will not require the borrower to provide verifications or documentation.

February 19 -

A dip in conventional mortgage refinance demand drove mortgage application volume down compared with one week earlier, according to the Mortgage Bankers Association.

February 19 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14